Since the advent of Direct to Home services in India and the Digital Addressable Systems (DAS) in cable TV, set top boxes (STBs) have been imported and majority of the boxes are still being imported.

The Indian government has been trying to foster and encourage Indian companies to start manufacturing boxes in India, but have not met with great success till now. We need to understand the efforts of the Indian manufacturers with limited success and why imports from China, Korea and several ASEAN nations have continued.

A STB is not a simple piece of hardware; it has a complex relationship between multiple partners, which are STB manufacturer, chipmaker, CAS technology provider, middleware provider and the operator. It is a lifelong alliance — as long as the life of the STB.

The Indian manufacturers say that distribution platform operators are not willing to give them orders; the operators ask whether the manufactures can give a box that’s of good quality in terms of the hardware and performance, and, more importantly, match the (competitive) pricing and delivery commitments.

Now this merry-go-round has been going for some time even as imports continue — simply because imports offer several of the following advantages:

- A fast turn around time in case of changes in delivery schedules.

- Consistency in quality.

- Low or competitive prices; almost the same as locally manufactured products.

- Longer credit terms as international manufacturers have long credit lines to support the sales.

- Since international manufacturers target multiple markets (Africa, Latin America, South East Asia, for example), they are able to offer benefits of volume purchase.

- International manufacturers are able to support the software changes as required by the operators over a longer period of time.

- International manufactures access testing labs to get their products certified, which helps in quality maintenance and provides a certain level of comfort to the operators buying the products.

- Manufacturing in ASEAN countries has benefit of the lower/nil customs duty; thus saves some cents for the operators.

Operators give the paramount importance to quality, as a defective or malfunctioning box costs an operator its subscription revenue, a call center call and loss to brand image.

The software support is another critical part. If an operator is looking at a box life of five years, then it expects continuous support for five years even if the purchase transaction has been over. That’s why operators prefer to work with a manufacturer who has been around for years and will remain so for several more years.

We have seen many operators who had gone for low cost boxes from certain manufacturers in China; all of them are struggling today as they are unable to get the software support, which is a must, and they are forced to replace boxes that turn out to be an expensive exercise.

It is good to see that due to the efforts of the Indian government in 2020, as part of the self-reliant India or Atmanirbharta push, many operators have announced they will ask their STB manufactures to start making the boxes in India. But, it has to be seen how much of that will be done in India and will it be “Made in India” or “Make in India” — there’s a thin dividing line between the two, though.

Few manufacturers may start assembling the STBs in India, which will be the first step. Yet, the objective of the government to have Indian manufactures come out with their own products is still a goal a little far off.

In the recent discussions in Udyog Manthan (trade talks for excellence), under the umbrella of the Ministry of Electronics & Information Technology (MEITY), few points that came out in sharp focus included the STB industry’s needs for support in terms of getting longer credit period, product quality, trained manpower and interoperability.

Credit lines can be worked with banks and if there is a genuine case, bankers may be willing to extend the same to the manufacturers — a mechanism of escrow accounts can be worked out for the manufactures and operators.

For Indian manufacturers to be long-term credible players, they will have to look beyond Indian markets. There is a big market in Africa, South East Asia and Latin America, for example. The access to those markets would be possible if they are able to compete on quality and price.

As we say, quality is not something that can be made in a factory; it’s a mindset. If the objective is to have a quality product, then production practices, testing facilities, and help of third party test labs will be required.

We have in India good test labs like Eurofin India, which can help the operators test their boxes on software and hardware. So, infrastructure is there and if they are doing it for others in India, why not take advantage of that? Eurofin is the certifying agency for the CI plus LLP also. Thus, it can bring valuable experience of the international markets for the benefit of Indian manufactures and operators. Labs like ERTL can help test the electrical parameters, which, in a way, help in doing away with reinventing the wheel.

There is no denying that we need to create facilities; the facilities needed are available but need to be approached, properly exploited and leveraged.

Manpower for development of a STB and software development too are available in India. We have international manufacturers having their development centers and using them to develop boxes is simply a case of harnessing those resources as long-term assets.

The STB manufacturer and operator alliance is unbreakable once made and it would give a boost to the industry. All it needs is a long-term vision and plan from both to be part of the journey, which can be very pleasant and fruitful.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

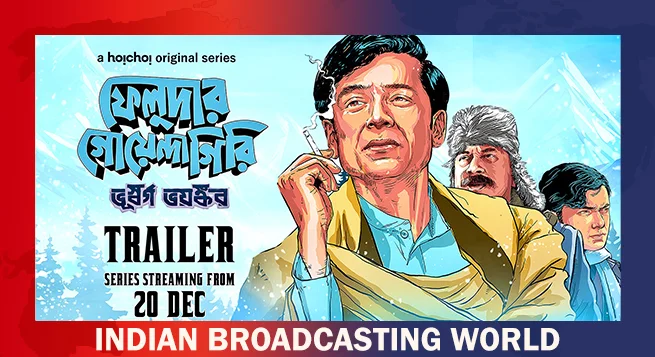

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025