By Karan Taurani @Elara Capital

Believe the merger process should finalize over the next 2-3 quarters, in case NCLT provides approval for the same

Our detailed report on merger impact analysis is enclosed below

ERRATA – RECTIFICATION

– This advisory will not apply to domestic online ‘real money skill gaming’ operators such as poker, rummy, and fantasy sports websites that are incorporated in India and comply with the laws of the land

– It will only apply to foreign betting websites

– Neutral impact for Nazara, Dream11, and other real money gaming companies

Archipelago of synergies

PVR-INOL merger – Compelling storyboard We believe, the PVR-Inox (INOL) merger, if it materializes in the near term, may trigger multiple synergies immediately, in the form of advertising revenues and convenience fees for the merged entity, which should directly improve overall profitability. Other synergies – reduced rental costs, corporate overheads, etc. – may also ensure, in the medium to-long term. Diametrically, we do not expect any major synergy on metrics such as spend per head and ticket prices as these are largely location-led – Distributor share is also expected to remain stable.

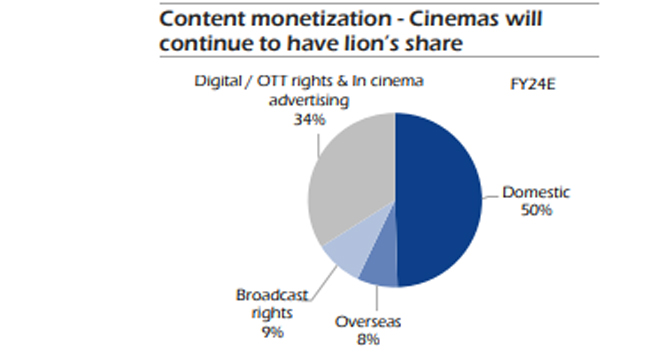

Cinema – Most important medium for producers

Theatricals accounted for 12.9% of M&E revenues globally in CY19, as per Theme report 2021, largely similar to India’s 10%. Despite the strong growth in the digital segment, domestic theatricals may continue to account for 50% of film revenues in FY24E (as per the EY FICCI report). This shows the importance of this medium in terms of content monetization

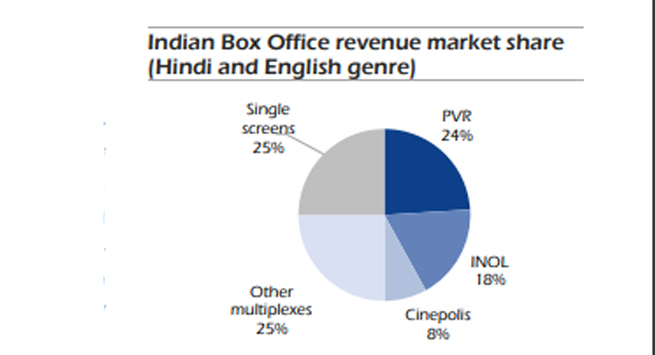

Potential market share gain – Another merger-led advantage

Multiplexes account for 75% of Box Office (BO) revenues for Hindi/English genre content in India. We believe, the merged entity has the potential to gain BO market share on 1) widespread geographical

exposure and 2) stronger screen addition. The regional genre is a huge untapped prospect for multiplexes that have a mere 30% BO share in the genre. PVR and INOL enjoy 53% screen share in multiplexes, which will give them an edge over the competition.

Valuation re-rating – Another big trigger

The consolidated entity may post INR 71bn revenues in FY24E, as per our estimates, factoring in immediate synergies in ad/convenience fees. We expect a bigger delta on profitability, with FY24E EBITDA margin at 20.8% (ex IND-AS). The sheer size of the entity as also market share gains

and growth benefits may re-rate valuations much beyond averages, in our view, to 16x forward EV/EBITDA. – PVR’s average EV/EBITDA preCOVID was 14x. This, in turn, may catalyze a potential valuation of INR 231bn for the merged entity. The current market cap of both entities is INR 178bn.

We view INOL to have a higher potential upside than PVR, given: 1) strong synergies and 2) robust re-rating towards revised multiple (INOL historically trades at a 20 percent discount to PVR’s 14x). We maintain BUY on PVR/INOL, with INR 2,375/INR 575 TP. The potential TPs, with the merger materializing, can approach INR 2,600/INR 680 levels, for PVR/INOL, respectively.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025