India’s online gaming sector, currently valued at $3.1 billion, has the potential to expand to a staggering $60 billion by 2034 amid challenges surrounding regulation and taxation, stated a report by USISPF and TMT Law Practice, released yesterday.

According to an IANS report from New Delhi, the US has been a significant contributor to India’s gaming sector, with $1.7 billion of the total $2.5 billion in foreign direct investment (FDI) coming from the US alone.

“This reflects the immense confidence global investors have in India’s rapidly growing gaming market, which is projected to become a $60 billion opportunity by 2034,” said Dr Mukesh Aghi, President and CEO, United States India Strategic Partnership Forum (USISPF).

Notably, 90 percent of this FDI is in the pay-to-play segment, which also accounts for 85 per cent of the sector’s overall valuation.

However, challenges surrounding regulation and taxation persist. India stands out for its high tax rate, imposing a 28 percent Goods and Services Tax (GST) for all formats on the total deposits made by players

The report also highlighted that the United Nations Central Product Classification (UN CPC), which forms the basis for taxation in domestic jurisdictions globally, defines online gaming separately from online gambling.

“With a large consumer base of over 600 million gamers, this space is rapidly being monetized and presents a substantial export opportunity. However, for Indian companies to compete globally, we need a level playing field with progressive tax and regulatory policies that align with international standards,” said Aghi.

The report examined the regulatory frameworks and taxation policies in 12 key gaming markets. It revealed that all 12 countries have a separate legal definition for games of chance, ensuring a clear distinction from skill gaming formats.

It emphasized that adopting platform revenue or the commission collected as the tax base is crucial not only for ensuring fair taxation but also for preventing the proliferation of unregulated, untaxed illegal offshore markets that could undermine both industry viability and government revenue.

“A more nuanced regulatory and taxation regime, similar to those adopted in global markets, would not only provide clarity but also foster sustainable growth in the online gaming sector,” said Abhishek Malhotra, partner at TMT Law Practice.

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Indian creators aim for global impact, say streaming is redefining storytelling

Indian creators aim for global impact, say streaming is redefining storytelling  Ashish Chanchlani unveils poster for ‘Ekaki’

Ashish Chanchlani unveils poster for ‘Ekaki’  ‘Panchayat’ S4 teaser hints at fierce election showdown

‘Panchayat’ S4 teaser hints at fierce election showdown  Network18 surges ahead of Times Internet

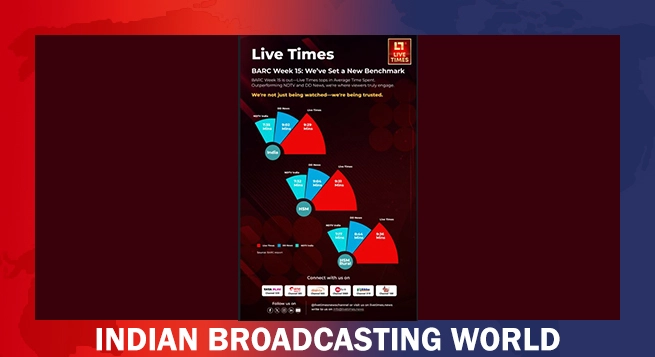

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement