The Moneycontrol Global Wealth Summit 2025, held on March 7 in Mumbai, brought together top policymakers, financial leaders, and industry experts to discuss India’s roadmap to achieving a $10 trillion market capitalization.

With the theme “Next Wave of Wealth Creation: India’s $10 Trillion Market-Cap Opportunity,” the summit explored market trends, regulatory shifts, and investment strategies shaping India’s economic trajectory.

As India cements its position as the world’s fastest-growing major economy, the event provided a platform to analyze global market volatility, economic policy shifts, and wealth creation opportunities. Key figures such as Maharashtra CM Devendra Fadnavis, SEBI Chief Tuhin Kanta Pandey, and investment heavyweights like Howard Marks and Mark Coombs shared their insights on India’s financial future.

Setting the stage, Moneycontrol’s Managing Editor, Nalin Mehta, highlighted India’s financial revolution, noting a surge in Demat accounts from 22 million in 2014 to 185 million today. He also emphasized India’s dominance in global IPO markets, raising $19.2 billion in 2024—double that of China.

“A decade ago, India was the 10th largest economy. Today, we’re 5th and on track to becoming 3rd. Our equity markets have quadrupled, and nearly half of mutual fund assets now come from beyond metro cities,” Mehta stated, reinforcing India’s deepening financial participation.

Howard Marks, Co-Chairman of Oaktree Capital Management, dissected the impact of macroeconomic cycles, emphasizing that interest rates are returning to historical norms after an era of near-zero rates. “A healthy economy doesn’t need ultra-low rates or extreme hikes—it needs balance,” he said, urging investors to adapt to moderate rates instead of chasing past anomalies.

SEBI Chairman Tuhin Kanta Pandey provided a regulatory perspective, stressing transparency and investor trust as crucial for sustaining India’s financial momentum. “SEBI itself must be transparent about conflicts of interest, and we are developing a framework to ensure greater disclosure,” he stated. He also underscored India’s projected 6-6.5% GDP growth in 2025, driven by the Viksit Bharat initiative.

V. Vaidyanathan, MD & CEO, IDFC FIRST Bank, pointed to financial inclusion and digitalization as transformative forces, highlighting the rising credit-to-GDP ratio as a major driver of economic expansion.

The summit featured a compelling lineup of industry pioneers discussing diverse financial themes:

Mark Coombs, CEO of Ashmore Group, explored the impact of Trumponomics on global capital flows.

David Tait, CEO of the World Gold Council, analyzed whether gold’s bull run is sustainable.

Anish Shah, MD & Group CEO of Mahindra Group, and Neelkanth Mishra, UIDAI Chief & PM Economic Advisory Council Member, discussed India’s roadmap to a $10 trillion market cap.

Ashish Chauhan (CEO, NSE), Harsh Jain (Co-founder, Groww), and D.P. Singh (Joint CEO, SBI Mutual Fund) debated India’s equity market boom, the rise of SIPs and F&Os, and evolving retail investor behavior.

Beyond traditional markets, the event also explored cryptocurrencies, REITs, and alternative investments, reflecting India’s expanding financial landscape.

Morgan Housel, best-selling author of “The Psychology of Money,” delivered a powerful session on investor psychology, emphasizing that success in investing is more about managing emotions than crunching numbers.

“Markets are driven by narratives—Tesla, for example, produces far fewer cars than Volkswagen but is valued many times higher. That’s the power of a compelling story,” he said. He also warned investors against falling prey to FOMO, stating, “If you cannot control fear of missing out, investing will never work for you.”

The summit concluded with a keynote address by Maharashtra CM Devendra Fadnavis, who unveiled the state’s ambitious plan to become India’s first $1 trillion sub-economy by 2030.

“Maharashtra is the only state that has systematically pursued a half-trillion-dollar economy. By 2030, we will cross the $1 trillion mark,” he declared. He also highlighted grassroots financial inclusion, citing the Laadli Bahin Yojana, which provides ₹1,500 per month to women, as a model for economic empowerment.

With insights from global investors, policymakers, and industry leaders, the Moneycontrol Global Wealth Summit 2025 offered a blueprint for India’s economic ascent. As the country moves toward a $10 trillion market cap, the discussions and strategies outlined at the summit will shape its financial future, fostering sustained growth, investment opportunities, and wealth creation.

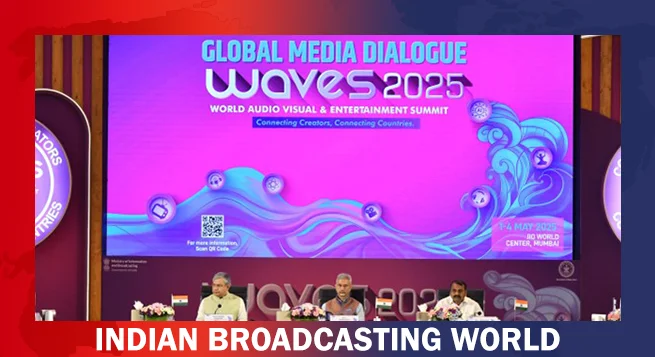

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

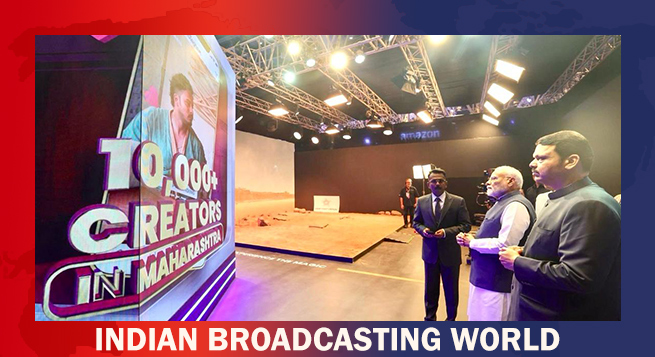

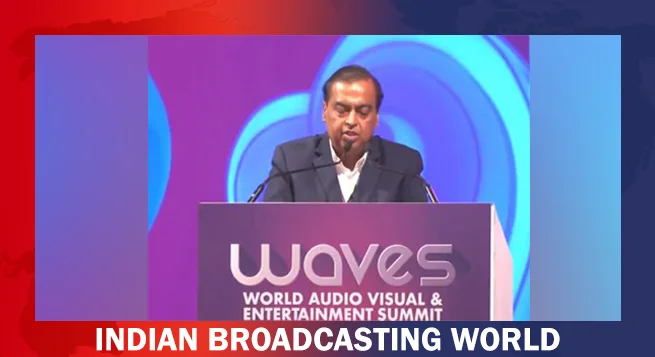

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

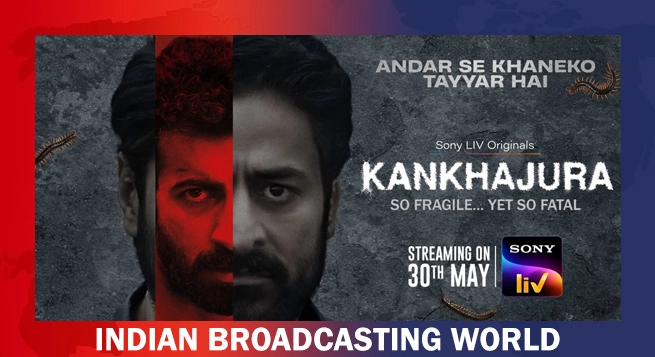

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles