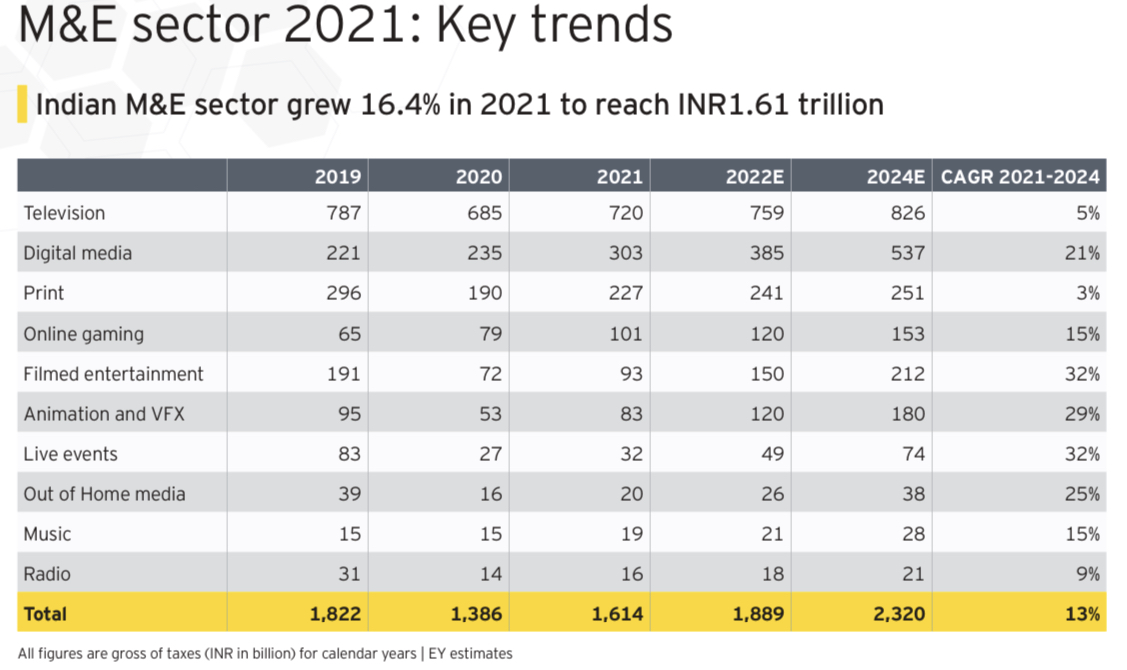

The good news is that TV advertising grew 25 percent in 2021. The bad news: subscription revenues continued to lag to register a growth of a mere 2.4 percent on the back of loss of six million pay TV homes even as the Indian media and entertainment (M&E) sector is projected to continue recovering this year from Covid shocks to reach INR2.32 trillion (US$30.9 billion) by 2024, according to a new Ficci-EY industry report.

The Indian M&E sector recovered by 16.4 percent to INR1.61 trillion (US$21.5 billion) in 2021, still 11 percent short of pre-pandemic 2019 levels, reason being the second wave of COVID-19, which impacted the April-June quarter, according to the report, titled ‘Tuning Into Consumer: Indian M&E Rebounds With a Customer-centric Approach’

While television remained the largest segment, digital media cemented its position as a strong number two segment followed by a resurgent print.

“We expect the M&E sector to grow 17 percent in 2022 to reach INR1.89 trillion (US$25.2 billion) and recover its 2019 levels, then grow at a CAGR of 11 percent to reach INR2.32 trillion (US$30.9 billion) by 2024,” stated the authors of the report.

Some of the highlights of the report are as follows:

► Television advertising grew 25 percent to end 2021 just 2 percent short of 2019 levels.

► Subscription revenue continued to fall for the second year in a row; experiencing a 6.2 percent de-growth due to a reduction of six million pay TV homes and a fall in consumer-end ARPUs.

► Connected TV sets, however, increased to 10 million.

► Digital advertising grew 29 percent to reach INR246 billion. In addition, advertising by SME and long-tail advertisers reached INR117 billion. Included in these revenues is advertising earned by e-commerce platforms of INR55 billion, which is now 16 percent of total digital advertising.

► Digital subscription also grew 29 percent to reach INR56 billion. 80 million paid video subscriptions across almost 40 million Indian households generated INR54 billion, an amount that is around 50 percent of broadcasters’ share of TV subscription revenues.

► Due to a plethora of free audio options, just three million consumers bought music subscriptions, generating INR1.6 billion.

► Print advertising revenues grew 24 percent in 2021, though ad rates remained subdued. Subscription revenues saw a growth of 12 percent on the back of recovery in direct to home and newsstand sales as well as rising cover prices. Corporate sales, metro circulation and English dailies remained under stress, though the situation seems to be improving.

► Despite people going back to work as the effects of the pandemic receded and continued regulatory uncertainty, the online gaming segment grew 28 percent in 2021 to reach INR101 billion. Online gamers grew 8 percent from 360 million in 2020 to 390 million. Real money gaming comprised over 70 percent of segment revenues.

► Capacity restrictions during the year, notwithstanding, over 750 films were released in 2021, as compared to just 441 releases in 2020. Over 100 films released directly on streaming platforms too. The segment grew 28 percent, but remained at half its 2019 levels.

► At 57 percent, animation and VFX was the fastest growing segment in 2021, as content production resumed, service exports increased and the industry adopted virtual production.

► Live events segment grew 20 percent over an extremely depleted base, primarily due to the relaxation of event curbs in a few States and increase in vaccination rates. However, revenues were just 40 percent of 2019 revenues. It appears that pure digital events are here to stay: they have been adopted across several product and service categories.

► OOH media grew 27 percent, but remained at 50 percent of 2019 levels. Capacity utilization improved towards the end of 2021, but rates remained challenged. The segment is expected to regain 2019 levels not before 2024.

► The Indian music segment grew by 24 percent in 2021. 90 percent of revenues were earned through digital means, though most of it was advertising led; there being around only three million paying subscribers. Performance rights witnessed a recovery and grew by 89 percent once lockdown restrictions were lifted.

► The radio ad volumes recovered 29 percent over 2020 but are still 6 percent behind 2019 volumes. Ad rates fell 13 percent on an average and recovery will only be seen once daily travel resumes fully and the retail sector recovers. Many radio companies are looking at alternate revenue streams to make good the differential.

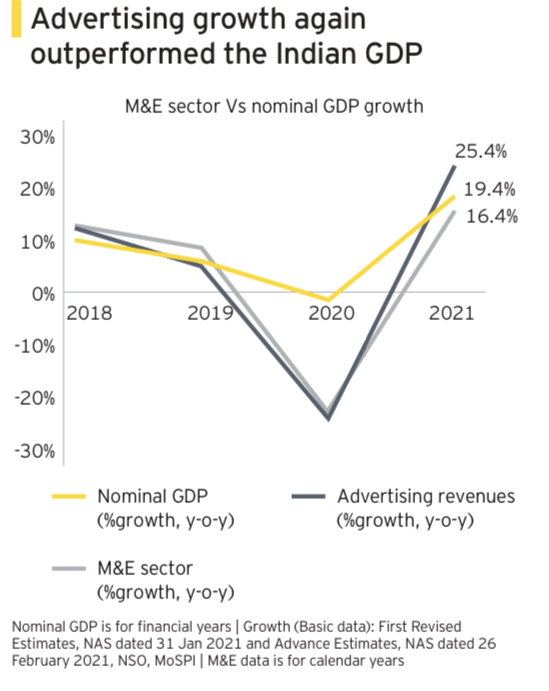

► In 2021, when India’s GDP grew 19 percent, advertising recovered 25 percent.

► The M&E sector recovered just 16 percent as consumers’ subscription spend remained impacted by COVID-19 across film, events and television.

► Subscription grew just 2.4 percent in 2021.

► At INR746 billion, advertising recovered to just 6 percent below 2019 levels.

► While digital advertising grew INR55 billion, the highest growth was in television advertising of INR62 billion, followed by a growth of INR29 billion in print.

► Overall, subscription grew INR15 billion with film, print and digital showing a combined growth of INR42 billion while television saw a drop of INR27 billion.

► Overall, subscription revenues were 18 percent below 2019 levels due to lower theatrical revenues as lockdowns and capacity restrictions impacted film releases; fall in pay TV households and reduced television ARPUs, and reduction in absolute print circulation, particularly in metros and for English dailies.

► Share of subscription reduced from 51.5 percent of total revenues in 2020 to 46.5 percent in 2021.

► Video remained the largest earning segment in 2021, holding on to its gains of 2020 as work-from-home and school-from-home remained significant for most Indians throughout 2021.

► The pandemic-impacted year, 2020, caused a fall in the share of experiential, but we expect it to recover by 2024.

► Text has probably seen a permanent loss due to the fall of print circulation, but will grow its share on the back of online advertising and print and digital subscription growth.

► Audio revenue models remain largely ad supported, and their revenue share will therefore remain stable.

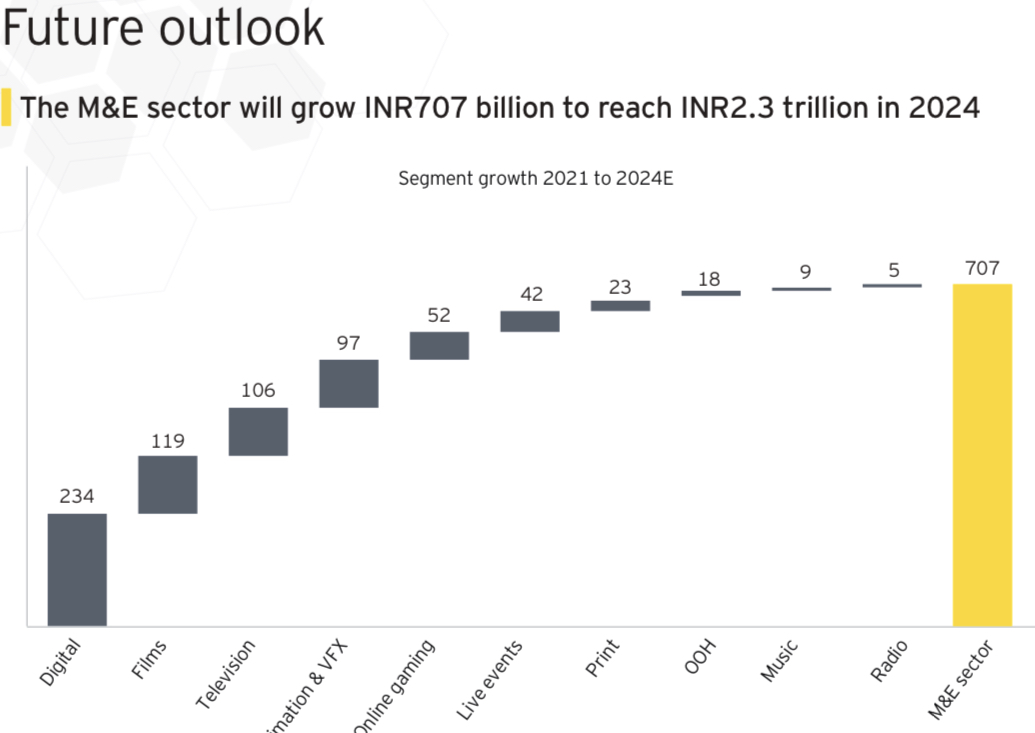

Future Outlook: The Indian M&E sector will grow at a CAGR of 13 percent and add INR707 billion in three years.

The key contributors to this growth will be digital, films and television (together adding 65 percent of the growth), followed by animation and VFX (14 percent) and online gaming (7 percent).

Online gaming will continue to grow and reach 500 million gamers by 2025 to become the fourth largest segment of the Indian M&E sector. The segment will grow across all its verticals viz, esports, fantasy sport, casual gaming and other games of skill, but revenue growth will be led by mobile-based real-money gaming applications across these verticals.

Products like Second Life, which enable people to adopt avatars and lead a life in virtual worlds they could only imagine till now, will increase in popularity – a trend already being seen in developed markets with high quality broadband.

This could be one of the most important use cases for the metaverse in India and the report estimates over 50 million avatars to be created by 2025, leading to an incredible virtual commerce opportunity.

Sports fans can increase their engagement with live sports – watching matches from a seat of their choice, interacting with sportspersons, attending after-match parties with their friends and watching replays on demand – all from the comfort of their homes.

Innovations in such virtual experiences could be the boost non-cricketing sports need in India to enable trial and build stickiness.

Marketers feel no differently as a survey of 50 marketers had 52 percent of the respondents planning to increase their event spends in the next few years.

Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

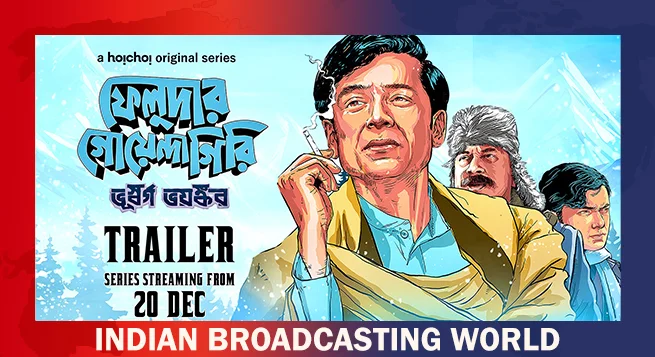

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  New adventure of detective Feluda debuts on Hoichoi Dec. 20

New adventure of detective Feluda debuts on Hoichoi Dec. 20  ‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report

‘Pushpa 2’ breaks records as most watched film of 2024: BookMyShow Report  Hungama OTT unveils ‘Pyramid’

Hungama OTT unveils ‘Pyramid’  Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24

Amazon MX Player to premiere ‘Party Till I Die’ on Dec 24  aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’

aha Tamil launches ‘aha Find’ initiative with ‘Bioscope’  Netflix India to stream WWE content starting April 2025

Netflix India to stream WWE content starting April 2025