Zee Entertainment Enterprise Limited (ZEEL) board, in its board meeting held on September 21 unanimously provided an in-principle approval for the merger between Sony Pictures Networks India (SPNI) and ZEEL.

In the merged entity, Zee will hold 47.07 percent while the balance of 52.93 percent will be held by Sony. Punit Goenka would continue to be the CEO and MD of the merged entity.

The Zee Board has evaluated not only on financial parameters, but also on the strategic value that the partner brings to the table. The Board concluded that the merger will be in the best interest of all the shareholders and stakeholders, an offoical statement released by Zee said.

The merger is in line with ZEEL’s strategy of achieving higher growth and profitability as a leading media and entertainment company across South Asia. The Zee Board has authorized the management of ZEEL to activate the required due diligence process.

The shareholders of SPNI, will hold a majority stake in the merged entity and would also infuse growth capital into SPNI as part of the merger such that SPNI has approximately USD1.575 billion at closing, for use in pursuing other growth opportunities, the statement said.

Basis the existing estimated equity values of ZEEL and SPNI, the indicative merger ratio would have been 61.25 percent in favour of ZEEL. However, with the proposed infusion of growth capital into SPNI, the resultant merger ratio is expected to result in 47.07 percent of the merged entity to be held by Zee and the balance 52.93 percent of the merged entity to be held by SPNI.

Botht he companies have entered into a non-binding term sheet to combine both companies’ linear networks, digital assets, production operations and program libraries. The term sheet provides an exclusive period of 90 days during which ZEEL and SPNI will conduct mutual diligence and finalize definitive agreement(s). The merged entity will be a publicly listed company in India.

As part of the transaction, Punit Goenka will continue to be the Managing Director and CEO of the merged entity. Further, certain non-compete arrangements will be agreed upon between the promoters of ZEEL and SPNI.

According to the term sheet, the promoter family is free to increase its shareholding from the current 4 percent to up to 20 percent in a manner that is in accordance with applicable law.

The final transaction would be subject to completion of customary due diligence and execution of definitive agreements and required corporate, regulatory and third- party approvals, including the votes of ZEEL’s shareholders.

Speaking on the development, R. Gopalan, Chairman, ZEEL said, “The Board of Directors at ZEEL have conducted a strategic review of the merger proposal between SPNI and ZEEL. As a Board that encompasses a blend ofhighly accomplished professionals having rich expertise across varied sectors, we always keep in mind the best interests of all the shareholders and ZEEL. We have unanimously provided an in-principle approval to the proposal and have advised the management to initiate the due diligence process.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

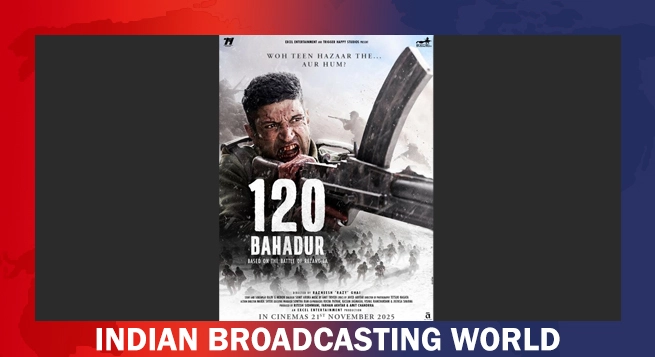

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025