(Market Cap – INR 19 | Rating – BUY | Target Price – INR 350 )

View

TVT has reported an in line quarter 4.4%YoY ad revenue growth despite 1) high revenue base last year and 2) blackout of BARC data for news genre; we maintain our view that incumbents like Aaj Tak will have no negative impact on ad. revenues due to the BARC blackout as smaller channels in the news genre will see a negative impact of the same. Expect gains in the Hindi advertising revenue segment in the near term too going ahead. We also maintain our positive stance on the digital business offerings as it is platform agnostic and in the fragmented OTT market, content owners like TVT will have an edge to scale up their digital business offerings. Profitability on the core TV business may see some minor gains due to operating efficiencies, however the big take would be scale and growth on the digital business in the medium to long term. The stock has moved up 75% over the last one year post our initiation report in June’20; we maintain our positive stance as TVT remains to be one of our top picks in the Indian broadcasting space. We will review estimates and target price

Quarterly highlights

- TV Today Network reported revenue growth of 2.9% YoY to INR 2,143mn(Elara E : INR 2,076mn), as the growth in TV broadcasting segment(contributing 82% of sales) by 4.4% YoY & the digital business(other operating revenues up 19% YoY) was largely offset by weakness in radio business(down 33.5% YoY) and newspaper publishing business being shut during the quarter having no operational revenues for the quarter v/s INR 69mn in Q4FY20

- TV broadcasting segment (contributing 82% of revenues) grew 4.4% YoY to INR 1,765mn, despite a high base(grew 19.5% YoY in Q4FY20), led by continued traction for news channels, stable market share for Aaj Tak & second wave of COVID(Mar’21) again driving viewership gains for news genre. TV Broadcasting segment delivered EBIT margins of 22% during the quarter, flat YoY

- Radio broadcasting segment(contributing mere 1%) has been a drag, continued to decline 33.5% YoY to INR 24mn, however saw improvement QoQ with growth of 14.6% YoY. The segment incurred a loss of INR 42mn during the quarter vs a loss of INR 40mn in Q4FY20

- Newspaper Publishing segment has been shut during the operations & thus reported no operational revenues for the quarter

- Other operating revenues for the quarter(contributing 17%), witnessed a strong growth of 19% YoY to INR 354mn, maintaining the quarterly run-rate led by the digital business traction for Aaj Tak during the quarter. Segment reported a margin expansion by 100bp YoY to 19% indicating strong profitability

- Overall EBITDA stood at INR 497mn, with EBITDA Margins improving by 75bp YoY to 23.2%, as all verticals demonstrated a stable profitability YoY, with marginal expansion for digital business during the quarter

- PAT for the quarter grew by 30.2% YoY to INR 362mn on the back of stable operating performance, higher other income & lower tax rates.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

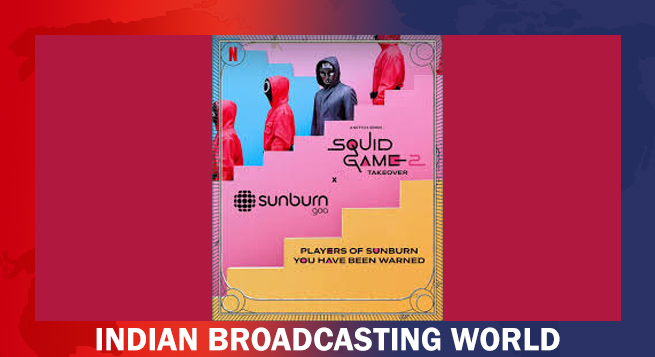

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29