Indian tax authorities have served notices to online gaming companies demanding about Rs. 1 trillion ($12.03 billion) in taxes that they have allegedly evaded, a government source said yesterday, according to Reuters.

In August, India decided to impose a 28 percent tax on online gaming companies on the total funds deposited to play online games, leading to some firms like Mobile Premier League laying off employees.

“The amount for which show cause notices have been issued to online gaming companies is around 1 trillion rupees,” the government official, who did not want to be named, told reporters, a Reuters report from New Delhi stated.

The Finance Ministry did not immediately respond to a request for comment.

Meanwhile, Reuters on September 26 had reported that even as the country’s tax authorities slapped a $150 million from Dream11 for underpaying goods and services tax during 2017-2019, the gaming company moved the Mumbai High Court challenging the tax claims.

Dream11 and Indian tax authorities are in a dispute over what tax rates should be paid by such gaming platforms, which have become hugely popular for fantasy cricket games they offer.

Dream11, according to the Reuters report, argues it should pay a tax on fees it charges customers, while Indian authorities are demanding a higher 28 percent tax on total gaming revenue it makes from players, court papers show.

The latest on the Mumbai court case by Dream XI is not known by Indianbroadcastingworld.com.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

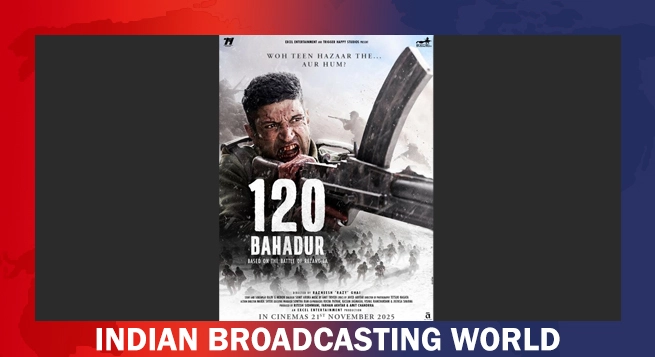

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025