Viacom 18 yesterday created a near monopoly in the Indian cricket broadcasting sphere by bagging both TV and digital rights of the national team’s home series for the next five years with a cumulative bid of approximately Rs 6,000 crore, beating Star India and Sony in a three-way battle.

However, at this point of time it’s not clear whether Viacom18 will continue to offer Indian cricket’s home matches free on JioCinema, a la IPL 2023, depending on ad revenue to shore up the bottomline. Or, with a near-dominance with content in a cricket-crazy nation like India, JioCinema would change track to go completely subscription-based.

At the moment, some premium English language shows on JioCinema are behind a paywall, while most other content, including films and exclusive web shows, are free to stream.

Coming back to the issue of Indian cricket, country’s cricket governing body BCCI had invited separate e-bids for both linear (TV) and digital for best price discovery.

The Indian cricket board BCCI had issued a tender for media rights to the international and domestic matches for September 2023-March 2028 to be played in the country. It said in a statement yesterday: “Viacom 18 Media Private Limited has acquired the Media Rights…for a cumulative figure of INR 5,963 crore.”

“Viacom 18 paid Rs 3101 crore (approximately) for digital and Rs 2862 crore for linear (TV). As has been the trend, digital has fetched more. With IPL digital rights being bought by Viacom for Rs 26,000 crore plus, they now have almost all the high profile cricket properties save IPL linear (TV) and ICC events,” a broadcasting industry source, tracking developments closely, told PTI on conditions of anonymity.

The rights, according to a PTI report, will come into effect with India’s three-match home series against Australia beginning September 22 and end on March 31, 2028.

“Congratulations @viacom18 for winning the @BCCI Media Rights for both linear and digital for the next 5 years. India Cricket will continue to grow in both spaces as after @IPL and @wplt20, we extend the partnership @BCCI Media Rights as well,” BCCI secretary Jay Shah said on X, formerly twitter.

He went on to add: “Also a big thank you to @starindia @DisneyPlusHS for your support over the years. You played a key role in making India Cricket reach its fans across the globe.”

India will be playing 88 international games across three formats, including 25 Tests, 27 ODIs and 36 T20Is with per match value of the deal standing around Rs 67.76 crore. This is nearly Rs 7.76 crore more than last cycle’s Rs 60 crore per match value.

However, the PTI report pointed out that the BCCI is getting Rs 175 crore less than Rs 6138 crore it received during last cycle, which had more games, specifically 102. If one looks at the prevailing market sentiments , it is not a bad price to fetch as the per match valuation has increased.

One needs to factor in that only marquee Test matches and series versus England and Australia will fetch a decent advertisement revenue. For matches against other nations, it is only the T20 that’s the cash cow.

India will play Australia in 21 games and will be pitted against England in 18 matches across three formats during the next five years, the PTI report said.

Commenting on the media rights acquisition by Viacom18, Karan Taurani of Elara Capital opined, “Acquisition of BCCI bilateral rights will also enable Jio cinema to become even bigger in the Indian OTT ecosystem; the platform has an AVOD market share of 22-24 percent already in CY23. After factoring IPL revenue and other content, revenues can scale up further due to these bilateral rights.

“This in turn will intensify competition in the OTT segment and work negatively for other broadcast-based OTT players like Sony, Zee, Disney+Hotstar. It will also continue to negatively impact SVOD revenue growth for Indian OTT, as Jio Cinema may continue to offer content free.”

(Photo of cricket match courtesy BCCI website)

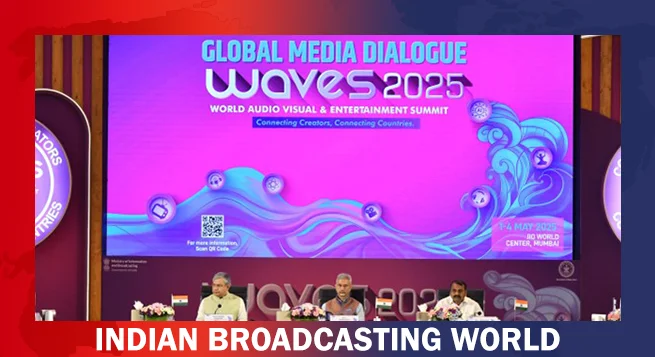

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

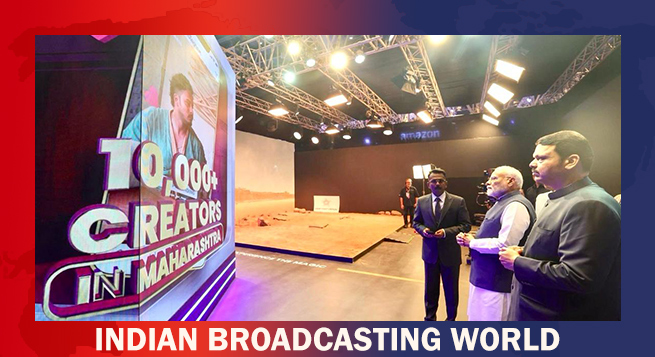

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

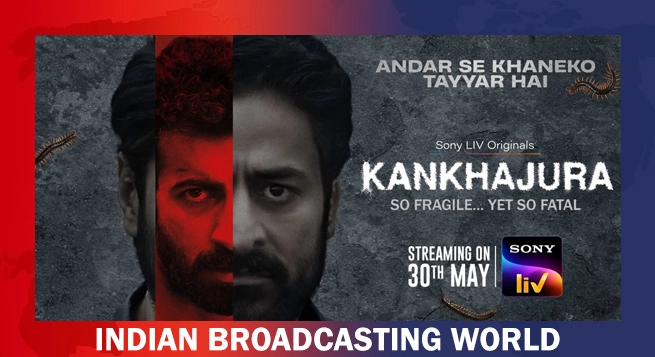

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles