An Indian tribunal yesterday lifted the ban on Zee Entertainment top boss Punit Goenka to hold board positions in any of the four Zee Group companies, paving the way for him to resume the proposed role in the planned merger between ZEE and the Indian unit of Japan’s Sony Group.

India markets regulator, Securities Exchange Board of India (SEBI), in August, had barred Goenka and Zee Group Chairman Subhash Chandra from holding positions in Zee company boards alleging they were actively involved in diverting company funds to the group’s other listed entities and firms related to founding shareholders.

The Securities Appellate Tribunal’s (SAT) verdict on Chandra was not announced by 1147 IST, a Reuters report stated yesterday.

Zee Group had announced a merger of ZEE with Sony’s Indian business in 2021, but the move was delayed due to an interim SEBI order, which had restrained Goenka from directorships of any listed companies.

In August, India’s company tribunal had approved the merger creating a $10 billion company.

SAT said on Monday Goenka will cooperate with any further investigation by the regulator.

Meanwhile, in a statement, accessed by Indianbroadcastingworld.com, Elara Securities’ Karan Taurani said the Monday’s tribunal order can expedite the Zee-Sony merger process and is a positive for Zee overall.

Commenting on SAT’s order, Taurani’s analysis yesterday said, “If SEBI gives a go ahead in favour of Mr Punit Goenka, without going to the Supreme Court, post the detailed order that is to be released tonight. In this case, we expect the record date to be announced around last week of November’23. This in turn means that the listing of the merged co. will happen towards first week of Jan’24. Further, with Mr Punit Goenka coming on Board, there will be no need for any changes in the term sheet, or any Board/shareholder approval required for change in CEO; this also means that business will be as usual for ZEE and lesser transition time with little change in senior management.”

However, according to Elara Securities, there can be a scenario two too: SEBI moves the Supreme Court to appeal for a stay against SAT’s order.

“Further, the SAT order may only mention that Mr Punit Goenka can continue as CEO of Z or the merged company…SEBI’s investigation on grounds of fraud may continue after this relief by SAT. This in turn means that there is still a high likelihood of the merger going through without Mr Punit Goenka.”

Top India Ministers pitch WAVES ’25 to foreign envoys in New Delhi

Top India Ministers pitch WAVES ’25 to foreign envoys in New Delhi  JioStar secures 20 top brands for TATA IPL 2025

JioStar secures 20 top brands for TATA IPL 2025  After Airtel, Reliance announces pact with Starlink

After Airtel, Reliance announces pact with Starlink  In a surprise move, Airtel joins hands with Musk’s Starlink for India

In a surprise move, Airtel joins hands with Musk’s Starlink for India  Creators are India’s digital ambassadors: Commerce Minister Piyush Goyal

Creators are India’s digital ambassadors: Commerce Minister Piyush Goyal  TRAI likely to recommend 5-year satellite spectrum allocation

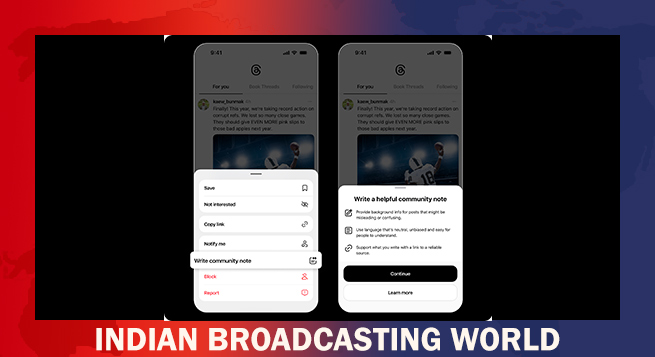

TRAI likely to recommend 5-year satellite spectrum allocation  Meta to test Community Notes, based on X tech, in US

Meta to test Community Notes, based on X tech, in US  Prime Video’s ‘Overcompensating’ to premiere in May

Prime Video’s ‘Overcompensating’ to premiere in May  Cinépolis honours Aamir Khan’s legacy with film fest

Cinépolis honours Aamir Khan’s legacy with film fest