Twitter Inc. has picked up a minority stake in Aleph Group Inc., the digital advertising firm said on Tuesday as it seeks to go public in the United States.

Aleph did not reveal any financial terms of the investment but said Twitter’s stake buy would help the company expand its educational tech platform, according to a Reuters report.

Emerging markets-focused Aleph, which helps large digital platforms connect with advertisers and customers, counts Meta Platforms Inc., Spotify Technology SA and Microsoft Corp-owned LinkedIn among its customers.

Despite wide-ranging supply chain disruptions that delayed products from reaching shelves and a user privacy clampdown by Apple Inc. that many feared would disrupt mobile advertising, brands have continued to advertise online.

Founded in 2005 as IMS Internet Media Services, Aleph was valued at $2 billion last year after private equity firm CVC Capital Partners boughta stake worth $470 million.

“Having Twitter as a stakeholder in Aleph is a particular honor and a special recognition for us. This is a clear endorsement of our efforts in educating a new generation of digital professionals, equally everywhere around the globe,” Gastón Taratuta, Aleph Group Founder and CEO, said in a statement.

“Access to quality education is key to personal success, yet some parts of the world keep being left behind. Our mission is to ensure that being a digital expert becomes a possibility for all and we are committed to making that happen,” Taratuta added.

The internet and mobile phones have created an information superhighway, and Aleph is paving that highway with educational tools and content to deliver to those parts of the world that have yet to harness the full power of digitalization, the digital advert company claimed.

“Aleph has been a valuable and strategic partner to Twitter for many years,” said Sarah Personette, Twitter’s Chief Customer Officer, in a statement, adding, “With a diverse set of capabilities, Aleph has supported our business globally , both as a sales and technology partner. This investment is a natural evolution in our relationship with Aleph.”

Aleph had confidentially filed for a US initial public offering in October.

Latin American fintech company MercadoLibre Inc. is also among Aleph’s investors, having picked up a stake worth $25 million in August last year.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

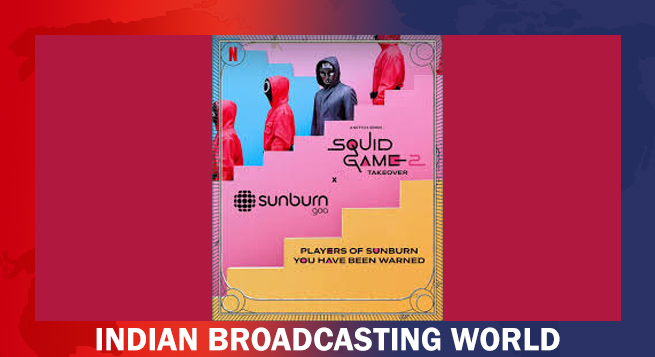

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29