Many Indian Ministers view bets on online gaming platforms as a “social evil”, and the government believes a social as well as economic purpose will be served if revenues fall due to a new 28 percent tax, the Revenue Secretary said yesterday.

The government on Tuesday shocked the $1.5 billion online gaming industry, which has surged in popularity and attracted foreign investment, when it announced the tax. Executives have warned of job losses and reduced earnings, a Reuters report stated.

“Government believes social as well as economic purpose will be served as people will indulge in more productive activities if revenues (of online gaming companies) fall due to the new 28 percent tax,” Federal Revenue Secretary Sanjay Malhotra told Reuters in an interview.

“If demand is highly elastic, and revenues go down substantially, then a social purpose is at least served,” said Malhotra, the top civil servant in India’s Department of Revenue, part of the Ministry of Finance.

The decision to impose the tax was taken after nearly two years of deliberation. A government panel had earlier raised concerns and proposed “de-addiction measures” such as periodic warnings and advisories during games.

Calls for a review of the tax have been rebuffed, with officials saying further consultation with the industry is not needed.

“Moral angle is certainly there when we are taxing online gaming at 28 percent. Lot of Ministers at Goods and Services Tax Council were of the view that betting on online gaming is a social evil, and should be discouraged,” Malhotra said, according to the Reuters report.

Concerns about addiction have risen in line with the rapid rise of online gaming.

The revenue of fantasy gaming platforms during the Indian Premier League cricket matches rose 24 percent from a year earlier to over $342 million with over 61 million users participating, Redseer consultancy said this month.

Malhotra rebuffed concerns that the tax would undermine foreign investment, triggering job losses.

“Employment and investments have to cater to the needs of the society and what is good for the economy at large,” Malhotra said, “No government would promote an industry only for the sake of employment and investment, if the industry is not in public interest.”

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

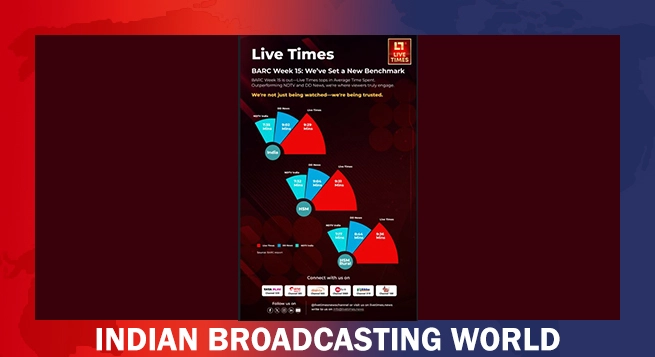

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement  Tata Play, Airtel merger talks off

Tata Play, Airtel merger talks off  DishTV Watcho launches FLIQS to boost OTT access

DishTV Watcho launches FLIQS to boost OTT access  Balaji Originals debuts with ‘The Great Indian Cricket Fan’

Balaji Originals debuts with ‘The Great Indian Cricket Fan’  Emmy Award winner ‘Delhi Crime’ initially struggled to find backers

Emmy Award winner ‘Delhi Crime’ initially struggled to find backers