TV Monthly Monitor – April’21 – Viewership shifts, yet rankings intact

Listed broadcasters’ overall performance

Zee: Rankings intact, viewership weakness in GECs offset by strong come-back in the movies genre

Zee reported a mixed performance in April, as group level ranking within the key genres was maintained, despite some viewership losses due to eyeball shift to IPL as also a halt in live GEC content given the onset of Covid Wave II. Gains in Movies, Marathi and FTA channels offset a viewership loss in flagship GEC channels. Zee continued to retain its second spot at group level among broadcasters, following the STAR group, which was an undoubted leader across genres. Zee has maintained its viewership recovery share for key regional genres after sharp losses to STAR channels over September-October 2020, especially within the Marathi and Bangla genres.

The Zee Group continues to dominate in regional genres, such as Kannada, despite losing 300bp share to 29.7%. However, Zee remains second within the Marathi genre as STAR Pravah continues to hold gains of 3,636bp in the past 12 months to 42% share for the top spot, ahead of Zee’s group-level share. Zee’s share stood at 38.8% (combined), recovering MoM, after hitting a low of 35.9% in December 2020 as losses in flagship Zee Marathi channel on halt in live GEC shoots were offset by 275bp MoM gains in Zee Talkies. Within the Bangla genre too, it retained the second spot, with viewership gains of 270bp in the past two months, thus narrowing the gap with the leader, STAR Jalsha. This was led by traction for Zee’s top shows, Mithai, Krishna Koli, Jamuna Dhaki and Aparijita Apu throughout February-April 2021, outperforming STAR Jalsha. Within the Tamil genre, Zee continued to show some weakness, as Zee Tamil, after hitting a high of 22.2% share in August 2020, lost all gains to finish at 16% in April 2021, down 630bp over eight months – still, the channel sustained its third spot. On other hand, Zee maintained second position in the Telugu genre with a minor 14bp MoM gain for Zee Telugu.

The Zee Group posted a strong performance within the movies genre as its flagship channel Zee Cinema made a come-back for the third spot, with 20.5% viewership share, up 655bp MoM. However, Zee Anmol Cinema posted a partial loss in last month gains, reporting 7.2% share, down 390bp MoM. Zee Group’s combined share within the movies genre was 27.7% – the group regained its dominating top spot within the genre. Within the GEC genre, viewership share dipped for Zee channels, as Zee TV even-though while sustaining its fourth spot in the GEC (urban) segment, lost 87bp MoM to 9.5% share. Also, within the Hindi GEC (rural) genre, Zee Anmol lost 390bp MoM to 13.4% share, maintaining the second spot. This led to a sharp 350bp MoM dip in Zee Anmol and Big Magic’s combined share to 18.9%, next to STAR Group in the genre.

SunTV: Flagship channel revives on election viewership, but overall viewership much below historical highs

Sun TV, the flagship channel, scripted a come-back with viewership gains of 150bp MoM to 37.7% share on Tamil Nadu Elections exit polls and results in April. However, it is still way lower versus its 40%+ share pre-Covid. KTV, Sun TV Group’s other movie offering in the Tamil genre, has witnessed a minor 45bp MoM loss to 11.1% share. However, the channel’s viewership dipped 950bp in the past 12 months.

In the Kannada genre, Udaya TV’s viewership spiked a sharp 275bp MoM to surpass STAR Suvarna in the genre with 18.4% share. However, this is still way lower than 32.9% peak viewership share in May 2020, losing 1470bp in the past 12 months. In the Telugu genre, Gemini TV remains in the fourth position with a loss of 50bp MoM to 12.4% share. Sun Bangla bounced back slightly within the Bangla genre, gaining 170bp MoM to 2.7% share.

Within the regional GEC genre, impressions dipped due to a viewership shift to IPL in April. Among genres, Tamil impressions declined 2.2% MoM, Telugu grew 0.8% MoM, while Kannada impressions declined 3.9% MoM.

Within the Hindi GEC (urban+rural) genre, impressions counts were down 7.5% MoM, while for individual Hindi GEC urban/rural genres, they declined 6.2%/12.5% MoM respectively. Hindi movies genre reported a growth in impressions count by 11.1% MoM, witnessing similar trends as in Covid-Wave I. In case of Marathi viewership, impressions declined 2.1% MoM, while the Hindi News genre impressions were not reported in April.

Rating & Valuation

We recommend Buy on Zee with a TP of lNR 300 based on 16x one-year forward P/E after factoring in Zee5 valuation and the worst-case scenario of write-offs on the balance sheet. We recommend Reduce on SUNTV with a TP of INR 535 based on 14.5x one-year forward P/E. We recommend Buy on TVTN with a TP of lNR 350 based on 10.5x one-year forward P/E.

NBF issues another advisory to member TV news channels

NBF issues another advisory to member TV news channels  Govt directs OTT platforms to stop airing Pak content

Govt directs OTT platforms to stop airing Pak content  Netflix to have AI-powered iOS search in TV app revamp

Netflix to have AI-powered iOS search in TV app revamp  India sets up panel to review copyrights laws, AI disputes

India sets up panel to review copyrights laws, AI disputes  ZEEL appoints Rohit Suri as Chief Human Resource Officer

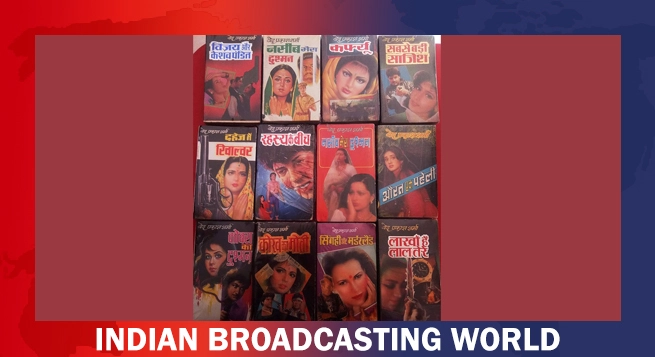

ZEEL appoints Rohit Suri as Chief Human Resource Officer  Ved Prakash Sharma’s bestselling novels to get film adaptations

Ved Prakash Sharma’s bestselling novels to get film adaptations  Ultra Play celebrates iconic Bollywood mothers with content lineup

Ultra Play celebrates iconic Bollywood mothers with content lineup  Sony PAL records 15.6% weekly reach in Week 17: BARC Report

Sony PAL records 15.6% weekly reach in Week 17: BARC Report  Dolby announces Mother’s Day special content lineup

Dolby announces Mother’s Day special content lineup