By Karan Taurani@Elara Capital

As per official announcement, Adani group has acquired VCPL, which holds 29 percent stake in NDTV (indirectly via promoter loans, convertible into shares) and has provided for an open offer to acquire more 26 percent stake at a price of INR 295 (a 20 percent discount vs CMP)

– Even basis, the open offer price (20 percent lower vs CMP), NDTV as a company is trading at almost 3.5x fwd sales (FY24), as compared to this it’s larger peer TVT (TV Today), which is trading at mere 0.7x fwd EV/sales (FY24).

– TVT is the market leader in Hindi news genre, which has the largest share in overall news genre (Hindi language has a 70% share in news genre), and also has a sizeable digital presence (19 percent revenue contribution from digital); TVT digital revenue has grown at a CAGR of 34 percent (FY19-22).

– TVT has reported an overall revenue CAGR of 8 percent (FY19-22), vs NDTV whose revenue CAGR has been (0.2 percent) in the same period.

– EBITDA margins for TVT have been in a narrow band of 25-26 percent; NDTV’s margins are also similar at 25 percent.

– Indian television news industry size is Rs. 2800cr (70 percent of this market is dominated by Hindi news), growing at a CAGR of 10 percent (Ex COVID base); it contributes approx. 9 percent of tv ad spends, within which TVT/NDTV have an approx revenue market share of 30 percent/15 percent respectively. News accounts for a viewership share of 9-10 percent on the TV segment.

– The news market in India is highly dominated by advertising, as subs revenue is mere 2-3 percent of the overall revenue.

– Tv news segment reports strong growth during state or general election times, due to increased viewership and time spent; TV news was the only genre that reported fastest recovery towards pre covid levels, backed by increased viewership during covid times.

Our View

We believe valuations paid for this acquisition are at a healthy premium (3.5x sales, after factoring the 20 percent discount on CMP), considering peers in the TV broadcasting space (Z/SUNTV/TVT trades at a FY24 EV/sales multiple of 2.4x/3.5x/0.7x). However, this move will enable a large corporate house backing for a news channel, after Reliance/Times group own the TV18 and Times Now/ET Now respectively, which enables better distribution via the homegrown platform.

We believe, news is a genre, which will have the least negative impact due to consumer shift towards digital, as the latter is more watched in live form and not in the form of catch up (other GEC content has seen a big shift from tv to digital due to catch up feature, convenience viewing).

News as a business model, is also platform agnostic in nature, as its content can be shared across most platforms vs broadcasters who have to invest heavily in forming their own platform in this highly fragmented market with elevated content costs.

We maintain our positive stance on TVT and have a BUY rating with a SOTP basis TP of INR 540, which is based on 1.3x fwd EV/sales (steep discount vs NDTV even at open offer price). NDTV has a stronger presence in the English news genre which is currently dominated by Times Now and Republic; in terms of Hindi genre, NDTV is usually at the third place post Aaj Tak and India TV.

With TV viewing becoming more selective amidst regulations like NTO 2.0 and the market dominance by larger players in the news genre, we don’t expect sustainability in these premium valuations for NDTV over the near to medium term.

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  IPL suspension: JioStar says national interest top priority

IPL suspension: JioStar says national interest top priority  Kamal Haasan postpones ‘Thug Life’ audio launch

Kamal Haasan postpones ‘Thug Life’ audio launch  Pranav Mohanlal’s horror thriller titled ‘Dies Irae’

Pranav Mohanlal’s horror thriller titled ‘Dies Irae’  ZEEL appoints Rohit Suri as Chief Human Resource Officer

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

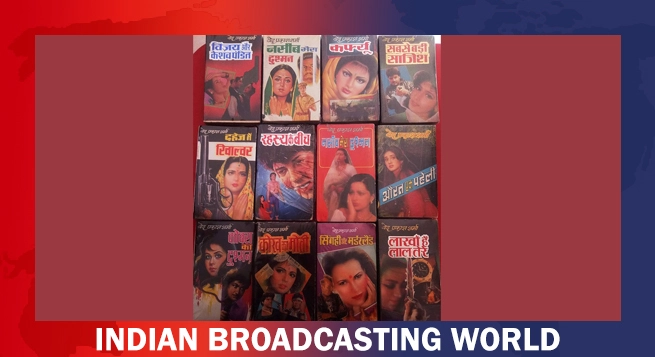

Ved Prakash Sharma’s bestselling novels to get film adaptations