Zomato – Table d’hôte

Zomato is well positioned to take advantage of India’s food delivery market, growing way faster than other EMs. The company is planning to raise INR 82,500mn through an IPO to invest in its current business and initiate new delivery-focussed business streams (scaling to delivering any product). Concerns persist on the ‘other delivery’ business, which is heavily fragmented and also features e-commerce players that offer steep discounting and enjoy inventory-holding capacity. Zomato gleans 85% of its revenues from its core India business and 15% from its international business. Zomato enjoys first-mover advantage in the restaurant listing space as also venturing into customer programmes such as Zomato Pro, a subscription service with attractive customer discounts

Favourable demographics-led growth drivers galore…

Zomato is well poised to achieve medium-term, double-digit revenue growth on: 1) increased smartphone penetration, 2) convenience-led higher food ordering frequency and 3) opportunities in tier 2/3 markets. To its advantage, the Indian food delivery market is duopolistic in nature, thereby commanding a much higher commission rate versus global markets. This counterpoise should sustain but for a new entrant in the fray. Cost efficiencies should also feature soon on the menu, most likely in the medium-to-long term, on curtailing delivery costs (shifting delivery boys to variable pay-rolls) and lowering customer discounts.

…yet assorted risks may slightly sour the platter

The likely entry of a global giant such as Amazon, that had tested waters some time ago, will always be an overhang. We believe such an entry will affect Zomato as it may significantly reduce: 1) delivery charges and 2) take rates, which will affect incumbents’ growth rates. Amazon’s entry in the e-commerce/video space had disrupted the respective segments on free delivery/higher cost content offerings. Further medium-term revenue growth may likely be capped at ~20% on: 1) poor delivery offtake in smaller cities given less traffic and consumer preference of dining out, 2) reduced average order value (AOV) on expansion in tier 2/3 cities, which in turn caps delivery charges growth and 3) convergence in new user acquisition pace post 2025 as the smartphone base matures.

Valuations

We believe Zomato may trade at premium valuations versus global peers on better growth rates – it may command a big scarcity premium within the Indian internet space. However, profitability issues loom large even beyond long-term horizons, as discounts are a significant variable to driving order volumes. Other profitability variables – AOV and delivery charges – do not offer double-digit growth potential, in the medium term. We believe order volumes should revive to pre-Covid levels by FY23 once WFH restrictions are relaxed completely on increased vaccination cover. New users and increased frequency remain other growth drivers.

Elara View

– India – Delivery market opportunity attractive

– Migrants, smaller restaurants crucial to order volume recovery to pre-Covid levels

– Medium-to-long term revenue growth drivers limited

– Larger chains’ order volumes may be weak, long term

– Threat of e-commerce players in delivery space

– Aggregator offerings cannot be replicated very easily

– New initiatives may drive growth, operating efficiency

– Profitability concerns softly shade high growth prospects

– Duopolistic, high-growth market command a premium versus global peers

Govt. not considering rules for use of AI in filmmaking: Murugan

Govt. not considering rules for use of AI in filmmaking: Murugan  DTH revenue slide to ease to 3–4% this fiscal year: Report

DTH revenue slide to ease to 3–4% this fiscal year: Report  At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam

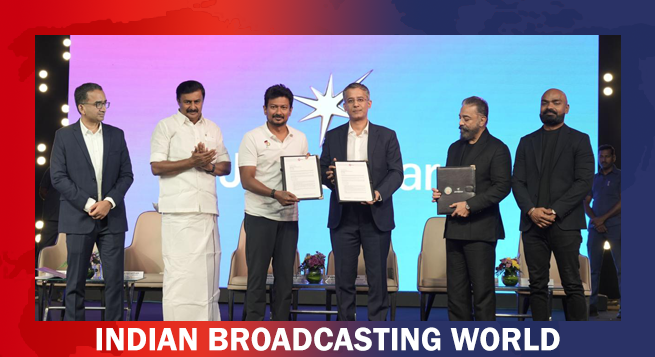

At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam  JioHotstar to invest $444mn over 5 years in South Indian content

JioHotstar to invest $444mn over 5 years in South Indian content  Standing firm, TRAI rejects DoT views on satcom spectrum fee

Standing firm, TRAI rejects DoT views on satcom spectrum fee  Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film

Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film  ‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist

‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist  BBC names Bérangère Michel as new Group CFO

BBC names Bérangère Michel as new Group CFO  ‘Border 2’ teaser to be unveiled on Vijay Diwas

‘Border 2’ teaser to be unveiled on Vijay Diwas  CNN-News18 Rahul Shivshankar takes editorial charge

CNN-News18 Rahul Shivshankar takes editorial charge