The digital media will potentially overtake television as the leading segment in the media & entertainment sector in 2024 with an estimated size of Rs 75,100 crore, said a joint report from industry body FICCI (Federation of Indian Chambers of Commerce and Industry) and EY on Tuesday.

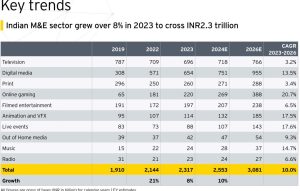

According to IANS, the Indian Media & Entertainment (M&E) sector grew by 8.1 percent in 2023, reaching Rs 2.32 lakh crore and is expected to touch Rs 2.55 lakh crore and cross Rs 3 lakh crore mark by 2026, it added.

“We expect the M&E sector to grow 10.2 percent to reach Rs 2.55 trillion by 2024, then grow at a CAGR (Compound Annual Growth Rate) of 10 percent to reach Rs 3.08 trillion by 2026,” the report said.

Though in 2023 television remained the largest segment with Rs 69,600 crore, however, it had a degrowth of 1.83 percent as against Rs 70,900 crore in 2022, it said. While, the digital media in 2023 crossed Rs 65,400 crore and is expected to be around Rs 75,100 crore in 2024, which is ahead of Rs 71,800 crore figure of the television media.

The report estimates digital media would be around Rs 95,500 crore in 2026, with a CAGR growth of 13.5 percent between 2023-26.

While TV media would be Rs 76,600 crore, which would be around 20 percent less than digital media.

“In 2024, digital media is poised for explosive growth, potentially overtaking television to become the leading segment of the M&E sector. This surge in digital media is forecasted to propel the M&E sector’s growth to a 10 percent annual rate, crossing Rs 3 trillion (USD 37.1 billion) by 2026,” said Kevin Vaz Chairman, FICCI Media and Entertainment Committee.

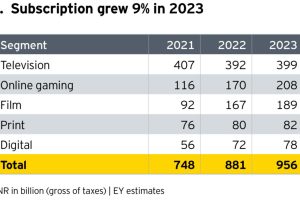

This growth is buoyed by a robust digital infrastructure, widespread adoption of OTT platforms, significant growth in the gaming segment, and the availability of cost-effective options for consumers.

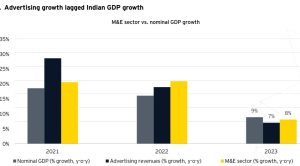

The report expects digital advertising to grow at a 13.5 percent CAGR to reach Rs 84,200 crore, on the back of improved governance.

According to the report, the connected TV (smart TV) saw a 50 per cent growth as internet penetration continues to rise.

“The broadband market is growing with subscription numbers recording 904 million. It is inevitable that smartphone users have grown and consequently, the average usage time continues to rise,” it said.

However, it also added despite high app downloads of 26.4 billion, India was behind in monetising this potential, with users spending half their time on social media apps. “The year also saw the growth of digital ad spending by 15 percent, predominantly in search and social media. By 2026, the digital segment is expected to grow to Rs 95,000 crore with an increased focus on governance,” it said.

The Media & Entertainment sector (M&E) sector, which was around Rs 2.14 lakh crore has grown around Rs 17,300 crore in 2023, led by growth from Digital media, Print, Online gaming, and Animation and VFX, the report said.

“While the sector was 21 percent above its pre-pandemic levels, television, print, and radio still lagged their 2019 levels,” it said.

The share of traditional media, which includes television, print, filmed entertainment, live events, OOH (Out-of-home), music, and radio stood at 57 percent of M&E sector revenues in 2023, down from 76 percent in 2019, it added.

In 2023, TV advertising fell 6.5 percent due to a slowdown in spending by gaming and D2C brands, which impacted revenues for premium properties. However, it also added despite high app downloads of 26.4 billion, India was behind in monetising this potential, with users spending half their time on social media apps. “The year also saw the growth of digital ad spending by 15 percent, predominantly in search and social media. By 2026, the digital segment is expected to grow to Rs 95,000 crore with an increased focus on governance,” it said.

The Media & Entertainment sector (M&E) sector, which was around Rs 2.14 lakh crore has grown around Rs 17,300 crore in 2023, led by growth from Digital media, Print, Online gaming, and Animation and VFX, the report said.

“While the sector was 21 percent above its pre-pandemic levels, television, print, and radio still lagged their 2019 levels,” it said.

The share of traditional media, which includes television, print, filmed entertainment, live events, OOH (Out-of-home), music, and radio stood at 57 percent of M&E sector revenues in 2023, down from 76 percent in 2019, it added.

In 2023, TV advertising fell 6.5 percent due to a slowdown in spending by gaming and D2C brands, which impacted revenues for premium properties.

On the print media, the report said it has buckled the global trend and continued to thrive in India.

“Advertising revenues grew 4 percent in 2023, with a notable growth in premium ad formats, as print remained a “go-to” medium for more affluent and nonmetro audiences. Subscription revenues grew 3 percent on the back of rising cover prices. Digital revenues were insignificant for most print companies,” it said.

Bodhitree appoints Sudip Roy CRO; launches new revenue division

Bodhitree appoints Sudip Roy CRO; launches new revenue division  SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer

SonyLIV drops ‘Black, White & Gray-Love Kills’ trailer  Rahul Sinha takes charge of Zee News’ DNA

Rahul Sinha takes charge of Zee News’ DNA  JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges

JioStar vice-chair Uday Shankar on surge in streaming subs, trade tariff challenges  Kritika Kamra joins forces with ‘Peepli Live’ maker

Kritika Kamra joins forces with ‘Peepli Live’ maker  ‘Vicky Donor’ returns to theatres on April 18

‘Vicky Donor’ returns to theatres on April 18  ‘Bhool Chuk Maaf’ unveils ‘Koi Naa’ first song of the album

‘Bhool Chuk Maaf’ unveils ‘Koi Naa’ first song of the album  Cinystore Technologies unveils ‘KeepItShort’ new OTT platform

Cinystore Technologies unveils ‘KeepItShort’ new OTT platform  MIB cancels 1,100 MSO registrations; only 843 remain active

MIB cancels 1,100 MSO registrations; only 843 remain active