Telecom operators Reliance Jio and Bharti Airtel cumulatively gained nearly 25 lakh (25,00,000) mobile subscribers in November 2022 even as troubled Vodafone Idea lost nearly 18.3 lakh customers, according to data by sector regulator TRAI.

India’s largest telco Reliance Jio cemented its lead in the market adding 14.26 lakh net subscribers in November, whereas Airtel added 10.56 lakh users, according to a PTI report from New Delhi that is based on data released by the Telecom Regulatory Authority of India (TRAI) yesterday.

At the end of November 2022, Jio’s mobile subscriber tally stood at 42.28 crore, the levels rising from 42.13 crore during the previous month.

Bharti Airtel’s subscriber gains pushed up mobile user count of the Sunil Mittal-led company to 36.60 crore in November.

In sharp contrast, cash-strapped Vodafone Idea lost 18.27 lakh subscribers during the month in reference, tempering its subscriber base to 24.37 crore in November.

As per TRAI data, the total broadband subscribers increased to 825.38 million at the end of November 2022 with a monthly growth rate of 0.47 per cent.

Top five service providers constituted over 98 per cent market share at the end of November 2022. The list included Reliance Jio Infocomm Ltd (430.18 million), Bharti Airtel (230.56 million), Vodafone Idea (123.48 million), and BSNL (25.85 million), amongst others.

As on November 2022, the top five wired broadband service providers were Reliance Jio Infocomm Ltd (7.38 million), Bharti Airtel (5.56 million), BSNL (4.02 million), Atria Convergence Technologies (2.14 million) and Hathway Cable & Datacom (1.13 million).

The top five wireless broadband service providers were Reliance Jio Infocomm Ltd (422.81 million), Bharti Airtel (225 million), Vodafone Idea (123.47 million), BSNL (21.83 million), and Intech Online Pvt. Ltd. (0.23 million), according to TRAI’s latest subscription data.

Total wireless subscribers decreased to 1,143.04 million at the end of November 2022, from 1,143.63 million at the end of October 2022, sliding 0.05 per cent.

“Monthly growth rates of urban and rural wireless subscriptions were 0.24 per cent and -0.39 per cent respectively,” TRAI said.

MIB to unveil M&E sector statistical handbook today at WAVES

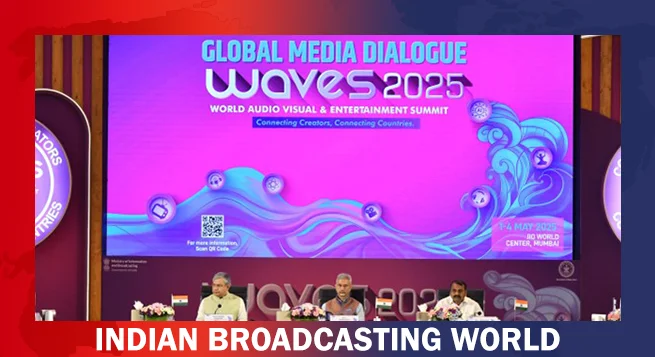

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

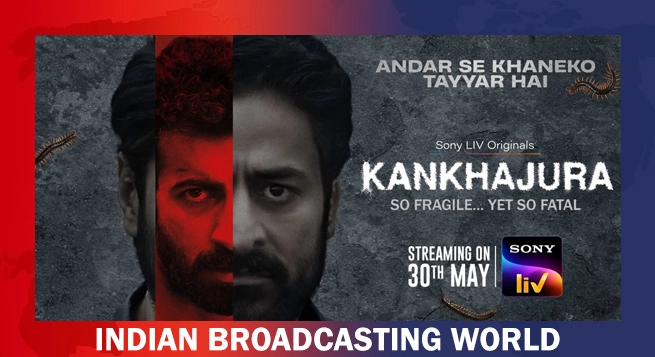

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles