Entertainment Network India Limited (ENIL), the operator of India’s top FM radio channel Radio Mirchi, has recorded a net profit of ₹21.6 crore for the quarter ending December 31, 2023, marking an impressive 108 percent year-over-year (YoY) growth.

EBITDA stood at ₹44.3 crore, boasting a 33 percent margin and demonstrating a substantial 36.4 percent YoY improvement, primarily driven by robust top-line growth.

Revenue grew 21 percent YoY to ₹140 crore, led by robust demand in free commercial time (FCT), which was driven by high retail activity during the quarter. Non-FCT revenues also experienced a notable surge, reporting strong revenue growth of 45 percent YoY, The Economic Times reported.

It added that the digital segment contributed ₹11.4 crore to the revenue, making up 13 percent of the total radio revenues. Additionally, ENIL invested ₹6.2 crore in digital to further fortify its presence in the segment.

ENIL said the deal to acquire Gaana has been completed, and the company is actively engaged in revitalizing the brand and the product to enhance Mirchi’s digital offerings to its audience. This acquisition is an important step towards turning around ENIL’s digital story.

The international business continues to remain stable and profitable, reporting an EBITDA of over ₹2.3 crore during the quarter.

ENIL CEO Yatish Mehrishi said: “I am thrilled to report a strong quarter with increased activity in radio and a fantastic festive season. Our revenue growth has outpaced the industry, demonstrating our leadership. Over the past two years, we’ve seen consistent revenue growth, doubling the industry average, and significantly improving profitability.

“As our current businesses gain momentum, we’re dedicated to future investments. The addition of Gaana is a crucial step in our digital journey, aiming to offer high-quality audio content on a unified platform. Looking ahead, the synergy between our brands, Mirchi and Gaana, along with our industry experience, positions ENIL as a key player in India’s audio entertainment space.”

As of December 31, 2023, the company has cash and cash equivalents totaling ₹262 crore.

Telecom subs base up marginally; Trai withholds updated b’band data

Telecom subs base up marginally; Trai withholds updated b’band data  WAVES driven by industry; govt just a catalyst: Vaishnaw

WAVES driven by industry; govt just a catalyst: Vaishnaw  In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in

In officials’ reshuffle, Shankar moves out of MIB; Prabhat comes in  Balaji Tele elevates Viren Trivedi to finance controller

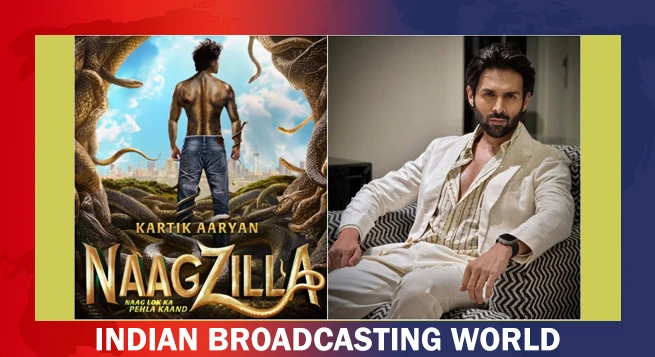

Balaji Tele elevates Viren Trivedi to finance controller  Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’

Kartik Aaryan turns shape-shifting serpent for ‘Naagzilla’  Mohit Suri’s ‘Saiyaara’ set for July 18 release

Mohit Suri’s ‘Saiyaara’ set for July 18 release  ApplaToon launches ‘Kiya & Kayaan’

ApplaToon launches ‘Kiya & Kayaan’  Jio captures a massive 85% share of India’s 5G fixed wireless market

Jio captures a massive 85% share of India’s 5G fixed wireless market  WAVES offers big opportunity to all media: Murugan

WAVES offers big opportunity to all media: Murugan