Samsung Electronics Co Ltd. will merge its mobile and consumer electronics divisions, the firm said on Tuesday, naming new co-chief executives in the biggest reshuffle since 2017 to simplify its structure and focus on the logic chip business.

Two co-chief executives, instead of three, will lead the South Korean firm as it pivots on the two business pillars of chips and consumer devices, including smartphones, to help lead the next phase of growth and boost competitiveness, Reuters reported from Seoul.

Samsung, whose Galaxy flagship brand helped it become the world’s biggest smartphone maker by volume, is seeking to revive slowing mobile growth, whose profit contribution shrank to 21 percent last quarter from nearly 70 percent at its peak in early 2010s.

Instead, its component business, led by chips, has become the most profitable, helped by a boom in data storage and a recent shortage of global semiconductor supplies.

The business generated nearly three-quarters of Samsung’s 15.8 trillion won ($13.4 billion) operating profit last quarter.

Samsung said Han Jong-hee, the head of visual display business, would become a co-CEO, leading the newly merged division spanning mobile and consumer electronics as well as continuing to lead the television business.

Han has risen through the ranks in Samsung’s visual display business, without experience in mobile.

It is not immediately clear what changes or divisions of labour were expected under Han, but analysts said the reshuffle could help Samsung tackle challenges such as offering seamlessly connected services between its smartphones and home appliances.

“In the long term, the biggest challenge is forming a platform of Samsung’s own,” said Lee Jae-yun, an analyst at Yuanta Securities Korea, adding, “Those businesses have to keep increasing connectivity between devices, but so far it hasn’t been able to create a lasting platform with presence.”

More immediate problems are a shortage of chip supplies, rising raw material prices, logistics difficulties, and competition from Apple Inc. and Chinese rivals amid concerns about a slowing mobile market, analysts said.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

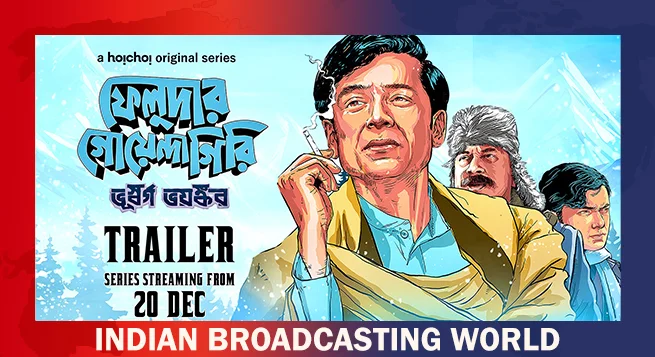

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  Urmila Venugopalan to head MPA in APAC as Belinda Lui retires

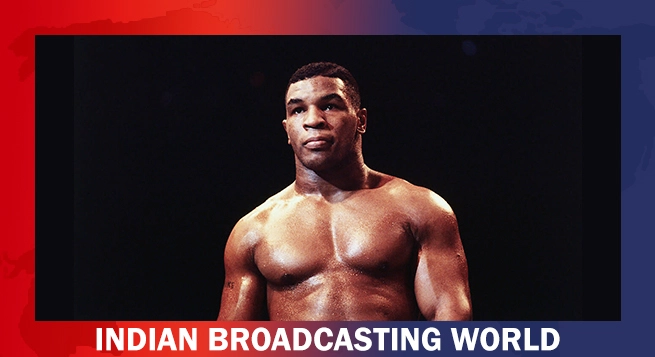

Urmila Venugopalan to head MPA in APAC as Belinda Lui retires  Netflix announces sports series on boxing legend Tyson

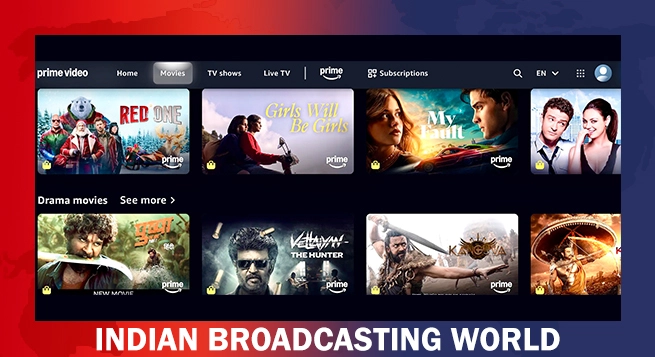

Netflix announces sports series on boxing legend Tyson  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

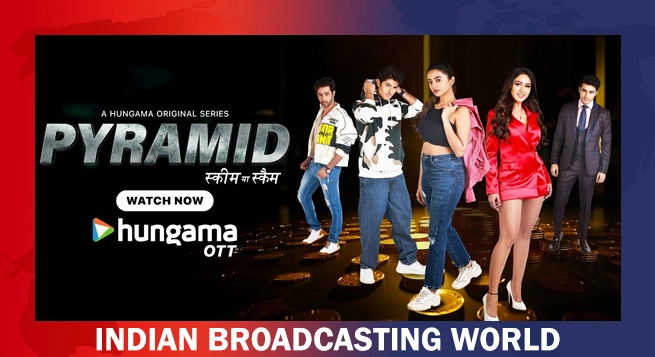

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’