By Elara Caps

Sun TV (SUNTV IN) posted strong revenue growth including IPL of 47.4 percent YoY, up 43.3 percent QoQ and up 8 percent vs pre-COVID levels to INR 11,393mn, better than our estimates of INR 9,977mn, led by healthy advertising revenue, which grew 40.8 percent YoY to INR 3,432mn, up 2 percent QoQ & down 7 percent vs pre-COVID levels.

EBITDA margin expanded 290bp YoY to 64 percent and down 285bp QoQ despite content investment. Sharp improvement in margin was driven by higher top-line growth, which was partially offset by overall operating expenses, which grew 36 percent YoY and up 54 percent QoQ. COGS grew 33 percent YoY and up 10 percent QoQ; other operating expenses (including IPL cost) grew 58 percent YoY and 175 percent QoQ

The company reported a PAT (including IPL revenue) of INR 4,917mn, up 26.2 percent YoY, driven by strong top-line growth and better operating efficiency. Other income grew 80 percent YoY and 88 percentQoQ, which was partially offset by increased depreciation cost, which grew 6x YoY and up 221 percent QoQ & up 31 percent vs pre-COVID levels. During the quarter, an interim dividend of INR 5 per share has been approved by the Board.

SUNTV has reported healthy ad growth of 41 percent YoY on low base, 7 percent lower than pre-COVID. It is estimated to report ad revenue CAGR of 7 percent over FY23-25, which may be in line with industry average; we expect a strong uptick in H2FY23, backed by local advertising support; we believe SUNTV needs to gain steady viewership across key genres (Tamil viewership share still at 40 percent, lower than pre COVID levels of 44 percent, to outperform market averages on the ad growth front. The digital business also remains a lag with no fresh investments on OTT originals; the movie catalogue is large, but sizeable original catalogue is needed to scale up digital business in the highly fragmented India market. EBITDA margin will have the positive impact of IPL in FY24 (as IPL revenue is estimated to grow 2.4x YoY); however, overall EBITDA will be in a narrow range of 63-64 percent.

Valuations: We pare down our revenue estimates by 0.9 percent for FY23 and FY24 each after factoring in slightly lower ad growth; the core broadcasting business is trading at a low valuation of 6.5x (if we were to exclude IPL and cash balance). We reiterate Buy with a SOTP-based TP of INR 675. We value the IPL business at INR 65bn based on September 2023E.

Hathi Ram returns in gripping ‘Paatal Lok’ S2 teaser

Hathi Ram returns in gripping ‘Paatal Lok’ S2 teaser  ITG launches ‘Stage Aaj Tak’ with Yo Yo Honey Singh’s Millionaire Tour

ITG launches ‘Stage Aaj Tak’ with Yo Yo Honey Singh’s Millionaire Tour  ‘Squid Game’ S2 debuts with 68mn views; #1 in 92 countries

‘Squid Game’ S2 debuts with 68mn views; #1 in 92 countries  Meghan Markle’s ‘With Love, Meghan’ premieres Jan 15

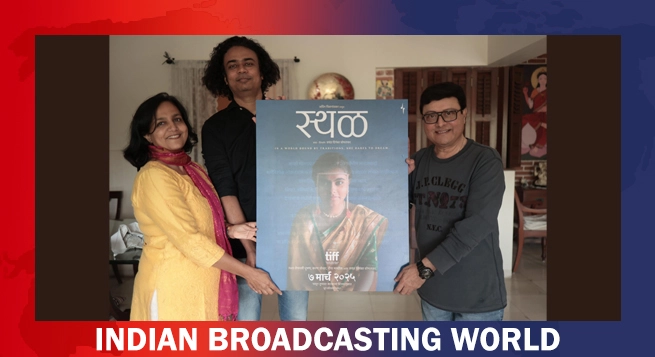

Meghan Markle’s ‘With Love, Meghan’ premieres Jan 15  Jayant Digambar Somalkar’s ‘Sthal’ set for March 7 release

Jayant Digambar Somalkar’s ‘Sthal’ set for March 7 release  Vi unveils ‘SuperHero’ plan with unlimited midnight data

Vi unveils ‘SuperHero’ plan with unlimited midnight data  aha OTT joins forces with 16 brands for ‘Unstoppable with NBK’ S4

aha OTT joins forces with 16 brands for ‘Unstoppable with NBK’ S4  DoT boosts connectivity for Maha Kumbh Mela 2025

DoT boosts connectivity for Maha Kumbh Mela 2025