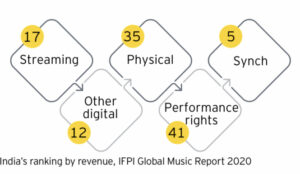

Despite performance rights witnessing a decline of around 67 per cent in 2020 due to pandemic-related lockdown, the Indian music segment is expected to grow at 15 per cent CAGR piggybacking increasing digital revenues, according to the Ficci-E&Y media and entertainment report 2020.

Though the music segment remained more or less stable at INR 15.3 billion in 2020, it is expected to grow at a CAGR of 15 per cent to reach INR 23.2 billion by 2023, on the back of increasing digital revenues and recovery of performance rights.

Interestingly, though lockdown had put stringent restrictions on road travels, one of the favourite time to consume music, India’s consumption of an average of 21.5 hours/week is higher than the global average of 17.8 hours/week, the report stated.

Some of the other trends highlighted by the report are as follows:

► Growth at the music label level was around 5%, primarily due to increase in digital licensing revenues.

► Performance rights witnessed a decline of around 67% due to countrywide lockdowns resulting in restrictions on outdoor activities.

► Physical sales saw a further decline of 75% as the medium continued to lose its relevance, except for products like Carvaan, the values of which are not considered in this sector report. (A juke-box of pre-recorded songs, Saregama company’s Carvaan is a hit product with Indians.)

► As far as music consumption is concerned, despite restrictions on commuting, during which many Indians listen to music, there was an increase in time spent on streaming apps, on account of new listening habits during other activities.

► Industry leaders estimated a 53% increase in music consumption during leisure and 25% increase during fitness activities in 2020.

► Average monthly stream count was over 10 billion streams in first half of 2020 and crossed 11 billion streams per month during lockdown

► Paid consumers on streaming apps increased by 15% post COVID-19.

►Regional music and independent artists found their voice in 2020.

► With decline in film music, independent artists increased their reach and share in the top 100 published songs; non-film songs in the top 100 charts rose to 65% from 40% in 2019.

► Many artists used virtual events to stay connected with their fans.

► Consumption of Bhojpuri music grew four times over the last year whereas Haryanvi, Bengali and Odiya music witnessed 2.5x growth from last year.

► 39% of all streams were generated by regional language music, which was a 33% growth from 2019.

► As far as music monetization is concerned audio streaming grew 15%.

► Growth in audio streaming was driven by a 13% increase in broadband penetration in 2020, a smartphone base which grew to over 450 million and a significant conversion of 2G and 3G connections to 4G connections.

► With the influx of domestic and international players in the audio OTT space, demand being driven by inexpensive data and increased smartphone penetration, digital music contributed around 90% of total revenue for both labels and at end customer value.

► Streaming apps have a base of approximately 200 million active monthly users, but the paid subscriber base is still around 2 million.

► Revenues at a label level increased from INR 13.4 billion in 2019 to INR 14.1 billion in 2020.

► Share of revenues attributable to digital crossed 90%.

►Piracy continued to plague the music segment as it remained at 67% in 2020, but is still higher than the global average of 27%.

► China has succeeded in curtailing music piracy through innovations such as hiring and grooming artists and streaming sites directly working with them, resulting in 96% of consumers listening to licensed music.

► International music consumption too grew in 2020. Korean pop (K-Pop) has seen growth of 350% on the Gaana app in 2020, with K-pop band BTS making it to the top five artists streamed in India on Spotify.

► 60% of the top 10 albums on Spotify were by international artistes

The future outlook of the Indian music industry is as follows:

► Paid subscriber base could cross 5 million by 2023.

► But, so long as music is available for free on YouTube and other platforms, the music segment will find it difficult to increase paid OTT subscribers.

► The report expects paid music OTT subscribers to cross 5 million by 2023 and generate revenues of INR 1.8 billion.

► The report expects the average revenue per paid subscriber to stabilize at INR 1 per day in India by 2023.

► Given that the smart TV base is expected to touch 40 million homes by 2025, there is an opportunity to create curated experiences for music in the home.

► This could be through partnerships with television OEMs, apps, aggregators, etc.

►India always prefers to watch its music and as OTT content volumes will cross 3,000 hours by 2023, the music they use in their content will begin to garner a larger share of listenership.

► There is an opportunity to increase the synchronization revenue for music labels due to emergence of numerous short form content creation platforms post the TikTok ban, including gaming platforms, online event platforms.

►With the growth of platforms, the need to differentiate will continue to increase, giving rise to the need for varied and exclusive content

This provides an opportunity for music labels to build a portfolio of exclusive variants and non- music content.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Junaid Khan, Khushi Kapoor set to come in ‘Loveyapa’

Junaid Khan, Khushi Kapoor set to come in ‘Loveyapa’  ABP News hosts ‘Newsmaker of the Year Awards’ to honour 2024’s trailblazers

ABP News hosts ‘Newsmaker of the Year Awards’ to honour 2024’s trailblazers  ShortFlix, News 7 Tamil collaborate to launch new entertainment show

ShortFlix, News 7 Tamil collaborate to launch new entertainment show  CNN-News18 concludes 2024 with year-end specials spotlighting Bollywood

CNN-News18 concludes 2024 with year-end specials spotlighting Bollywood  Tata Play celebrates Salman Khan’s birthday with superhit movies

Tata Play celebrates Salman Khan’s birthday with superhit movies