By Karan Taurani /Elara Caps

– As per media reports, Star has bagged TV media rights for IPL at around 23,500cr , which is a premium of 30% over the base price, in line with expectation as TV medium is largely matured and subject to tepid mid to high single digit ad growth; concerns persist on subs revenue front which will keep APRU’s under check due to regulatory headwinds

– On Digital media front, Viacom has bought the rights for INR 20,500, which is a premium of 70% over the base price, this slightly lower than our estimate as we were expecting a premium of atleast 80% as digital segment has a 1) strategic value, as it enhances users on any platform and also enables cross selling of other content and 2) digital segment has potential to grow at over 30% helped by increased penetration and consumption trends. The premium is tad lower than our estimate, as many tech giants did not end up bidding for the same and backed out

– On overall basis, the rights valuation is at INR 44,000 as of now; we estimate addition of another INR 4,000cr backed by cluster rights and overseas package, which will take the total value closer to INR 50,000cr , largely in line with our estimate of INR 50,000cr

– Basis above, TV rights have moved up 2x as compared to earlier cycle , backed by 40% more number of matches and inflationary trends in pricing. Digital rights on the other hand may breach 5.5x(including non exclusive cluster) vs earlier cycle backed by better viewership growth and penetration opportunity

– On TV/digital front , we expect the break even to happen only in the third year; as far as profitability is concerned, TV gross profit margin will peak at 12% in the fifth year whereas digital gross margin will breach 35% in the fifth year; basis our assumption of growth in both segments and the content costs

– IPL revenue for teams is estimated to grow 2x towards INR 650-750cr helped by jump in media rights and increased number of matches; PBT margins too will move towards a range of 30-40% , from current PBT margin of 15-25%); this in turn will impact team valuation positively , and May breach towards INR 8,000-10,000cr mark. In terms of market cap, the biggest delta mkt cap is for SUNTV which as the team will contribute almost 40% of mkt cap post new valuation, whereas for UNSP it will be 18% of mkt cap contribution; for RIL it will be as low as 0.7%

– Await final details tomorrow; enclosed above is our report assuming final price of INR 50,000cr and the impact of it on all team revenues

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Zee Telugu wraps up 2024 with ‘Sa Re Ga Ma Pa Party’

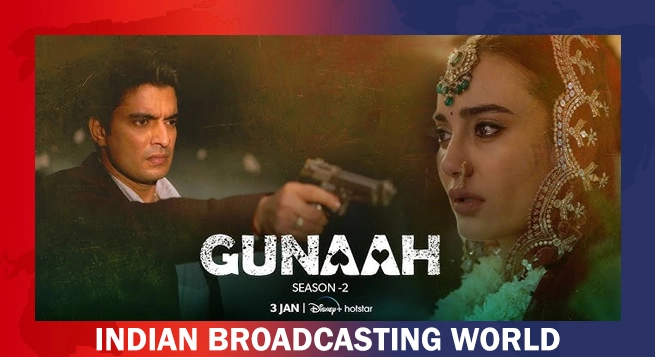

Zee Telugu wraps up 2024 with ‘Sa Re Ga Ma Pa Party’  Disney+ Hotstar unveils ‘Gunaah’ S2 teaser

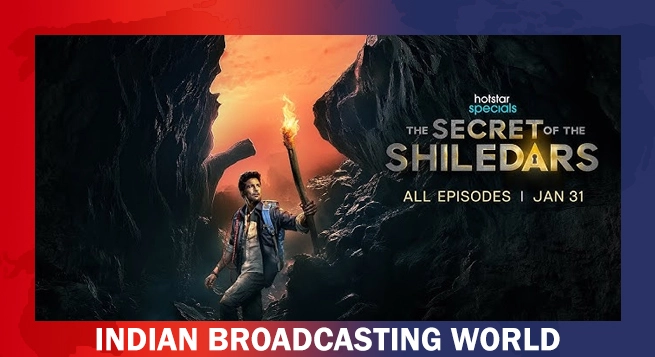

Disney+ Hotstar unveils ‘Gunaah’ S2 teaser  ‘The Secret of The Shiledars’ to premiere on Disney+ Hotstar Jan 31

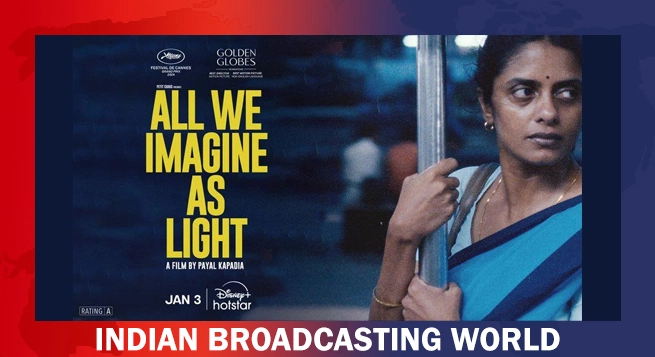

‘The Secret of The Shiledars’ to premiere on Disney+ Hotstar Jan 31  ‘All We Imagine As Light’ to stream from Disney+ Hotstar on Jan 3

‘All We Imagine As Light’ to stream from Disney+ Hotstar on Jan 3  ‘Yeh Jawaani Hai Deewani’ returns to theatres Jan 3

‘Yeh Jawaani Hai Deewani’ returns to theatres Jan 3