By Karan Taurani@Elara Capital

In the media and entertainment (M&E) industry, digital is now occupying centre stage, starting to impact all forms of traditional media.

For example, the cinema medium is at 25 percent lower footfall versus pre COVID level, primarily on low willingness by the audience to watch small/medium-budget content in theatres.

Key genres such as movies, GECs (60 percent of TV industry viewership share) losing viewership share, given lower time spent, as digital platforms gain currency.

Social (Meta), e-commerce (Amazon, Flipkart), display (Google), aggregators (YouTube) are acting as key segments, accounting for a lion’s share (85 percent) in the digital advertising ecosystem, leaving very little for broadcaster-based OTT platforms (Sony Liv, Zee5 etc.).

There seems little or no growth potential for linear TV households, as connected TV gains traction with improved broadband penetration/5G launch. Even markets in South India that traditionally enjoyed higher time spent on TV (25 percent more than the national averages) are likely losing eyeballs, as global OTT giants invest aggressively in regional content (50 percent new content initiatives are regional-centric).

Increased content cost too hurting OTT platforms’ ROI potential, leading to near-term unviability.

However, digital media too is facing concerns in some forms like the following:

1) Monetisation – Ad slot pricing far lower than TV’s.

2) Market highly fragmented – India has 45 OTT apps.

3) ARPUs compressed on video OTT platforms, due to TV ARPU being low and India being a price sensitive market.

4) Heavy ad dependence working against OTT platforms; on volatile macro environment – new age companies may curtail ad budgets.

5) Most platforms depend on telecom service providers (TSPs) and OEMs for content distribution and reaching a large subscriber base, which significantly hits ARPUs.

6) Growing acceptance of smart TV purely depends on wired broadband penetration (fibre), which has been very low for India (16 percent).

We believe a come-back of traditional media cannot be ruled out and may ideally depend on a confluence of factors like:

1) Increase in the number of large-budget films (VFX, high production value and compelling stories) and consistent successful runs driving footfall growth versus pre-COVID level.

2) Acceptance of Hindi/South content pan-India, that may drive scale for India Box Office (BO).

3) Better and sharper measurement on traditional mediums such as TV that could help better advertising prospects.

4) Some innovation in the nature of content (GEC, reality shows) for the youth can positively impact TV viewership

5) Consolidation of larger broadcasting groups that may streamline revenue/cost synergies and a combined ‘go to market’ strategy for digital media.

Globally, digital advertising may continue to gain ground, medium term, despite a cut in budgets due to macro-economic headwinds, as traditional media may not see any respite, given huge adoption of connected TV (CTV). Emerging nations may continue to grow at a faster pace versus global digital advertising (3-3.5x global digital growth), which will drive momentum for shift to programmatic ad spends.

Egypt, Lat America, Indonesia and India may outperform within emerging nations.

For India, digital advertising, global media giants such as Google/Meta may continue to lose ground as their current market share is 65 percent, down from 80 percent in the past four years.

This is primarily on the back of segments such as e-commerce, gaming and video OTT that have gained strong ground, as ad budgets are shifting due to changing consumer trends. This shift in digital advertising augurs well for programmatic advertisers such as Affle – this helps them provide large-scale publishers for better conversions.

Our recommendation: Positive on traditional media/adtech players; consolidation aplenty.

We have a positive stance on Zee Entertainment Enterprises, largely on the back of potential Z/Sony merger in the near term. This will drive synergies in the low-growth traditional business, which in turn can make it the market leader. In case of better execution on content/strategy and very little overlap in genres, this merged entity may become the market leader and move beyond Star/Disney.

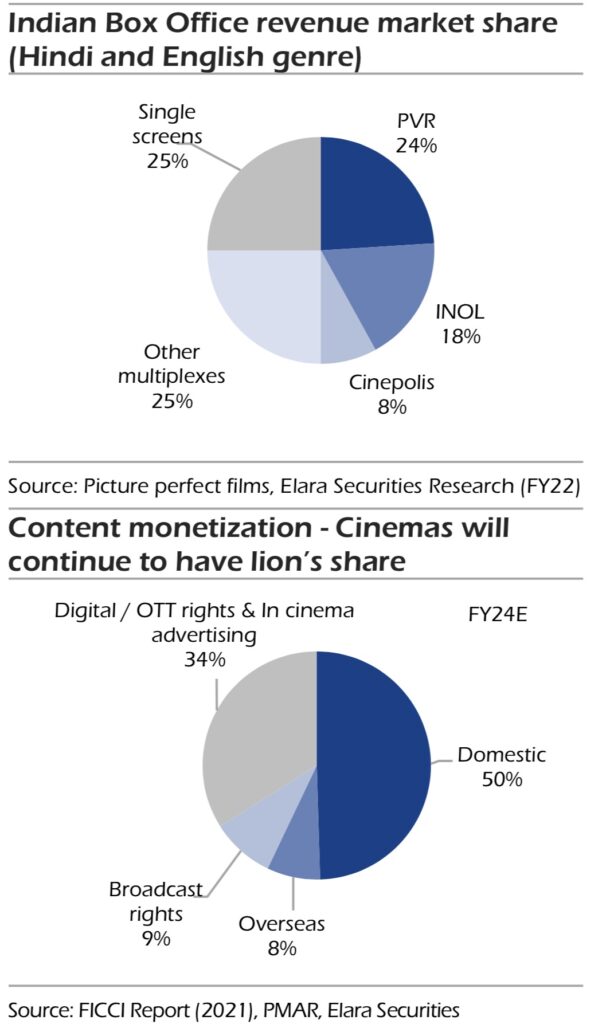

In the cinema medium too, merger of PVR and Inox augurs well for the industry as the combined entity may gain significant market share in South India, coupled with multiple revenue synergies (ad revenue and convenience fee) that positively impacts overall profitability.

Acceptance of dubbed content across genres is also a big advantage for overall content consumption.

Our positive stance on SUNTV is more tactical in nature as the INR 50 billion cash pile may be used for a buy-back/special dividend, coupled with the IPL team valuation (SRH), which has seen a surge due to recent auctions.

Preference for TV Today Network is largely on the back of the news genre, which may see very little negative impact of digital as it is consumed live and is not catch-up in nature. We also prefer ad-tech players such as Affle that have significantly higher presence in the emerging nations, which may post healthy growth despite macro-economic headwinds and will outperform on the digital advertising front versus global averages/developed nations.

Further, CPCU-based model may also be a safe haven in an uncertain macro environment, as more budgets are allocated to high ROI models.

(Illustration courtesy dreamstime.com)

AniMela partners AMS for India’s global AVGC XR fest

AniMela partners AMS for India’s global AVGC XR fest  Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’

Filmmaker Shekhar Kapur feels AI ‘yet to match human imagination’  Punit Goenka makes himself unavailable for Zee MD post ahead of AGM

Punit Goenka makes himself unavailable for Zee MD post ahead of AGM  ‘Kicking Balls’ premieres on Prasar Bharati’s WAVES

‘Kicking Balls’ premieres on Prasar Bharati’s WAVES  Streambox unveils subscription-based TV service Dor

Streambox unveils subscription-based TV service Dor  Vir Das’ maiden hosting stint at 52nd Emmy Awards ‘went well’

Vir Das’ maiden hosting stint at 52nd Emmy Awards ‘went well’  ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market

ABP News overtakes Aaj Tak, ABP Majha leads Marathi news market