In Q3 FY24, Netflix saw remarkable growth, with total revenue increasing by 15 percent year over year, exceeding expectations. The platform added 5.1 million paid net memberships during the quarter, leading to a 52 percent surge in operating income to $2.9 billion and an improved operating margin of 30%. Earnings per share (EPS) climbed by 45 percent to $5.40, despite a $91 million foreign exchange loss from Euro-denominated debt.

Among the regional highlights, Netflix’s APAC (Asia-Pacific) revenue grew by 19 percent year over year, the highest growth across all regions. The company attributed this success to strong local content offerings in countries like Japan, Korea, Thailand, and India, enhancing its product-market fit in the region. Other regions also experienced significant revenue increases, with UCAN (United States and Canada) and EMEA (Europe, Middle East, and Africa) both growing by 16 percent, while LATAM (Latin America) saw a more modest 9 percent growth.

Despite the challenges posed by paid sharing, Netflix maintained healthy engagement levels, with viewers spending an average of two hours per day per paid membership. While sharing led to reduced viewing on shared accounts, Netflix noted that view hours in households that purchased their own subscriptions increased in 2024.

The company also highlighted its focus on monetization strategies, including price adjustments and the expansion of its ads-supported plan. The ads plan saw a 35 percent growth in membership quarter over quarter, now accounting for over 50 percent of sign-ups in ad-supported countries. Netflix plans to further scale its ad business in 2025, expecting critical ad subscriber growth by 2026.

Looking ahead, Netflix plans to launch its in-house first-party ad tech platform in Canada next month, followed by a broader rollout across all ad-supported countries in 2025.

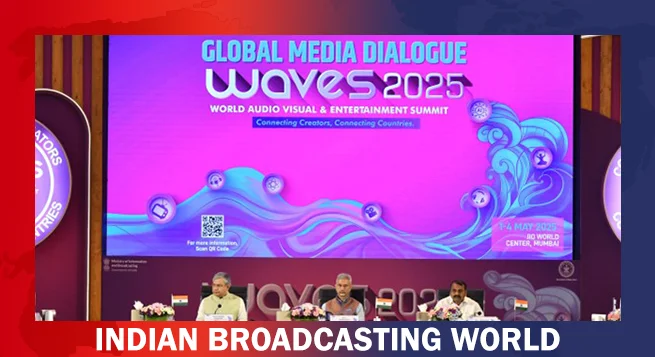

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

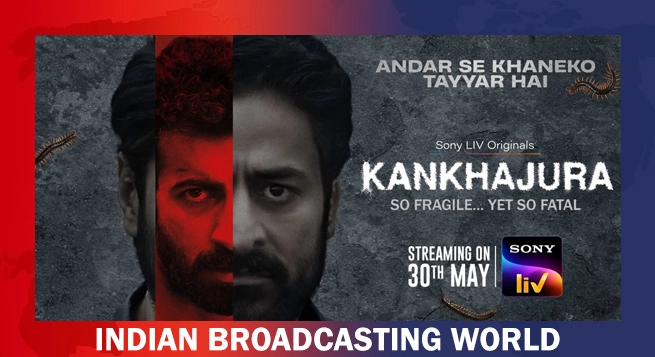

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

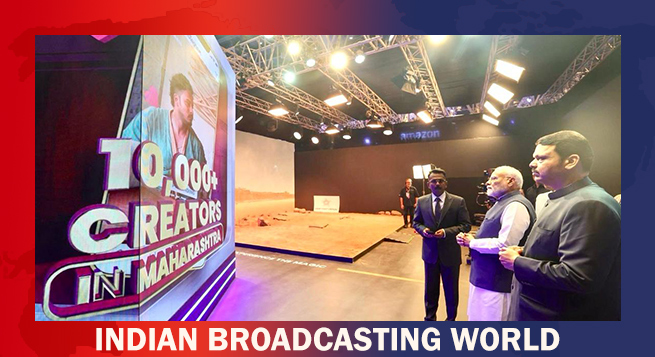

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles