By Elara Caps

Digital growth intact

Miss on revenue growth; digital performance strong

TV Today Network’s (TVTN IN) Q1 revenue grew 7 percent YoY to INR 2,182mn (down 10 percent QoQ and 11 percent versus pre-Covid level), below INR 2,508mn estimated. This was mainly due to softer performance in Television and other media operations (98 percent of overall revenue). Television and other media operations grew 7 percent YoY to INR 2,146mn.

Radio broadcasting revenue grew 18.5 percent YoY to INR 36mn (3 percent of overall revenue), but pared 5 percent versus Q1FY20 (pre Covid), led by full unlocking of the economy and overall radio industry recovery. Overall, Q1 EBITDA margin dipped 400bps YoY to 21.7 percent (up 162bp QoQ),

TV – Expect revival in H2

Expect TVTN’s FY23E-25E revenue CAGR at 14 percent despite a muted Q1. This should be led by strong growth in digital (25-30 percent CAGR and 20 percent revenue contribution) and pick-up in TV ad segment due to the festive season in H2FY23. TVTN continues to outperform peers (news genre) and other broadcasters, on market leadership in Hindi news.

Margin concerns persist, as the management embarks on new digital investment/initiatives (content/people). This may, however, augment medium-term growth. Expect FY23E EBITDA margin to be in a narrow 23-24 percent band versus the earlier 25-26 percent estimated, as digital investment initiatives continue in the next three quarters. TVTN continues to lead on ad pricing in the news genre versus peers, helped by a strong recall and healthy viewership share.

Valuations: Reiterate BUY; TP at INR 540

We pare FY23E/24E earnings estimates 23.7 percent/9.5 percent, on: 1) slightly lower ad revenue growth, as advertisers trim Q2 discretionary spend and 2) lower EBITDA margin due to investments planned in digital.

We maintain BUY and roll over to SoTP-based September 2023E TP of INR 540. Improved digital profitability in the medium term may trigger upgrades.

Can Trump’s foreign movie tariff threat impact Indian films’ biz?

Can Trump’s foreign movie tariff threat impact Indian films’ biz?  NBF issues advisory to member news channels on Pak guests

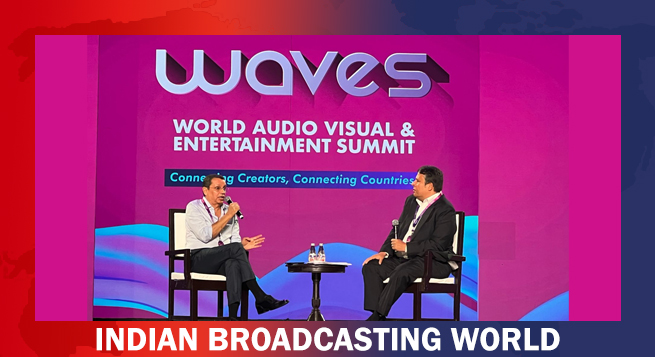

NBF issues advisory to member news channels on Pak guests  WAVES 1st edition right mix of M&E reality-check, biz, glamour

WAVES 1st edition right mix of M&E reality-check, biz, glamour  Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus

Uday Shankar upbeat on Indian M&E sector; stresses on need for local focus  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  Shemaroo bags 17 wins at 2025 GEMA Awards

Shemaroo bags 17 wins at 2025 GEMA Awards  IN10 Media rejiggs leadership team; aims digital content synergy

IN10 Media rejiggs leadership team; aims digital content synergy  Audible, MIB unveil audiobooks on India’s cultural legacy

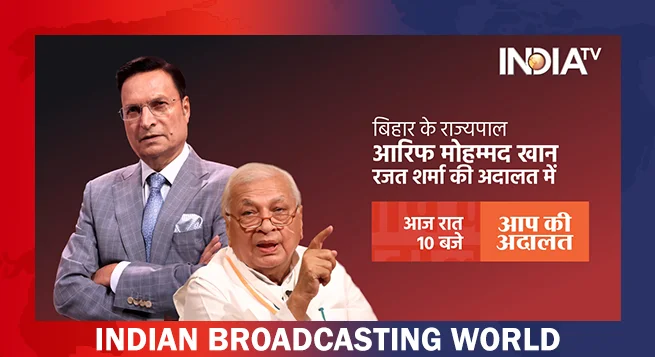

Audible, MIB unveil audiobooks on India’s cultural legacy  On ‘Aap Ki Adalat’, Bihar Guv Khan takes a dig at Pak politician

On ‘Aap Ki Adalat’, Bihar Guv Khan takes a dig at Pak politician