India’s two largest multiplex firms said on Sunday they would merge to create a giant cinema operator with more than 1,500 screens across 109 cities as the entertainment industry recovers from the COVID-19 pandemic.

PVR and INOX Leisure said the merger, which is subject to regulatory approvals, would help both companies improve efficiency, reach newer markets and optimise cost.

“The film exhibition sector has been one of the worst impacted sectors on account of the pandemic and creating scale to achieve efficiencies is critical for the long-term survival of the business and fight the onslaught of digital OTT platforms,” PVR Chairman Ajay Bijli said in a press release, quoted by Reuters in a report from New Delhi.

Over-the-top (OTT) platforms such Netflix, Amazon’s Prime Video and Disney+Hotstar have made deep inroads in India, where the pandemic ravaged a film industry known for song-and-dance spectacles watched by millions.

PVR is India’s largest multiplex chain with more than 850 screens, followed by INOX Leisure with about 650 screens. The merger follows a two-year period when most theatres were shut due to COVID-19 restrictions.

2021 remained a subdued year for the filmed entertainment segment, with lockdowns and several restrictions on production and exhibition across states.

Meanwhile, according to a new report on the Indian media and entertainment industry, released by FICCI-EY, despite COVID-related restrictions, over 750 films were released during the 2021, as compared to just 441 releases in 2020.

The report added that over 100 films released directly on streaming platforms, a trend which seems here to stay for certain genres, even as in 2021, the filmed entertainment segment grew 28 percent, but remained at around half its 2019 levels.

Domestic theatricals grew 57 percent, but were still 66 percent below 2019 levels. International theatricals fared marginally better but remain almost 80 percent below 2019 levels.

“Digital rights grew to INR40 billion —over double their 2019 levels. Broadcast rights saw no growth this year due to the dearth of theatrical releases and softening prices. In-cinema advertising continued to fall,” the report highlighted

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  Can Trump’s foreign movie tariff threat impact Indian films’ biz?

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  ZEEL appoints Rohit Suri as Chief Human Resource Officer

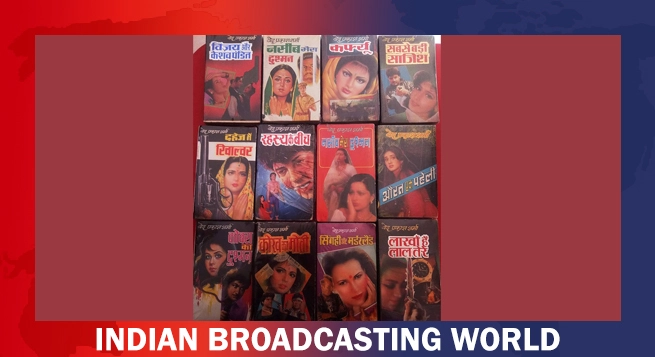

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup