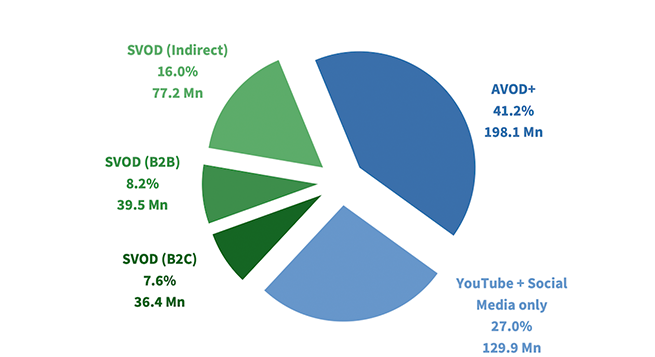

A new study released yesterday by Ormax Media said that India’s present OTT subscriber base stood at 481.1 million with the growth from 2022 to 2023 in double digits at 13.5 percent, but much lower than the growth from 2021 to 2022, which stood at a healthy 20.0 percent.

India’s OTT penetration now stands at 34 percent of the country’s population, up from 30 percent last year of which 101.8 million are paid subscribers.

SVOD audiences, who have access to paid content, comprise 153.0 million people, 31.8 percent of India’s OTT universe. The remaining 68.2 percent (328.1 million) are accessing only free content. A sizeable section out of these are watching videos only on YouTube and social media apps, Ormax Media said.

The SVOD (B2C) segment averages at 2.8 subscriptions per user, leading to a total of 101.8 million direct-to-consumer paid subscriptions in India. Metros like Mumbai, Bengaluru and Delhi are the top three cities with maximum paid subs.

The full report highlights how the growth this year has been driven by small towns and rural India. NCCS A,B cities (comprising households with high wages and where householders are educated ) and metros, as well as some of the mini metros, are beginning to either reach saturation, or slowing down considerably, witnessing single-digit growth in percentage terms, Ormax said in a statement.

The report divides the 481.1 million universe into five segments and is based on data collected from 12,000 respondents across India during the July-September 2023 period.

The Ormax OTT Audience Report was first published in 2021 and the third edition highlights that India’s OTT audience universe is rapidly growing with adoption outside the big cities and in the older age groups.

While streaming companies have data for usage and subscription of their platforms, there is no industry-level audience research available to size and profile the Indian OTT market at large, Ormax said.

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

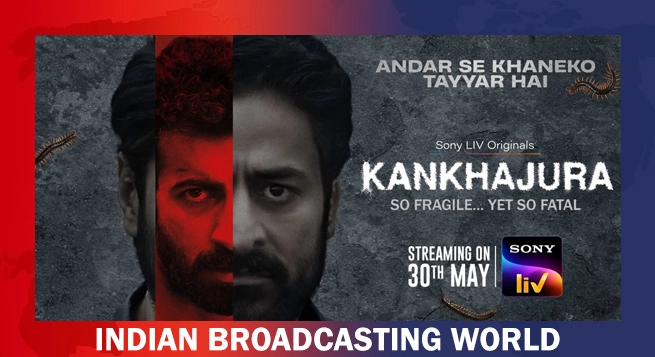

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles