There’s good and bad news for news publishers – both online and print. A FICCI-EY report on India’s media and entertainment sector said that while the reach of online news will grow in coming years, newspapers reach and readership will start to stagnate, but print revenues will grow at a CAGR of 3.4 percent until 2026.

Citing 2023 data from Comscore, the FICCI-EY report, themed #Reinvent and released last week, said online news had a reach of 456 million as compared to 574 million smartphones in India. By 2026, this reach is expected to grow to over 500 million.

“However, the consumption would not necessarily be on news apps or portals, but could shift to social media, D2C apps, aggregator apps or any place with a large online audience.

“Monetization will remain a challenge, as programmatic rates will remain low, making a case for a focus on direct deals and premium inventory formats,” the new report highlighted.

On newspapers’ reach and readership, the report said print will reach a steady state with a loyal reader base within the next three years, most of which will probably come from the growing base of educated people entering the workforce who need news and information to build their careers, as against faithful audiences ageing.

Cover price increases will lead to a winner-takes-all situation, with a reduction in second newspaper copies in the home and the print revenues will “grow at a CAGR of 3.4 percent” until 2026.

The growth will take print to Rs. 288 billion, on the back of premium advertising focusing on hard-to-reach affluent audiences, and cover price increases in certain markets, it stressed.

“We expect to see a 25 percent growth in average newspaper cover prices by 2025.

“Some products or brands could witness small drops as their faithful audiences age and cover prices continue to increase. As stronger brands survive, multiple products in a household may be rationalized.

“Given that most print companies earn less than 5 percent of their revenues from digital news products (we estimate that digital news generates less than Rs.10 billion, including digital native brands), the focus of print companies will remain on the core print product to increase its utility and appeal to loyal audiences, while digital initiatives of publishers will evolve into a separate enterprise that goes wider than just news,” the report observed.

Some other trends, amongst others, highlighted by the FICCI-EY report are as follows:

Audio Trends

► Segmentation will re-define monetization. It is expected the market to be driven by three major segments: the premium segment (top 3 percent to 5 percent or so of music streamers) will pay for music streaming and music experiences like concerts, themed dining options, merchandise, etc.; the aspirational segment (the next 10 percent to 15 percent) will consume music on ad supported streaming platforms, television, etc., so long as it comes bundled with data, e-commerce, or cable television bundles and the mass segment (the rest) will consume only free and ad supported options like FTA channels, YouTube, radio, direct to mobile digital signals, etc., on their smartphones and/or feature phones.

► Subscription focus will result in a growing paid base. From seven to eight million paid music streaming subscribers, the segment will grow to 15 million by 2026 if prices remain unchanged and the industry aligns on incentivizing users to pay.

► For further growth, the need to bundle music content, or price it at an affordable rate around Rs. 1 per day, will be unavoidable.

► International monetization will improve. India generates over 85 percent of its audio revenues from digital media.

► Countries like Nepal, Bangladesh, Pakistan and Sri Lanka are now witnessing/ starting to witness a surge in digital adoption.

► This has led to increased uptake of popular international platforms like TikTok, YouTube, Instagram, etc., in these countries and there is a need to monetize this consumption through industry-level partnerships and collaborations.

Experiential Trends

► Online gaming will grow and reach Rs. 388 billion by 2026.The segment will grow across all its verticals viz, esports, fantasy sport, casual gaming and other games of skill, but revenue growth will be led by mobile-based real-money gaming and casual gaming.

► As many global companies look to launch their games in India, we expect in-app purchases within casual games and esports to become significant revenue streams.

► Consolidation is on the cards, post the GST regulation changes of 2023. It is expected the market to stabilize with two to three fantasy sport players, one to two players each in rummy and poker, and one or two large multi- game platforms.

► Gaming event IP will come into being, in the form of esports leagues, national online gaming events and multi- game platforms where gaming will be united with social interaction and commerce.

► Once clarity on retrospective taxation is resolved, international interest will be significant, given limited opportunities for growth in foreign markets, and foreign investment into the segment will grow.

► Cinema will focus on a second HSM segment. The report predicts the film segment will continue to grow, driven by theatrical revenues as Hindi movies go mass market in their storytelling, incorporate more VFX to enhance the movie-going experience and expand more aggressively into tier-II and III cities.

► Broadcast rights will remain soft as pay TV homes continue to fall, but the gap will be made up through digital rights, as CTV homes are expected to grow significantly.

► Growth in overseas revenues will depend on opening-up of culturally similar markets like China and the Middle East.

► High-end cinemas will evolve into “experience zones” to cater to top-end multiplex audiences who watch movies for their spectacular experience and to enjoy an evening out with friends and family – a market we estimate at around over 100 million customers/50 million households today.

► In addition, a set of lower-priced “cinema products” will emerge for the next 100 to 150 million audiences across the top 50 to 75 cities of India, which will also require a change to the type of content being produced for these audiences, and which could even see regional OTT products releasing in a windozwed manner.

► The report said it expects more exhibition pricing innovation in the future around loyalty programs, discounting, group pricing, rentals, etc.

► Premium OOH assets will drive growth. The difficult-to-reach affluent audiences at airports, in premium trains and commercial and entertainment establishments would provide impetus for marketers to invest in the OOH medium.

► The share of DOOH would reach 15 percent of total OOH revenues as the number of screens in premium catchment areas increases, without hurting the growth of traditional OOH assets, as budgets would get more integrated with digital media purchasing .

► A good deal of entertainment, sports and cultural venues are being set up in tier II and III cities, which will provide a further boost to addressable OOH inventory and revenues.

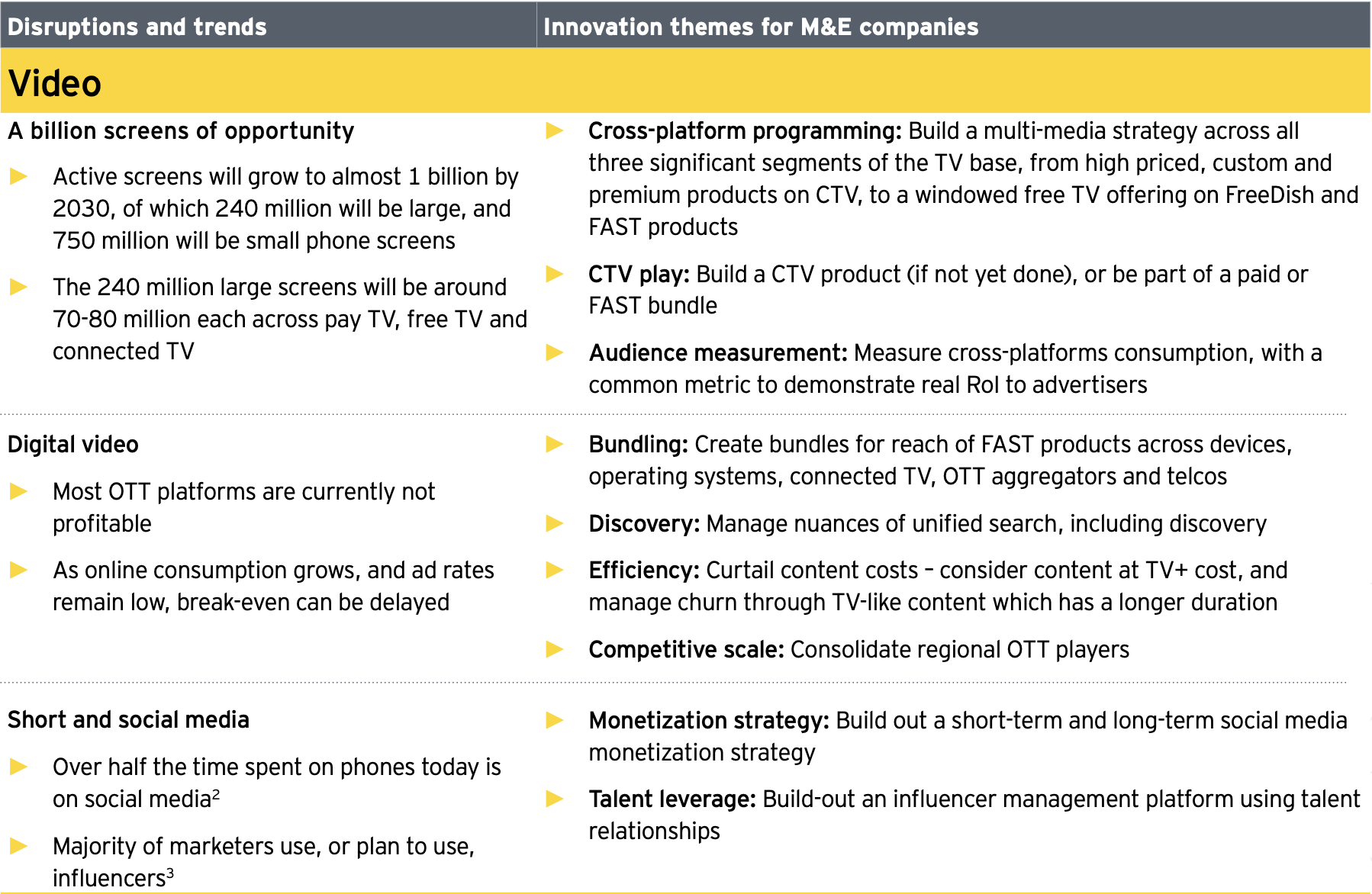

(Main image and chart courtesy FICCI-EY M&E 2024 Report, #REINVENT)

Jio Platforms net profit up 25.7% in Jan-Mar quarter

Jio Platforms net profit up 25.7% in Jan-Mar quarter  SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES

SRK, Aamir, Big B, Ted Sarandos, WPP CEO, MPA chief, other stars, to headline WAVES  TIPS Music ends FY25 on high note with 29% revenue growth

TIPS Music ends FY25 on high note with 29% revenue growth  WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture

WAVES’ Bharat Pavillion to showcase Indian media’s evolution,culture  Asianet News sponsors kabaddi teams Tamil Lion, Lioness teams

Asianet News sponsors kabaddi teams Tamil Lion, Lioness teams  ShemarooMe unveils women-centric ‘Umbarro’

ShemarooMe unveils women-centric ‘Umbarro’  Global DJ sensation Mahmut Orhan to perform Live in Mumbai

Global DJ sensation Mahmut Orhan to perform Live in Mumbai  Govt directs OTT platforms to follow disability laws

Govt directs OTT platforms to follow disability laws  Adani-owned NDTV losses increase

Adani-owned NDTV losses increase