Warner Bros. Discovery Inc. has laid out a new strategy that will merge the HBO Max streaming service with Discovery+ while vowing to take aim at Marvel’s ‘Captain America’and ‘Iron Man’.

The move will combine WarnerMedia’s dramas, comedies and movies with Discovery’s reality shows and comes as streaming services face a demand slowdown.

As part of the new strategy, the company will assemble a team to create a 10-year plan for its DC comics-related franchise that includes ‘Wonder Woman, ‘Superman’ and ‘Aquaman’, Reuters reported.

The approach was similar in structure to Walt Disney Co’s approach to the Marvel Cinematic Universe, Chief Executive David Zaslav said on Thursday after WBD announced its first combined financial earnings report.

In the first conference call after launching a comprehensive review of WarnerMedia’s assets following the $43 billion merger with Discovery, executives explained how they planned to reset the company that once prioritized streaming video investments into one that will seek a diversified approach.

“We have every platform in the ecosystem, and in a world where things are changing and there’s a lot of uncertainty … that’s a lot more stable and a lot better than having one cash register,” Zaslav said in a conference call with analysts.

The new plan also explores the opportunity for free ad-supported streaming services.

Executives said the review found previously approved investments and strategies that would hurt 2022 earnings before interest, tax, depreciation and amortization (EBITDA) by $2 billion. These included an emphasis on making its theatrical slate available directly on the subscription streaming service and a costly investment in CNN+.

“I agree with their attitude that streaming is just one component in monetizing content but there is still a more significant albatross from streaming investments, especially in 2022, than might have been expected,” said Benchmark analyst Matthew Harrigan.

The company, which reported combined results for the first time, also disclosed 92.1 million streaming subscribers at the end of the second quarter.

This reflected a gain of about 1.7 million from the previous quarter but also a decline of about 300,000 subscribers in the United States and Canada and the elimination of 10 million subscribers due to some non-core customers and AT&T wireless subscribers who never activated their HBO Max service.

Prior to the merger, HBO and HBO Max boasted a combined 76.8 million subscribers, including 48.6 million in the United States. Discovery+ ended the first quarter with 24 million subscribers.

The newly merged company reported a second-quarter net loss of $3.4 billion and a slight decline in revenue.

The net loss includes about $2 billion of amortization of intangibles, about $1 billion of restructuring and other charges, and $983 million of transaction and integration expenses, the company said.

Warner Bros. Discovery Inc WBD.O reported a 1% fall in pro forma quarterly revenue on Thursday, hit by weakening ad spending as the newly merged company reconfigures overlapping businesses from WarnerMedia and Discovery.

The company, which reported its combined results for the first time, reported revenue of $9.83 billion in the second quarter.

In a statement, WBD CEO David Zaslav gave a clue to the company’s thoughts on distribution, implying that it would not be placing all of its chips on streaming.

“We intend to maximize the value of that content through a broad distribution model that includes theatrical, streaming, linear cable, free-to-air, gaming, consumer products and experiences, and more, everywhere in the world,” he said.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  Yearender 2024 most anticipated film sequels of 2025

Yearender 2024 most anticipated film sequels of 2025  Airtel faces outage, users across India report network disruptions

Airtel faces outage, users across India report network disruptions  Kartik Aaryan to star in ‘Tu Meri Main Tera, Main Tera Tu Meri’

Kartik Aaryan to star in ‘Tu Meri Main Tera, Main Tera Tu Meri’  ‘MasterChef India’ returns with a celebrity twist

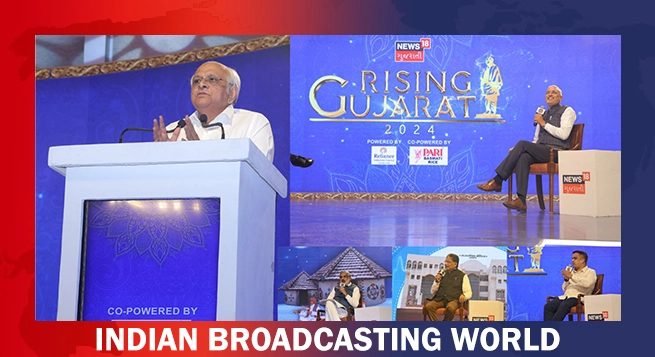

‘MasterChef India’ returns with a celebrity twist  News18 Gujarati hosts ‘Rising Gujarat’

News18 Gujarati hosts ‘Rising Gujarat’