Warner Bros Discovery said on Wednesday it wrote down the value of its TV assets due to the uncertainty of fees from cable and satellite distributors and sports rights renewals.

The film and entertainment studio, which owns sports network TNT and streaming service Max, recorded a $9.1 billion non-cash goodwill charge in the second quarter. This charge, stemming from a reassessment of the assets’ value since the merger of WarnerMedia and Discovery, contributed to a $10 billion net loss for the quarter, a Reuters report stated.

The media landscape has significantly changed in the past two years, impacting valuations and expectations for traditional media companies and this current situation is reflected in the write-down, CEO David Zaslav said in a call with analysts.

Asked whether the company was considering hiving off assets, CFO Gunnar Wiedenfels said on the call: “We’ve said before, you shouldn’t be surprised to see us engaging in you know, whatever M&A processes are going on out there.”

The shift of viewers from traditional television to streaming services has led to a decline in advertising revenue and affiliate fees, impacting the profitability of Warner Bros. Discovery‘s television assets. This decline is further compounded by the escalating costs of acquiring sports rights.

TNT failed to renew a broadcast deal with National Basketball Association games, at a time when live sports have become crucial for companies to increase viewership. The company sued the NBA last month. Losing the lawsuit would accelerate the decline of its TV business, analysts said.

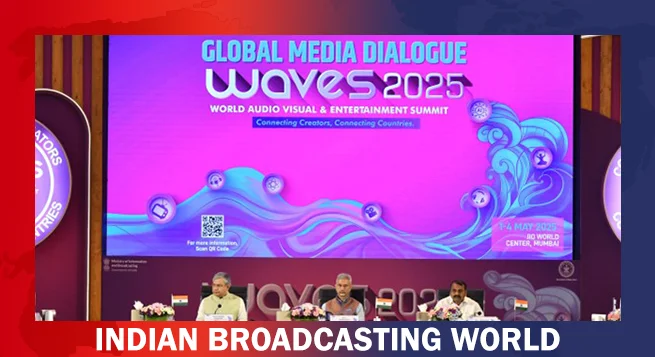

MIB to unveil M&E sector statistical handbook today at WAVES

MIB to unveil M&E sector statistical handbook today at WAVES  WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era

WAVES 2025: Media dialogue backs creativity, heritage & ethics in AI Era  Pay TV leaders chart course for India’s linear TV in digital age

Pay TV leaders chart course for India’s linear TV in digital age  Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025

Sudhir Chaudhary announces new show for DD News, says “Good content still has a place” at WAVES 2025  India can lead global entertainment revolution: Mukesh Ambani

India can lead global entertainment revolution: Mukesh Ambani  TRAI chief not in favour of separate rules for OTT, legacy b’casters

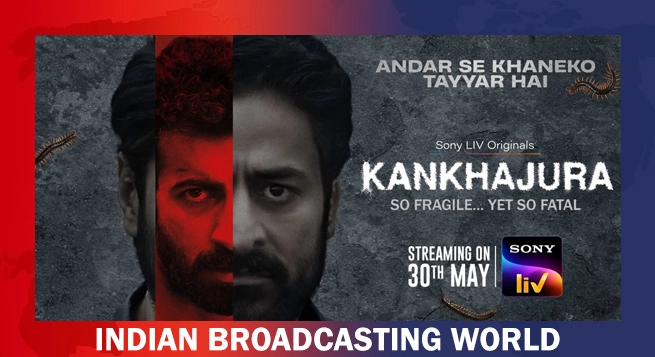

TRAI chief not in favour of separate rules for OTT, legacy b’casters  ‘KanKhajura’ start streaming on Sony LIV from May 30

‘KanKhajura’ start streaming on Sony LIV from May 30  Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI

Koyal.AI debuts at WAVES 2025, set to revolutionise music videos with GenAI  Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31

Zee Cinema to premiere ‘Pushpa 2: The Rule’ on May 31  ‘Create in India Challenge’ S1 honours global talent at WAVES

‘Create in India Challenge’ S1 honours global talent at WAVES  Amazon MX Player adds 20+ dubbed international titles

Amazon MX Player adds 20+ dubbed international titles