In what should be good news for India’s creative eco-system, including content producers and OTT platforms, country’s smart TV shipments recorded double-digit growth of 28 per cent in 2022, which was led primarily by the festive season in the third quarter of multiple new launches, discount events, and promotions, according to a Counterpoint Research report.

Moreover, demand for bigger screen-size TVs in the lower price tier also fueled the growth, it said, according to a PTI report.

While in the December quarter, after the festival sales, smart TV shipments were almost flat at 2 per cent year-on-year (YoY) due to a slowdown in demand.

Smart device maker Xiaomi continued to lead India’s smart TV market in 2022 with an 11 per cent share.

This was followed by Samsung, LG, One Plus and TCL, respectively in the fast-growing Indian smart TV market. OnePlus and TCL were among the fastest-growing smart TV brands in 2022, said the Counterpoint Research report.

Sony was among the preferred brands in the premium segment.

In 2022, over 99 per cent of the TVs were assembled locally, while only some high-end TV sets were imported by the brands, it said.

Moreover, 96 per cent of the market is being driven by LED TVs, and MediaTek chips had around a three-fifths share of the total TV market during the year.

In the December quarter, top five brands MI, Samsung, LG, One Plus and TCL controlled 42.6 per cent of the market share.

Senior Research Analyst Anshika Jain said, ”OnePlus, Vu, and TCL were among the fastest-growing brands in the smart TV segment in 2022. Xiaomi led the overall smart TV market with an 11 per cent share, followed by Samsung and LG.” Smart TV shipments in Rs 20,000-Rs 30,000 price band grew 40 per cent YoY to reach a 29 per cent share. The average selling price (ASP) declined 8 per cent YoY to around Rs 30,650,

Jain added: ”Smart TV contribution to overall shipments reached its highest-ever of 90 per cent during the year. It is expected to go up further due to more launches in the sub-Rs 20,000 price range and non-smart-TV-to-smart-TV migration. Non-smart TV shipments declined 24 per cent YoY in 2022. Online channels increased their contribution to the total shipments to 33 per cent during the year.”

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  Can Trump’s foreign movie tariff threat impact Indian films’ biz?

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  ZEEL appoints Rohit Suri as Chief Human Resource Officer

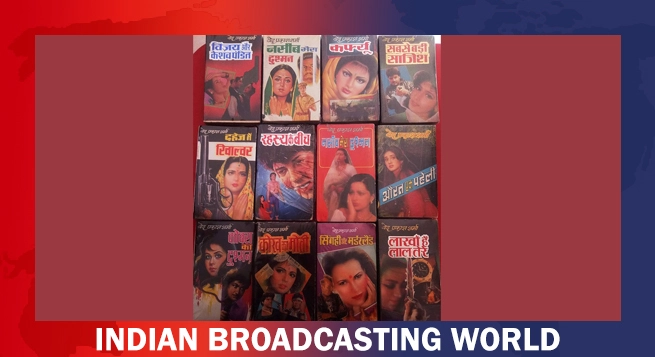

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup