The humongous sum of Rs 48,390 crore (approximately $ 6.2 billion) fetched from media rights of IPL cricket has divided industry experts, with some feeling that the market can easily absorb it, while others said anything ‘puffy and inflated’ puts pressure on the sport.

For advertisers, two separate entities bagging the TV and digital rights augur well as it would give them more options, according to a PTI report.

According to Rediffusion Managing Director Sandeep Goyal, the market will easily absorb the increase in prices of the IPL television rights, while on the digital front a complete metamorphosis could be expected in the OTT space like what Jio did to mobile telephony.

“Disney Star has ended up with a sweetheart of a deal on (TV) broadcast rights,” Goyal told PTI.

Stressing that concurrently, the number of matches has also been increased in the next five years, he said, “Effectively the price is up about 33 per cent in five years, which is an arithmetic increase the market will easily absorb”.

However, on the digital front, Goyal said, “I think Reliance is going to do to OTT what they did to mobile — a complete metamorphosis. So, Jio could well decide to give cricket free to all subscribers and go up 500 per cent on the current base. Voot (Viacom 18’s video-on-demand platform) is going to see a dramatic jump. Exciting stuff ahead”.

Expressing similar views, MediaCom CEO South Asia Navin Khemka said the bid was aggressive and has now made IPL among the top three globally, and real value will be unlocked in the next five years.

“This was expected considering how high the base prices were set, and there were three-four serious bidders. It is also a step-change for the way digital is being valued,” he added.

Also with the rights fragmented with no single entity getting both TV and digital rights, unlike last time, Khemka said, “It will be very interesting to see how they bring in innovation in the way IPL will be monetized. For advertisers, they would have more options to choose from”.

However, media and entertainment pioneer and entrepreneur Ronnie Screwvala, who founded the erstwhile UTV group (whose TV business was sold to Disney), expressed concern over the high prices of IPL rights.

“Should we send a Message of Congratulations or Message of Condolence to the Winning Cos for IPL bid – what say? Great for @BCCI great for all team owners and I wish I could say Great for Cricket -but we know anything so puffy & inflated puts a lot of stress on the Sport itself,” Screwvala said in a tweet.

After the conclusion of the IPL media e-auction, Zee Entertainment Enterprises Ltd (ZEEL), which took part in the bidding, said it evaluates all business decisions through the prism of value creation for all its stakeholders.

“At ZEE, we evaluate all business decisions through the prism of value creation for all our stakeholders and we will continue to evaluate every sports property with the same prism,” ZEEL President, Business, Rahul Johri said in a statement.

The BCCI on Tuesday announced mopping up a whopping Rs 48,390 crore (USD 6.20 billion) through IPL media rights for five years, starting 2023, and reaffirmed its status as a cricketing behemoth by securing one of the biggest broadcast deals in the history of the sport.

While Disney Star retained their Indian sub-continent TV rights by paying Rs 23,575 crore (Rs 57.5 crore/game), the most sought-after India digital rights deal was acquired for Rs 20,500 crore by the Reliance-backed Viacom18, which also won the non-exclusive Package C by paying Rs. 2,991 crore more.

The fact that digital rights value is higher than television showcases the scale and future potential of streaming in India,” Mihir Shah, Vice President at consultants Media Partners Asia, was quoted in a report by Reuters.

For Mukesh Ambani’s Reliance, which will stream the IPL for the first time, the deal plays into the company’s larger plans for its telecom and tech arm Jio, which has 400 million broadband customers, Shah said— a statement that’s quite similar to what Goyal had asserted on Reliance looking at now majorly disrupting the OTT realm.

Others in the IPL rights race included Sony Corp’s India unit and local broadcaster Zee Entertainment, both of whom are in the middle of a proposed merger.

“We had to factor in the market’s anticipated expansion and potential economic and other concerns over the next five years. Fiscal prudence, in my opinion, is critical for strategic management,” N P Singh, Managing Director and CEO Sony Pictures Networks India, said in a statement, according to a Reuters report.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

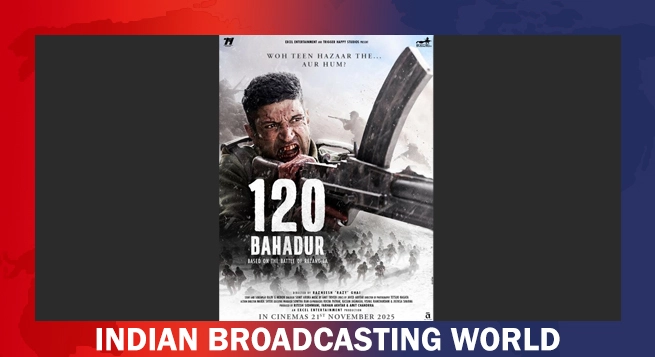

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025