Netflix is preparing to appeal a tax demand of ₹196 crore ($26 million) before the Income Tax Appellate Tribunal in India. This decision comes after a ruling earlier this year favored the Indian tax department in a dispute with the streaming giant. The tax department alleges that Netflix evaded income tax in India, contending that the company functioned as a dependent agent permanent establishment of Netflix.

The tax demand pertains to Netflix’s operations from April to December 2020 when it generated revenue exceeding ₹1,145 crore ($154 million), with profits attributed to its Indian operations amounting to ₹503 crore ($67.5 million), Economic Times reported.

Netflix paid only ₹13.36 crore ($1.8 million) in taxes, and the tax department argues that the remaining profit, associated with operations conducted in India through a permanent establishment arrangement, should be taxable in India, resulting in the disputed tax demand of ₹196 crore.

A spokesperson from Netflix stated, “We fully adhere to tax laws and their requirements globally,” without offering further details regarding the case.

The tax department also asserted that Netflix’s Open Connect Appliance (OCA), a content distribution network used to deliver its TV shows and movies, was based in India and therefore subject to taxation in the country.

India is a significant market for Netflix, witnessing the highest net subscriber additions globally in 2022, primarily due to an aggressive pricing strategy launched in December 2021. According to an EY media report, India leads the world in terms of time spent on over-the-top services, with subscription revenues projected to reach $3 billion by 2024.

India introduced a ‘Google tax’ on digital advertisements in 2016 and expanded it in 2020 to include e-commerce supplies or services to address concerns about digital companies generating revenue from large user bases without paying taxes in the country. Netflix’s ongoing tax dispute underscores the complexities of this evolving taxation landscape.

While Netflix is a prominent player in the entertainment industry, it has recently experienced slowing revenue growth. The company reported a revenue growth rate of 3.53% for the last twelve months of 2023’s second quarter. Despite trading at a high earnings multiple, Netflix’s stock performance has been lackluster in the past month, with a one-month price total return of -13.54%. However, it posted a strong return of 59.11% over the last year.

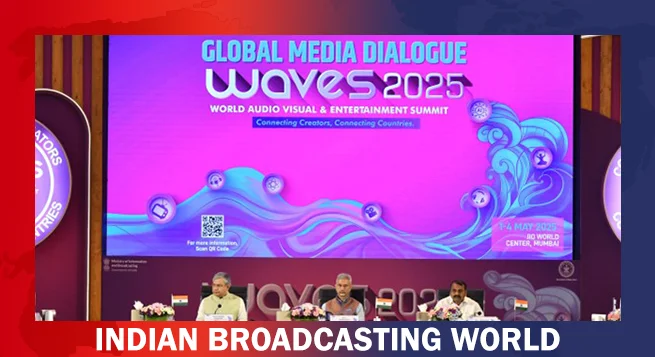

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

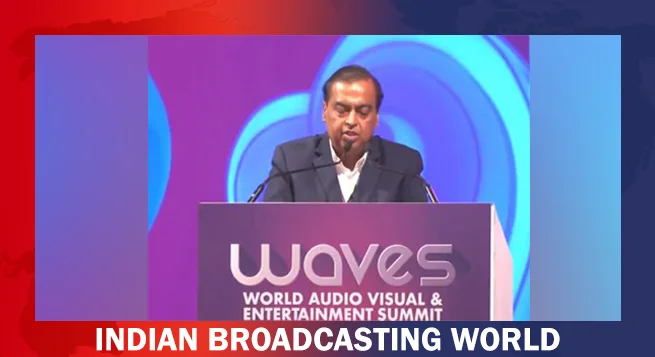

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles