By Karan Taurani@Elara Capital

(TDSAT, the telecom and broadcast disputes tribunal, in an order dated September 20, 2022 directed the pay channel broadcasters to supply details to broadcast regulator TRAI as to how they were retransmitting live/linear channels onto OTT platforms, along with detailed architecture. The TDSAT noted in the order, the full version not yet out, that there seems to be non-compliance of the downlinking guidelines of MIB by the pay TV broadcasters.)

Basis Supreme Court notification, uplinking/downlinking is limited only on platforms like IPTV, DTH, MSO; hence providing TV content to OTT platforms may not be allowed or may require some change in the rules.

Implications

As per our assessment, the above if passed (catch up TV content not allowed on OTT platforms of broadcasters) is a big negative as almost 50-60 percent of the consumption/time spent comes from catch up TV (movies and TV shows) for broadcaster based OTT platforms (Zee5, Sony Liv, Voot, Sun NXT etc).

Thus, no catch up TV content will negatively impact the content catalogue depth of broadcaster based (or broadcaster-owned) OTTs and eventually negatively impact overall revenue numbers too, as consumption may decline.

It may also lead to a situation wherein the broadcasters may have to increase content costs and invest in other content apart from catch up TV, which will lead to a situation of more hefty losses in this already heavily fragmented OTT market (Zee5, Hotstar already making losses in the range of INR 6-8bn)

A lot of broadcasters have also bypassed the TV route and moved some of their franchise based shows on the digital (OTT) platforms, as it attracts more audience and helps them in their overall digital strategy.

The only one respite is that not allowing TV content on OTT will help arrest negative impact on TV, as time spent on the latter continues to drop over the last three years, as audiences want to watch most of the content on convenience basis (GEC shows, films, infotainment, etc).

However, the above positive impact will remain only for compelling properties or shows or TV channels, which have a very strong recall; rest of the channels (TV shows) may end up losing viewership as new audience growth on TV remains absent.

In terms of monetisation, TV is a better medium for broadcasters helped by premium pricing (prime time), as compared to digital, which is highly fragmented with ample variety in content; however, all broadcasters/TV shows may not be able to gain because of the above, due to urban audience wanting to consume content without advertising and showing willingness to pay for the same.

It will have a bigger negative impact on the OTT ad revenues as most content deals are also bundled in nature (TV + OTT).

Our View

We believe there will be a substantial loss (in the range of 30-40 percent) in the subscription and ad revenue for broadcaster based OTT platforms, with a potential downgrade in the overall profitability due to a need for higher content investment (non-catchup TV content).

Digital revenues roughly contribute a wide range of 6-15 percent (Star/Disney at the higher end due to cricket) of revenue for broadcasters today; this will also be a drag for the news genre, as they too have a heavy dependence on their own TV content.

Select broadcasters may be able to gain in terms of eyeballs/viewership for their compelling properties/shows over near term. However, overall basis it will be a loss, as audience continues to spend more time on OTT with a wide variety of content without any censorship (bold, violent content); TV as a medium does not offer potential for healthy growth in viewership (poor experience due to ads, censorship etc) and there will be a high likelihood that customer transitions towards OTT, rather than moving back to TV.

The above move will also limit competitive capability for broadcasters vs. global OTT platforms, which invest heavily into content (content budgets for global OTT companies could be almost 3x that of broadcasters-owned OTT)

(Elara Caps has said these are initial views)

(ENDS)

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

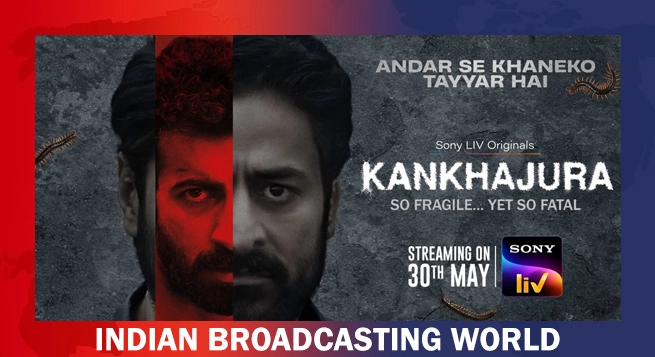

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles