The OOH (out-of-home) media grew 86 percent in 2022 to INR37 billion, the value of which includes traditional, transit and digital media, but excludes untracked unorganized OOH media such as wall paintings, billboards, ambient media, storefronts, proxy advertising, etc., according to a Ficci-EY report.

“We expect the OOH segment to exceed 2019 (pre-COVID-19) levels in early 2023, and achieve revenues of INR53 billion by 2025,” said the Ficci-EY report titled ‘Windows of Opportunity: India’s media & entertainment sector – maximizing across segments’.

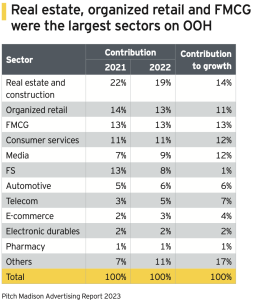

Presence of over 10,000 active brands is signalling the resurgence of this sector, the report has pointed out, adding the top five categories contributed 64 percent of OOH spends and 60 percent of growth.

Some of the highlights of the report are the following:

► The OOH segment has reached around 94 percent of 2019 revenue levels.

► Real estate, organized retail and FMCG were the largest advertisers on OOH.

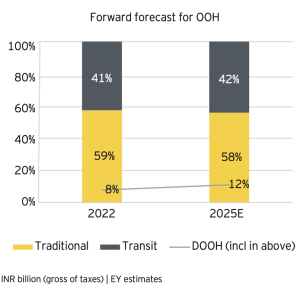

► Traditional OOH comprised 59 percent of revenues and remained the largest segment; transit media comprised the balance 41 percent.

► Digital OOH media (included in the above) contributed 8 percent of the segment’s revenues, up from 6 percent in 2021.

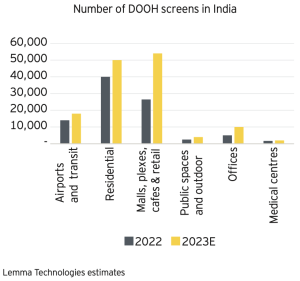

► The number of digital screens is estimated in the range of 60,000 to 100,000, of which a majority would be active.

► All categories registered an increase over 2021.

► Traditional media contributed 59 percent of total OOH media, not counting ambient media, wall paintings, proxy media (like ads in automated teller machines), storefronts and the informal/ unorganized sector.

► However, rates for most players interviewed were still 10-20 percent below their pre-COVID-19 highs.

► While BFSI and Governments spends recovered smartly, auto and handset segment spends remained muted for a variety of reasons like supply constraints and geo- political factors.

► Transit media generated INR15 billion in 2022 (41 percent of total OOH) up from around INR8 billion in 2021.

► Air passenger traffic in India has grown by 47 percent over 2021 but is still 14.5 percent lower than pre-pandemic levels.

► In vehicle advertising, creation of additional airports, launch of premium trains, opening metro lines, mega intra-city road projects and urbanization will aid the growth of transit media.

► DOOH (digital OOH) is rapidly growing due to the rising demand for data-driven and targeted advertising leading to measurable outcomes.

► DOOH comprised 8 percent of the OOH segment’s revenues, up from 6 percent in 2021.

► The number of connected screens increased to between 85,000 and 120,000, a majority of which were active.

Future Outlook

► OOH is expected to reach INR53 billion by 2025.

► The sector should reach its pre-pandemic revenue run rate in the first half of 2023.

► The key driver for growth would be the ability of the medium to provide access to NCCS A audiences at premium locations.

► Other drivers of growth would be the rapid addition of roadways, metros, airports, commercial establishments, etc. which will provide increased premium inventory, as well as the development of smart cities, which will integrate screens at several new areas such as charging stations, building exteriors, offices, etc.

► The higher SEC audiences at airports, in premium trains and commercial and entertainment establishments would provide impetus to marketers to invest in the OOH medium.

► The share of DOOH would increase to 12 percent of total OOH revenues as the number of screens in premium catchment areas increases, without hurting the growth of traditional OOH assets, as budgets would get more integrated with digital media purchasing.

► A number of entertainment, sports and cultural venues are being set up in tier II and III cities, which will provide a further boost to addressable OOH inventory and revenues. PE interest will increase; and could trigger consolidation.

► The growth in digital screens requires infrastructure- type funding, and this could result in the entry of private equity and venture capital.

► Since the required investments are not insignificant, it could lead to some level of consolidation of media asset owners, or require the creation of industry-wide platforms which can aggregate multiple infrastructure assets across owners.

► Innovation will be used to drive interest and engagement.

► The OOH segment globally has been witnessing delightful match-ups between old-school branding and new-age technologies.

► Some of these include geo-tagging and tracking audiences using cell tower data; custom messaging based on location, day part, weather, etc.; use of heat mapping and/ or sensors to engage in the moment gesture recognition interactivity between visuals and cellphones, including e-commerce/ transaction/ trial/ registration options automatic dependent surveillance broadcasts.

► Clustering and hyper-local packaging will emerge. Clusters, including grocery and pharma stores, local retail, cinema/plex and local parks, will become crucial for locality-based hyper-local targeting.

► Other cluster types could include business districts, hospitals, educational areas, etc. along with their connected transit hubs, supporting food and beverage facilities, etc.

► The OOH regulatory framework will evolve. Globally, the regulatory framework around OOH is being driven by the following factors:

technological advancements, changing consumer behaviour and increasing concerns about the environmental impact of OOH.

► DOOH and programmatic advertising have raised questions about issues such as privacy, transparency, and data protection.

► Under increasing pressure for OOH to be more sustainable and environmentally responsible, regulators have implemented restrictions on use of materials like plastic and vinyl in some countries, and encouraged the use of more eco-friendly alternatives.

► It is also expected that increased regulations would be put in place to limit the amount and type of advertising that is allowed in public spaces, and its aesthetics.

Govt. not considering rules for use of AI in filmmaking: Murugan

Govt. not considering rules for use of AI in filmmaking: Murugan  DTH revenue slide to ease to 3–4% this fiscal year: Report

DTH revenue slide to ease to 3–4% this fiscal year: Report  At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam

At Agenda Aaj Tak, Aamir, Jaideep Ahlawat dwell on acting, Dharam  JioHotstar to invest $444mn over 5 years in South Indian content

JioHotstar to invest $444mn over 5 years in South Indian content  Standing firm, TRAI rejects DoT views on satcom spectrum fee

Standing firm, TRAI rejects DoT views on satcom spectrum fee  Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film

Diljit Dosanjh wraps shoot for untitled Imtiaz Ali film  ‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist

‘Bhabiji Ghar Par Hai 2.0’ to return with comedy, chaos, a supernatural twist  BBC names Bérangère Michel as new Group CFO

BBC names Bérangère Michel as new Group CFO  ‘Border 2’ teaser to be unveiled on Vijay Diwas

‘Border 2’ teaser to be unveiled on Vijay Diwas  CNN-News18 Rahul Shivshankar takes editorial charge

CNN-News18 Rahul Shivshankar takes editorial charge