Paramount Global is considering scrapping plans to launch its Paramount+ streaming service in India this year in favor of a deal with existing partners, according to people familiar with its strategy.

The New York-based parent of the CBS and MTV networks is shifting its focus to selling more programming to the Indian streaming service JioCinema, said the people, who asked not to be identified discussing plans that haven’t been made public. Paramount owns a 13 percent stake in JioCinema’s parent company, Viacom18, an operator of TV channels locally.

The company declined to comment.

The delay is part of a larger trend of big media companies dialing back their spending and international expansion plans as they look to wring profits from streaming businesses that have delivered mostly losses so far. They’re also contending with a fall in viewers for traditional TV channels as streaming grows in popularity.

“We are in a temporary pullback phase to appease Wall Street, especially for the studios, which are also managing the controlled decline of other business lines,” Guy Bisson, executive director, of Ampere Analysis, said.

Warner Bros. Discovery Inc., which has promised Wall Street that its streaming business will be profitable this year, said in September that it’s delaying the launch of its Max service in Latin America until the first quarter of 2024. In April, Warner Bros. agreed to license its films and HBO shows in India to JioCinema.

JB Perrette, who leads Warner Bros.’ global streaming effort, said at a media conference in Indonesia last month that the company may favor local partnerships over launching the Max service in some markets. If prices for local streaming services are low and competitors are already spending a lot on programming, “we may say this is not the right time,” Perrette said.

JioCinema, which also licenses programming from Comcast Corp.’s NBCUniversal, costs 999 rupees annually, or about $12.

Walt Disney Co. has held preliminary talks with companies interested in purchasing its Star business in India. The unit includes local cable channels and the Disney+Hotstar streaming service. Interested parties include local billionaire Mukesh Ambani’s Reliance Industries Ltd., Bloomberg has reported. Reliance is the largest shareholder in Viacom 18.

Disney generates an average of just 59 cents a month per subscriber from its Hotstar streaming service, less than 10 percent of what the average customer spends in the US and Canada.

It has also been shutting down cable TV channels overseas, including National Geographic-branded networks in Hong Kong, Taiwan, and Korea, and closing its Lucasfilm studio in Singapore. Next month, it will begin cracking down on Disney+ customers in Canada and other countries who share their passwords with people outside of their home, a way of boosting subscription revenue.

Amazon.com Inc., meanwhile, has slowed content spending growth for the Prime video service in some of its biggest international markets, including the UK, Germany, and Italy, according to Ampere.

While spending heavily on new programs was a way to win subscribers early on, there are fewer new customers to gain in more mature markets, Ampere’s Bisson said.

Telecom subs base up marginally; Trai withholds updated b’band data

Telecom subs base up marginally; Trai withholds updated b’band data  WAVES driven by industry; govt just a catalyst: Vaishnaw

WAVES driven by industry; govt just a catalyst: Vaishnaw  In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in

In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in  Balaji Tele elevates Viren Trivedi to finance controller

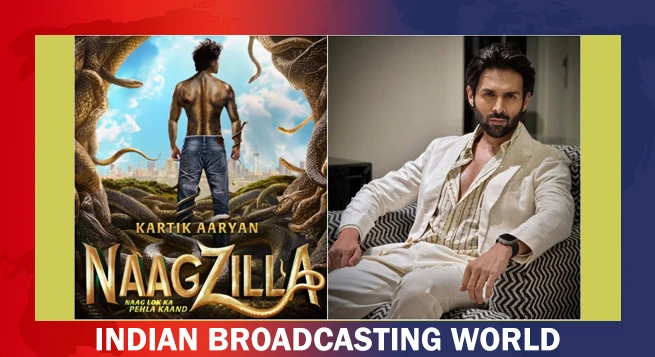

Balaji Tele elevates Viren Trivedi to finance controller  Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’

Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’  Mohit Suri’s ‘Saiyaara’ set for July 18 release

Mohit Suri’s ‘Saiyaara’ set for July 18 release  ApplaToon launches ‘Kiya & Kayaan’

ApplaToon launches ‘Kiya & Kayaan’  Jio captures a massive 85% share of India’s 5G fixed wireless market

Jio captures a massive 85% share of India’s 5G fixed wireless market  WAVES offers big opportunity to all media: Murugan

WAVES offers big opportunity to all media: Murugan