By Karan Taurani@Elara Capital

RIL in their AGM on Monday announced the launch of Jio Air Fiber, a device which will provide fiber-like Internet speed without wires, meaning that one will be able to get fixed broadband-like speed without actually having the issue of installing fixed cables in home.

We believe this will be a big disruption for the media industry over the near to medium term.

Struggle for Wired Broadband scale was real: Jio launched its wired broadband fibre service in H2FY20; this was with high fibre internet speeds and competitive pricing. Despite the same, India wired broadband penetration remains low at 15 percent as they have failed to scale up due to last mile issues with the LCO/MSO ecosystem.

We believe the concerns were primarily due to revenue share arrangements, which had prevented the aggregators from pushing Jio Fibre as a service. Companies like Hathway and Den too have tried hard to scale up their wired broadband services, but have failed to make a big impact in the same.

Wired broadband speeds are far superior vs wireless broadband: India’s wireless broadband penetration is 80%, however the speeds for the same have been much lower at 15 MBPS vs wired broadband speeds of 40 MBPS; in terms of other key nations – China has wired broadband speeds are 133 MBPS and penetration therein too is at 91%, much higher than that of India at 15%. Launch of Jio Air Fiber will enhance internet speeds in India sharply, coupled with lesser logistical issues in the last mile, as it will be wireless, which will further boost connectivity and speeds in the smaller markets (tier 2 and tier 3 cities)

Impact on consumer behaviour and consumption patterns – Jio Air Fiber – an oxygen for smart tv penetration: India’s smart TV penetration remains to be low at 10-15%, however this is growing at a rapid pace (over 30% YoY growth) and may move towards penetration levels of 25-30% over the next three years; launch of Jio Air Fiber will boost in-home internet speeds, which in turn will lead to rapid shift of users from traditional TV to smart TVs in the metro cities.

In fact if the prices are attractive (on par with wireless broadband or small premium), the tier 2 and 3 towns may even jump and move directly towards the smart tv technology.

This will improve digital content consumption growth (advertising and subscription led), which may further lead to a negative impact for the TV industry as a whole. Indian consumers spend INR 300-350 on cable ARPU today; we believe the trend towards digital will be sharper in metro cities, wherein the consumer is more prone to paying for SVOD service, whereas smaller town consumption will be more led by AVOD based services for now.

OTT has always been a threat for traditional TV genres (GEC, movies, music, infotainment), where catch up TV on content is possible; this threat is lesser in the case of genres like sports/news which is preferred to be consumed live.

Implications for the broadcasting industry – will need to move attention towards digital: TV broadcasters will need to provide a big impetus on their digital and OTT offerings, continue to scale up their subs base, as audience will move towards OTT at a more rapid pace due to the above launch (Air Fiber).

The OTT industry remains to be highly fragmented and hence content costs too remain hefty; however, consolidation will remain the need of the hour if linear broadcasters were to explore business synergies and move rapidly toward digital. In the traditional TV industry too, consolidation will be very important, as market dynamics move favourably towards larger players; in case of Sony/Zee merger going through.

We believe Star and Sony/Zee groups may together command an ad. revenue market share of 55%-60%, which makes it tougher for other players to compete/scale; there is a higher likelihood of this market share number inching higher for these large players in case of good execution on TV, as the audience moves towards selective viewing on TV.

Implications for the OTT industry – possibility of content innovation:

OTT segment will continue to grow a healthy CAGR of over 30% over the next five years, as content consumption will rapidly move towards digital due to the above launch. This will have a big boost for premium SVOD based platforms, which offer 4K and other premium nature of content.

OTT segment will remain highly competitive, as most platforms look to improve the nature of content shown; gaming within OTT is another segment which will boost consumption of OTT platforms and see a big benefit due to Air Fibre service. This move will also enable home grown based OTT platforms to produce immersive/differentiated content, which we believe is the next big driver for OTT platforms globally and in India

Implications for the cinema industry – experience led content consumption: Cinematic experience is one of its kind for large scale nature of content (3D, 4DX) etc and the above launch may not have a big negative impact on cinemas, unless producers/content creators fail to create differentiated cinematic content.

We expect a strong rebound in footfalls over the medium to longer term as content creators rejig stories and scripts in the hindi genre; further, a strong support from the regional/English genre remains due to the nature of content being made (large scale cinematic films)

Await pricing and more details on the JIO AIR FIBRE. We have a BUY rating on Z/SUNTV/TVT/PVR/INOL within the media sector.

NBF issues advisory to member news channels on Pak guests

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Indian creators aim for global impact, say streaming is redefining storytelling

Indian creators aim for global impact, say streaming is redefining storytelling  Ashish Chanchlani unveils poster for ‘Ekaki’

Ashish Chanchlani unveils poster for ‘Ekaki’  ‘Panchayat’ S4 teaser hints at fierce election showdown

‘Panchayat’ S4 teaser hints at fierce election showdown  Network18 surges ahead of Times Internet

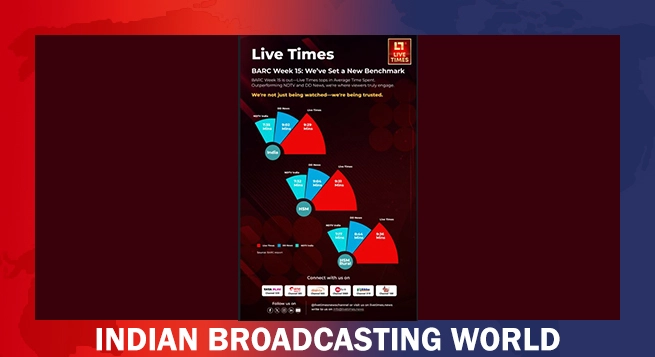

Network18 surges ahead of Times Internet  Live Times tops NDTV, DD News in viewer engagement

Live Times tops NDTV, DD News in viewer engagement