If the Indian recorded music industry was allowed to follow the free market economy by the government, the segment could have been approximately worth Rs. 3,332- Rs 4,107 crore in 2019, placing it in the top 10 music markets in the world, accordingto Blaise Fernandes President & CEO of The Indian Music Industry.

Since India’s linguistic heterogeneity — 2,264 languages recognised by the Indian constitution and 19,56,965 local dialects — mirror the cultural diversity of continental Europe, it is plausible to believe that India can aim to be on par with the size of the European music market in a decade, feels Fernandes.

According to him, this will happen mainly on the back of the currently 448 million smartphone users growing up to 973 million by 2025, compounded with the lowest data pricing in the world currently at $0.09 per GB of data.

In a recently released research paper, titled ‘A Case for Free Market Economics in The Indian Recorded Music Industry’, Fernandes says in the case of the recorded music industry, “due to the lack of free market economics, there has been no incentive to invest in new genres (of music)”.

“Those who invested in new genres despite all hurdles have not been able to effectively monetise their investments, “ the research paper explains.

The contributing variables to successful growth in both the (film and music) industries depend primarily on “financial fuel”, that is investment. When free-market conditions prevail, investors tend to take on high risks as can be clearly seen in the case of the film industry.

“However, if the free-market economy is disturbed, it would affect fair market values negatively, leading to a decline in investments as is evident in the case of the recorded music industry,” Fernandes stresses in the paper.

The table below is the breakdown of the publishing revenue formats for Europe in 2019.

| CISAC Creators Income Streams (in Europe, 2019) | Value in $ mn (in ₹)54 |

| Digital | 2298 (₹16185 Cr) |

| Live and Background | 3099.8 (₹21832.2 Cr) |

| TV & Radio | 4167.4 (₹29351.4 Cr) |

| Private Copying55 | 407.5 (₹2870.4 Cr) |

| Other | 492.8 (₹3471 Cr) |

In addition, the 700 million unique bank accounts, swift moves towards digital transactions — around 2.3 billion UPI transactions happen in a month — and the Indian government’s Bharat Broadband programme BharatNet will bolster progress.

The factors that lead to potential losses of around Rs 2,016 crore to Rs. 2,791 crore annually to the recorded music industry, according to Fernades’ paper, are the following:

- A deficit of Rs. 163 crore to Rs. 225 crore royalties denied to music industry by broadcast radio thanks to archaic laws such as compulsory and statutory licensing, which were introduced when broadcast radio was at a nascent stage. Today, according to FICCI FRAMES report on entertainment sector, private broadcast radio is at Rs. 3100 crore when compared to recorded music at Rs. 1500 crore.

- The Office Memorandum (OM) issued by DPIIT (division of Commerce Ministry), which inaccurately includes internet-based services under the scope of broadcasting organisations, result in huge potential losses, considering 73 per cent of the recorded music industry revenues are attributed to streaming. The withdrawal of the OM would allow for investments in I-pop, plus other regional genres as well impacting 53 per cent of the recorded music industry revenues.

- A Rs. 723 crore to Rs. 1,000 crore deficit is from public performance revenues at wedding ceremonies. As per a notice the westernised celebrations at wedding ceremonies are exempt from procuring public performance licenses for use of recorded music, while the Indian government imposes a 3 per cent GST on Mangalsutra ceremony. Further, an additional loss of Rs. 264 crore to Rs. 366 crore due to the pending status of PPL’s registered application to be recognised as a copyright society.

- A revision to intermediary liability provisions under Section 79 of the IT Act would help the recorded music industry realize the Rs. 145- to Rs. 200 crore revenue leakage coming from short form video content apps that are now proliferating the market in India and content uploaded by users on big tech platforms. These platforms monetize the user generated content via ad sales, which leads to further annual losses of Rs. 506- Rs. 700 crore to the music industry.

- Music piracy on digital platforms costs the recorded music industry Rs. 217- Rs. 300 crore in revenues.

| Industry Growth (in ₹ bn) | ||

| Year | Music | Film |

| 2005 | 8.3 | 66.9 |

| 2006 | 7.8 | 81.7 |

| 2007 | 7.4 | 96.4 |

| 2008 | 7.3 | 109.3 |

| 2009 | 8.3 | 104.4

|

| 2010 | 8.6 | 83.3 |

| 2011 | 9 | 92.9 |

| 2012 | 10.6 | 112.4

|

| 2013 | 9.6 | 125.3 |

| 2014 | 10 | 126 |

| 2015 | 11 | 138

|

| 2016 | 12 | 122 |

| 2017 | 13 | 156 |

| 2018 | 14 | 175

|

| 2019 | 15 | 191 |

The research paper goes to say that as per the IFPI GMR 2020 Report, the recorded music revenues for Europe accounted for $ 6,105million. In addition, the live music revenues were more than $8,882million and publishing revenues were $6085 million in Europe for 2019.

“If these archaic (Indian) laws are removed, India surely has the potential to be among the top 5 markets by 2031,” Fernandes concludes.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

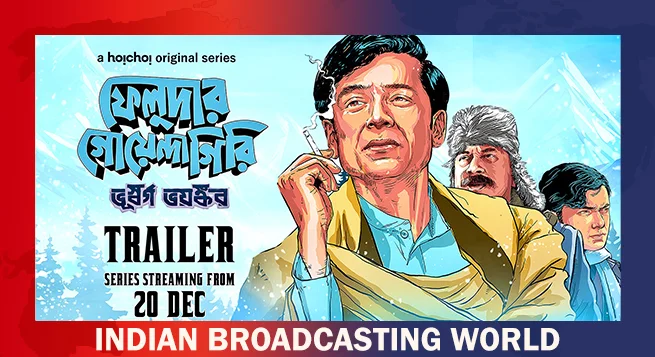

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025