Wave II submerses advertising spends softly versus 2020 levels*

Covid-Wave I defaced Q1FY21 ad revenues with decline of 61% YoY(ex- IPL)/79%/87% for TV/print/radio sectors, respectively. Nevertheless, we expect Q1FY22 tapering to diminish, versus FY20 base, at 25%/45%/35% decline, respectively, primarily on: 1) ongoing TV shoots led by a shift to alternate locations with minimal Covid impact on fresh content, 2) state-level restrictions versus pan-India lock-down in 2020 and 3) continued print-newspapers’ circulation and delivery (food, e- commerce, alcohol), leaning on 2020 learnings. We believe ramped vaccination pace should trigger a sharp ebb in new cases, which could uncork a faster unlock versus 2020 levels.

TV, digital advertising to revive at a faster clip to pre-Covid levels

We expect TV and digital advertising to show resilience and return to pre- Covid levels(FY20) at a faster clip, versus other mediums, to 100%/137% levels, respectively, in FY22E. We estimate TV/digital advertising to grow 18.6%(ex-IPL)/25% YoY in FY22 respectively as verticals such as FMCG, e- commerce, auto and telecom enjoy a larger share in these mediums. Alternatively, mediums such as print and radio will take longer to recuperate to pre-Covid levels given higher exposure to local/SME advertising segments. We expect print/radio to revive to only 71%/58% of pre-Covid levels by end-FY22E. Other verticals like cinema and out of home (OOH) too should traverse a similar elongated recovery time.

Broadcasters with regional plays and news genre to outshine

We believe broadcasters with high exposure to regional, sports and news genres will outperform on advertising growth in FY22 and beyond – Sports and news are the two genres with continued demand for live consumption. This should support their growth in the linear medium. Regional genres such as Marathi, Telugu, Tamil, Malayalam and others too offer a large untapped opportunity in advertising growth, as their transition to the digital medium should take longer versus Hindi and English genres. TV Today Network (TVTN) and Zee Entertainment (ZEEL) are our top picks within the listed broadcaster space given their presence in key genres and market share gain visibility.

Valuations – Maintain BUY on ZEEL, TVTN

We maintain BUY on ZEEL/TVTN with a TP of INR 300/370 within broadcasters in the listed media space. Visibility of a turnaround in digital offerings to tap better growth versus industry averages may lead to near- term multiple re-rating. Within the regional genre, Sun TV, the market leader in Tamil genre, may show re-rating potential in the near term, only basis successful execution of digital initiatives, even as global OTT giants continue to disrupt the space on higher content costs (Hindi and regional).

BCCI mulls suspending IPL as India-Pak tensions heighten

BCCI mulls suspending IPL as India-Pak tensions heighten  NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  Can Trump’s foreign movie tariff threat impact Indian films’ biz?

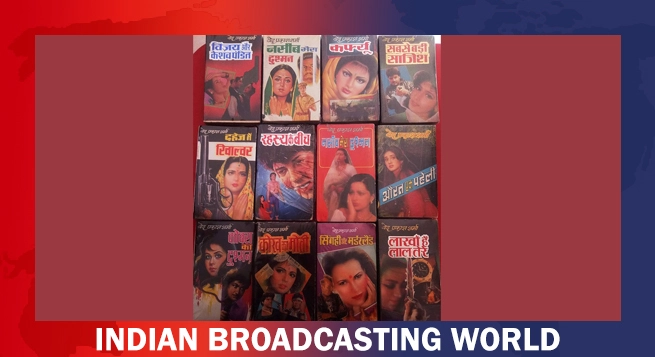

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup  Kangana to make her Hollywood debut with ‘Blessed Be The Evil’

Kangana to make her Hollywood debut with ‘Blessed Be The Evil’