New Delhi, 07-April-2021 By Karan Taurani, VP, Elara Capital

TV Broadcasting Space : Ad. growth back in growth trajectory

- We expect Zee Entertainment to report growth in ad revenues by 5% YoY, while a decline of 3.5% YoY for SUNTV, largely since the ad spends after an uptick during the festive season in Q3 have stabilised on QoQ basis and local advertising remains low for regional genres Continued traction for the GEC prime-time content, coupled with multiple cricketing events like India v/s England series have been the key drivers during the quarter helping ad spends to regain pre-COVID levels. Decline for SunTV is expected, since the flagship channel has been unable to recoup the lost viewership share slipping below the 40% mark. TV Today is expected to witness flat ad revenues for the quarter on a high base where it witnessed 19.5% growth YoY on back of surge in viewership for news genre and Aaj Tak maintaining its strong market share despite the TRP scam issue.

- On Subscription revenues, Z is expected to witness a 6% growth YoY largely on back of the reclassification of the music segment as core subscription revenues to remain in low single digit bracket given the high base of Q4FY20, while SunTV is expected to witness a 2% growth YoY led by the Tamil Nadu digitization. Other operating revenues are expected to remain muted YoY for Z as well as SUNTV given no big new movie release in case of Z while IPL revenues being fully booked in Q3FY21.

- EBITDA margins for Z to decline 70bp QoQ at 25.5% as heavy content investments continue for Zee5, while SUNTV is expected to witness a decline of 550bp YoY to 63% as programming costs for GEC content, content investment for OTT platforms has not translated to viewership gains & consequent ad/subscription revenues for SunTV during the quarter.

Movie Exhibition space: Selective Hollywood and regional content provide some respite

- Inox/PVR witnessed some green shoots with theatre re-opening across majority states and with the success of Master(clocking over INR 1950mn of Net BO Collections in India) & Godzilla v/s King Kong(clocking Net BO collections of over INR 400mn, which is highest for a Hollywood Movie since COVID-19 pandemic in India as Tenet & Wonder woman in the initial phases of unlock had recorded mere INR 140mn & INR 200mn respectively), we expect occupancy levels to be ~3x and 5x of Q3FY21 i.e. 9% in case of Inox & 14-15% in case of PVR driving footfalls for the quarter.

- Hindi Movies however have been a laggard as films like Indoo Ki Jawaani(clocking mere INR 19mn), Sooraj Pe Mangal Bhaari (clocking mere INR 38mn), and now Mumbai Saga reporting ~INR 90mn collection and is expected to report lifetime numbers of INR 100-120mn which are far lower as compared to the Hollywood releases & regional releases(Tamil & Telugu) like Master, Krack (clocking INR 600mn Net BO Collections), Eeswaran, Allu Adhurs, Red, Kabadadhaari (all clocking Net BO above INR 100-150mn). This has been primarily on back of high dependence of Hindi BO on the Maharashtra Circuit, which has been badly hit with increasing COVID cases due to which occupancy levels remaining low.

- Amongst Regional content, Yuvaratna (made by producers of the large film KGF) released on 2nd April and Namootikalam slated to release over the next one week, indicate that people in south are coming to cinemas in large numbers if 1) content is good 2) film is large scale, which has helped regain some confidence & green shoots for exhibitors.

- In terms of the other metrics, we expect ATP(Average Ticket Price) to remain at similar levels QoQ, while SPH(Spend per Head) to improve by INR 5 & INR 7 respectively during the quarter. Exhibitors are expected report EBITDA loss of INR 100mn & INR 68mn for PVR & Inox respectively as with the improved occupancy levels in Cinemas contributing to the topline(via BO Collections & F&B revenues), it will consequently lead to an uptick in cash burn towards INR 330-350mn/month for INOL, while at INR 650-680mn in case of PVR given resumption of theatre operations in full swing accommodating the increased footfalls

Radio: Long haul before normalcy

- We expect a revenue decline of 22%/26% YoY for the radio segment of ENIL and MBL respectively as despite the recovery in overall ad spends, radio has continued to remain a laggard given the shift towards digital mediums, pain for central government vertical & pricing pressures which are expected to persist in near term given the heavy discounting during COVID period to attract advertisers.

- However, ENIL’s non-radio i.e. solutions business will show some recovery led by the Mirchi Music Awards during the quarter declining 28% YoY v/s 51% in Q3FY21, but the halt of on-ground activations, cancellation of other big outdoor events, shows etc. constituting ~60-65% of the solutions business will continue to have a negative impact on the vertical. Digital products business which contributes 30-35% of the solutions business is expected to remain resilient, led by strong traction towards digital.

(The views expressed in the article are those of the writer and indianbroadcastingworld.com need not necessarily subscribe those views)

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

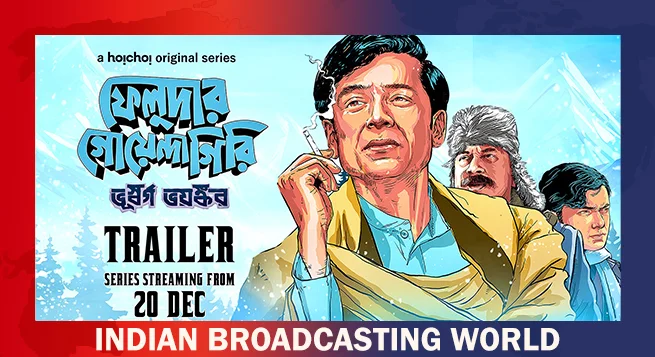

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  BSNL launches free Intranet TV in Puducherry

BSNL launches free Intranet TV in Puducherry  Netflix bags US rights for next 2 women’s FIFA WC

Netflix bags US rights for next 2 women’s FIFA WC  Urmila Venugopalan to head MPA in APAC as Belinda Lui retires

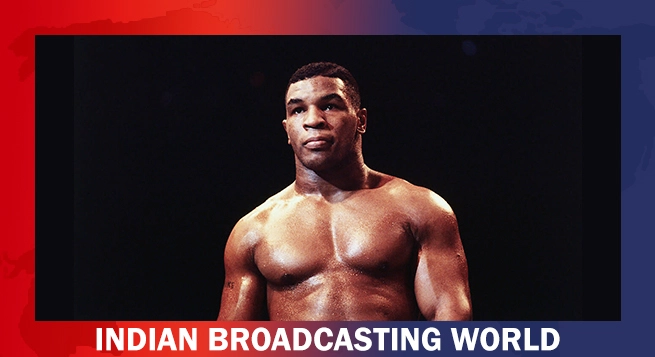

Urmila Venugopalan to head MPA in APAC as Belinda Lui retires  Netflix announces sports series on boxing legend Tyson

Netflix announces sports series on boxing legend Tyson  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription