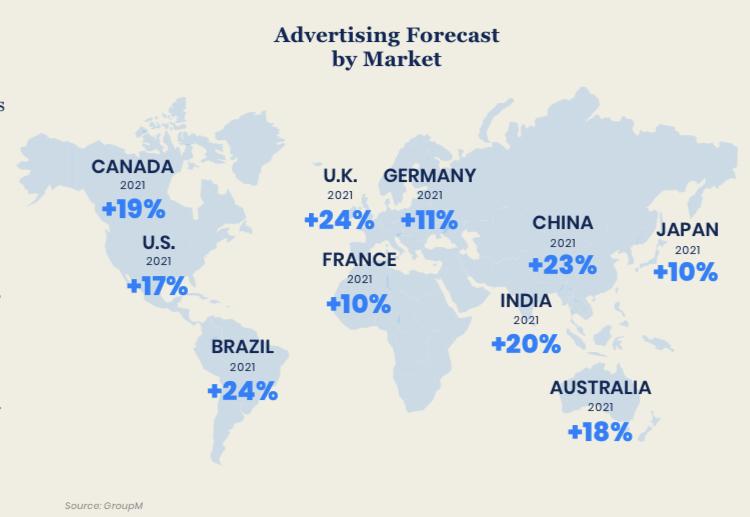

The mid-year forecast done annually of the media industry by GroupM, in 2021 has thrown up some interesting numbers. Global advertising is expected to grow by 19 per cent (excluding U.S. political advertising) during 2021, a significant upward revision from December forecast.

This represents a level of ad revenue that is 15% higher than 2019, as 2020 only experienced a 3.5% decline on GroupM’s revised estimates. High growth should persist for the foreseeable future, too, it predicted.

GroupM expects global advertising, including U.S. political, to exceed $1 trillion in 2026, up from $641 billion in 2020 and $522 billion in 2016. Of note, concentration within the industry has increased over this time: in 2020, the top 25 media companies represented 67% of total advertising revenue. That same group of companies accounted for 42% in 2016.

Looking at individual markets, several should see better-than-20% growth, including the U.K., Brazil, China and India. Many others will rise by the high teens, including Canada, Australia and the U.S.

Most of the improvement in growth reflected in this update belongs to digital media. GroupM now forecasts 26% growth for all forms of pure-play digital media versus 15% at the time of December update.

“Midway through 2021, advertising growth for the year is far exceeding previous expectations thanks, in no small part, to the pandemic. This has led to a major revision of our global forecast for this year and beyond. Many of the factors causing this faster growth were in place pre-pandemic, but COVID has only served as an accelerant. These include faster than expected expansions of app ecosystems, rapid small business formation activities and the growing role of cross-border media marketplaces, especially involving manufacturers based in China,” GroupM said yesterday while releasing the mid-year forecast for This Year Next Year report.

In its preface, the company said other changes were taking root as well. Traditional TV network owners are prioritizing investments in content delivered on streaming services. While many of them will offer some ad inventory and capture a share of total TV advertising, those gains will only offset reduced spending on the traditional form of the medium.

“Consequently, we see faster growth in Connected TV+ advertising (what we previously called “digital extensions of traditional TV”) than previously forecast, but total television advertising will generally be stable or slow-growing,” GroupM said.

Here are some other areas considered in detail in the report:

- Television is now expected to grow by 9.3% in 2021, an improvement from our prior 7.8% expectation.

- Beyond this year, low single-digit growth is expected for the broadly defined medium, including what is called Connected TV+ .

- It is estimated globally Connected TV+ inventory accounted for $16 billion in media company ad revenue, up by 25% over 2020 levels.

- It is anticipated Connected TV+ ad revenue will grow to $31 billion globally by 2026.

- TV’s unique reach advantage is set to erode at a relatively rapid pace in the near term as investments in ad-free or ad-light streaming video services — mostly U.S.-based — dominate the global industry going forward by spending billions of dollars on content.

- In audio advertising, expectations were raised significantly in this update, with a forecast now at 18% growth rather than December’s 8.7% level.

- However, following 2020’s 27% decline, even with these revisions, we do not expect the medium to return to 2019 levels any time soon.

- OOH advertising should fare well, growing by 19% in 2021.

- Although the 2021 forecast represents a slightly slower pace of growth than anticipated in December 2020, 2022 expectations are now slightly higher than before.

- Longer-term, OOH is benefitting from growing interest in the medium and is aided by new digital formats that allow for incremental sources of demand to emerge.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025