Even as Netflix co-CEO Reed Hastings made his exit to be the Executive Chairman, the company said it added 7.66 million subscribers in the fourth quarter, beating Wall Street forecasts of 4.57 million with help from ‘Harry & Meghan and ‘Wednesday’ in the battle to attract streaming television viewers.

Netflix projected “modest” gains in subscribers through March. It forecast 4 percent year-over-year growth in revenue during the period with the help of new revenue streams, Reuters reported Friday.

The company is facing restrained consumer spending and competition from Walt Disney Co, Amazon.com Inc and others spending billions of dollars to make TV shows and movies for online audiences.

Netflix lost customers in the first half of 2022. It returned to growth in the second half, but new customer additions remain below the pace of recent years.

To kick-start growth, Netflix introduced a cheaper, ad-supported option on November 12, 2022 in some countries. It also has announced plans to crack down on password sharing.

“2022 was a tough year, with a bumpy start but a brighter finish. We believe we have a clear path to reaccelerate our revenue growth,” Netflix said in its quarterly letter to shareholders, according to the Reuters report.

Netflix will start rolling out features this quarter to try and convert more password sharers to paying subscribers, Greg Peters, company CFO who has been elevated as co-CEO, said. He acknowledged it will not be a “universally popular move,” comparing it to a price increase that will increase cancellations for a time but pay off with added revenue.

The company’s global subscriber base hit 231 million at the end of December.

Audiences flocked to Addams family tale ‘Wednesday’, the third-most watched show in Netflix history, the company said. Murder mystery ‘Glass Onion’ and the British royals documentary ‘Harry & Meghan’ also were hits during the quarter.

Net income fell to $55 million or 12 cents per share, from $607 million or $1.33 per share a year earlier. Revenue rose 1.9 percent to $7.85 billion, in line with expectations.

Hastings, 62, co-founded Netflix as a DVD-by-mail business in 1997, saying the idea came from his frustration at having returned a rental of ‘Apollo 13’ to the local Blockbuster video store and getting socked with a $40 late fee.

“It feels like yesterday we were at our IPO. We were covered in red envelopes,” Hastings said on Thursday in a post-earnings video interview.

The business evolved in 2007 to a video streaming service that shook up Hollywood, prodding Netflix’s media rivals to invest billions in their own services.

Some of Hastings’ challenges were self-inflicted, such as his plan to spin off the company’s DVD business into a new company called Qwikster. That 2011 initiative cost the company 800,000 subscribers and sent the stock plunging.

The executive navigated another precipitous stock drop in April 2022, when Netflix reported its first subscriber loss in more than a decade. This forced Hastings to reconsider previously verboten ideas to spur growth, including an ad-supported version of the service.

Hit Shows Makes Netflix Stand Out: Netflix Inc’ steady stream of hit shows is helping it stand out in a crowded market while paving the way for double-digit revenue growth later this year, analysts said, after the firm topped estimates for subscriber additions.

The result was driven by some of the company’s strongest content slate, including the ‘Wednesday’ – its third most watched TV show on record – and murder mystery ‘Glass Onion’ – its fourth most popular movie.

“Content performance is underpinning all aspects of financial improvement and helps investors sleep better,” Wells Fargo analysts said, adding that double-digit revenue growth could be achievable in the second half of the year.

That outlook, which was also mirrored by other brokerages, stems from positive signs for the ad-supported plan and a crackdown on password-sharing that Netflix says will get more revenue out of the 100 million people who use the service without paying for it.

The company said it would roll out features this quarter to try and convert more password sharers to paying subscriber.

“This will not be a universally popular move,” said Greg Peters, who was promoted to co-CEO along with Ted Sarandos after Reed Hastings decided to move to the role of executive chairman.

But the company expects increased engagement and monetization after a short period of churn.

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar

Kevin Vaz, Kiran Mani, Sanjog Gupta to head 3 verticals of JioStar  Govt & industry to prime gaming space for global dominance: MIB Secy Jaju

Govt & industry to prime gaming space for global dominance: MIB Secy Jaju  Netflix ad-supported tier touches 70mn MAUs globally

Netflix ad-supported tier touches 70mn MAUs globally  Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film

Minister Murugan likens IFFI to Cannes fest; ‘Better Man’ opening film  Ali Fazal wraps up filming for ‘Metro In Dino’

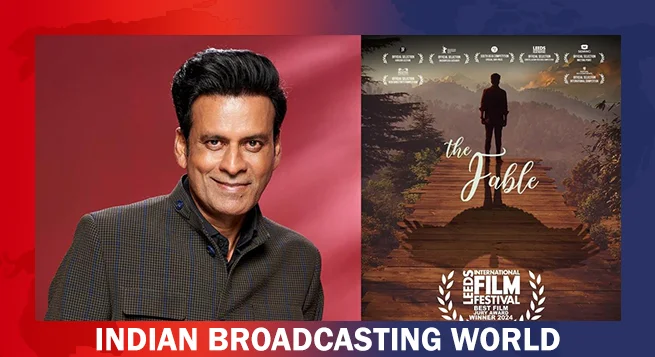

Ali Fazal wraps up filming for ‘Metro In Dino’  ‘The Fable’ wins best film at the 38th Leeds International Film Festival

‘The Fable’ wins best film at the 38th Leeds International Film Festival  Sony SAB brings back ‘Tenali Rama’ at 8 pm slot

Sony SAB brings back ‘Tenali Rama’ at 8 pm slot  Zee Telugu to premiere ‘Aay’ on November 17

Zee Telugu to premiere ‘Aay’ on November 17  Release date of Pratik Gandhi, Divyenndu-starrer ‘Agni’ announced

Release date of Pratik Gandhi, Divyenndu-starrer ‘Agni’ announced