India has held up approvals for import of Wi-Fi modules from China for months, driving companies such as U.S. computer makers Dell and HP and China’s Xiaomi, Oppo, Vivo and Lenovo to delay product launches in a key growth market, two industry sources said.

Imports from China of finished electronic devices — like Bluetooth speakers, wireless earphones, smartphones, smartwatches and laptops — containing Wi-Fi modules are being delayed, Reuters quoted unnamed sources as saying without specifying whether they were Indians or foreigners.

The Communications Ministry’s Wireless Planning and Coordination (WPC) Wing has withheld approval since at least November, according to the sources, who were familiar with lobbying efforts by firms seeking clearance.

More than 80 such applications by U.S., Chinese and Korean firms have been pending with the WPC since then, one of the sources said.

Even applications from some Indian firms, which bring in some finished products from China, are awaiting WPC approval, the sources added.

Dell, HP, Xiaomi, Oppo, Vivo and Lenovo did not respond to requests for comment.

The Communications Ministry too did not respond to a request for comment. And, both sources said the government had still to respond to representations made by industry lobby groups and individual companies.

India’s hard stance on Chinese imports comes amid Prime Minister Narendra Modi’s call for greater economic self-reliance.

His policies have helped boost the growth of smartphone assembly in the South Asian nation, and the sources believe the government’s intention is to persuade companies to locate more of their production of electronic devices in India.

“The government’s idea is to push companies to manufacture these products in India,” one of the sources said.

“But tech companies are caught in a difficult situation – making in India would mean big-ticket investments and a long wait for returns, on the other hand the government-imposed hurdle on imports means a potential loss of revenues.”

India previously allowed companies to self-declare wireless equipment, a move that made imports easier, but new rules in March 2019 mandated firms to seek government approval.

While India’s market and export potential have turned it into the world’s second-biggest mobile maker, tech analysts and industry insiders say it does not yet have the size or scale for companies to invest big in making IT products and smart wearable devices.

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  TIPS Music ends FY25 on high note with 29% revenue growth

TIPS Music ends FY25 on high note with 29% revenue growth  WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture

WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture  Telecom subs base up marginally; Trai withholds updated b’band data

Telecom subs base up marginally; Trai withholds updated b’band data  YO YO Honey Singh, Stage Aaj Tak wrap up ‘Millionaire Tour’

YO YO Honey Singh, Stage Aaj Tak wrap up ‘Millionaire Tour’  Prime Video announces global premiere for ‘Crazxy’

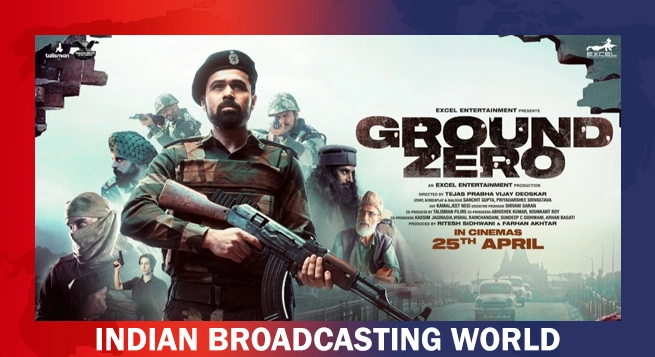

Prime Video announces global premiere for ‘Crazxy’  Emraan Hashmi teams up with Summercool to promote ‘Ground Zero’

Emraan Hashmi teams up with Summercool to promote ‘Ground Zero’  LinkedIn named official LIONS B2B Partner for Cannes Lions 2025

LinkedIn named official LIONS B2B Partner for Cannes Lions 2025  YouTube marks 20 billion uploads as it turns 20

YouTube marks 20 billion uploads as it turns 20