Twitter Inc. on April 15 adopted a limited-duration shareholder rights plan to protect itself from billionaire entrepreneur Elon Musk’s $43 billion cash takeover offer.

Musk made the bid on April 13 in a letter to the board of Twitter — the micro-blogging platform that has become a global means of communication for individuals and world leaders — and it was made public in a regulatory filing on April 14, Reuters reported.

After his TED talk on April 14, Musk hinted at the possibility of a hostile bid in which he would bypass Twitter’s board and put the offer directly to its shareholders, tweeting: “It would be utterly indefensible not to put this offer to a shareholder vote.”

Under the plan, also known as a ‘poison pill’ strategy to resist a bid from a potential acquirer, the rights will become exercisable if anyone acquires ownership of 15% or more of Twitter’s outstanding common stock in a transaction not approved by the Board.

The rights plan will expire on April 14, 2023, Twitter said.

GTPL Hathway reports stable performance in Q3 FY25

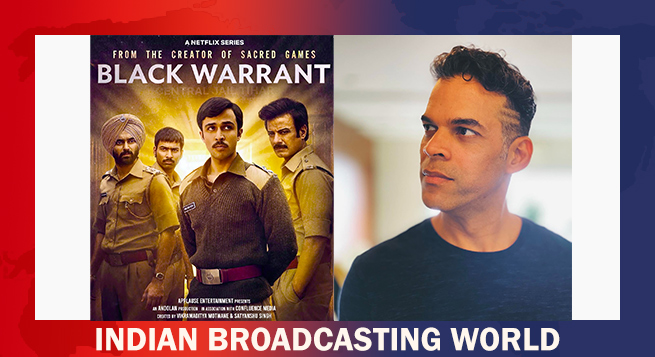

GTPL Hathway reports stable performance in Q3 FY25  ‘Black Warrant’: Motwane’s aimed to make an entertaining jail series

‘Black Warrant’: Motwane’s aimed to make an entertaining jail series  Draft data protection rules aims to balance rules & innovation: Minister

Draft data protection rules aims to balance rules & innovation: Minister  NDTV Profit unveils video podcast series ‘The Disruptors’

NDTV Profit unveils video podcast series ‘The Disruptors’  Tata Play celebrates Hrithik Roshan’s 51st birthday with his iconic hits

Tata Play celebrates Hrithik Roshan’s 51st birthday with his iconic hits  NDTV hosts ‘Mahakumbh ka Arthashastra’ conclave

NDTV hosts ‘Mahakumbh ka Arthashastra’ conclave  ‘MTV Roadies’ S20 returns Jan 11 with ‘Double Cross’ twist

‘MTV Roadies’ S20 returns Jan 11 with ‘Double Cross’ twist