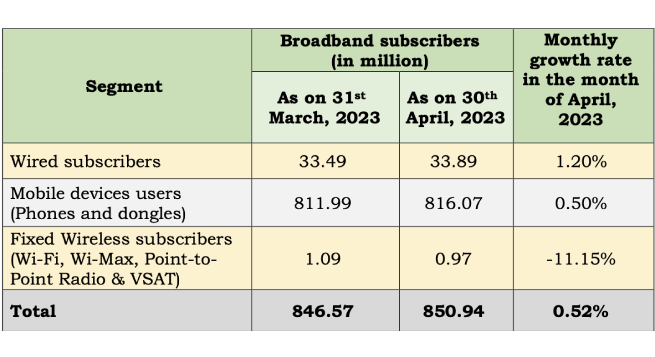

India’s total broadband subscribers increased from 846.57 million at the end of March-23 to 850.94 million at the end of April- 23 with a monthly growth rate of 0.52 percent, according to data put out yesterday by broadcast and telecom regulator TRAI.

Top five service providers constituted 98.39 percent market share of the total broadband subscribers at the end of April-23. These service providers were Reliance Jio Infocomm Ltd (441.92 million), Bharti Airtel (244.37 million), Vodafone Idea (123.58 million), BSNL (25.26 million) and Atria Convergence (2.14 million).

As on April 30, 2023, the top five wired broadband service providers were Reliance Jio Infocomm Ltd (8.65 million subscribers), Bharti Airtel (6.25 million), BSNL (3.63 million), Atria Convergence Technologies (2.14 million) and Hathway Cable & Datacom (1.12 million), the Telecom Regulatory Authority of India (TRAI) said.

The top five wireless broadband service providers were Reliance Jio Infocom Ltd (433.27 million subscribers), Bharti Airtel (238.11 million), Vodafone Idea (123.57 million), BSNL (21.63 million) and Intech Online Pvt. Ltd. (0.24 million).

According to TRAI, wireline subscribers increased from 28.41 million at the end of March-23 to 29.39 million at the end of April-23. Net increase in the wireline subscriber base was 0.98 million with a monthly growth rate of 3.44 percent.

The share of urban and rural subscribers in total wireline subscribers were 92.35 percent and 7.65 percent, respectively at the end of April, 2023.

The overall wireline tele-density in India increased from 2.05 percent at the end of March-23 to 2.12 percent at the end of April-23. Urban and rural wireline tele-density were 5.55 percent and 0.25 percent, respectively during the same period.

BSNL and MTNL, the two State-owned access service providers, held 31.68 percent of the wireline market share as of April 2023.

Total wireless subscribers decreased from 1,143.93 million at the end of March-23, to 1,143.13 million at the end of April-23, thereby registering a monthly decline rate of 0.07 percent. Wireless subscription in urban areas decreased from 627.54 million at the end of March-23 to 626.74 million at the end of April-23.

However, wireless subscriptions in rural areas increased from 516.38 million to 516.39 million during the same period. Monthly growth rate of urban and rural wireless subscription was 0.13 percent and 0.00 percent, respectively.

The wireless tele-density in India decreased from 82.46 percent at the end of March-23 to 82.34 percent at the end of April-23. The urban wireless tele-density decreased from 128.45 percent at the end of March-23 to 128.09 percent at the end of April-23 and rural tele-density also decreased from 57.46 percent to 57.44 percent during the same period.

The share of urban and rural wireless subscribers in the total number of wireless subscribers was 54.83 percent and 45.17 percent, respectively at the end of April-23.

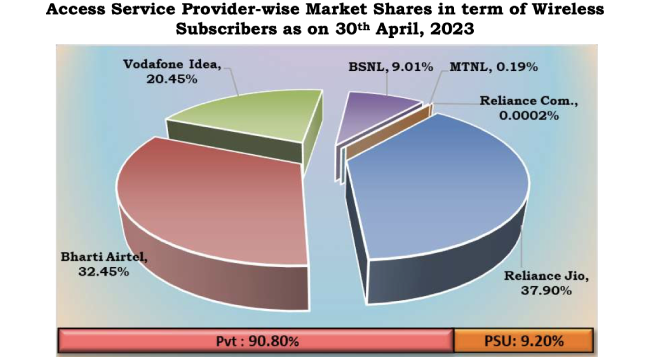

As of April, 2023, the private access service providers held 90.80 percent market share of the wireless subscribers, whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 9.20 percent.

The number of telephone subscribers in India increased from 1,172.34 million at the end of March-23 to 1,172.52 million at the end of April-23, thereby showing a monthly growth rate of 0.02 percent. Urban telephone subscriptions increased from 653.71 million at the end of March-23 to 653.88 million at the end of April-23 and the rural subscription also increased from 518.63 million to 518.64 million during the same period.

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  Can Trump’s foreign movie tariff threat impact Indian films’ biz?

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  ZEEL appoints Rohit Suri as Chief Human Resource Officer

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup