By Karan Taurani @ Elara Capital

Weak metrics in broadcasting; merger with Sony remains monitor able

Zee continues to struggle for viewership growth in the regional genre over last few quarters which has led to a below par performance on ad growth front (decline of 3% YoY) in a quarter where festive ad spends have generally been strong ; regional remains to be the key growth driver for Zee, as growth in Hindi genre has plateaued due to shift towards digital/OTT for within TV industry and lack of new content initiatives (non fiction) by Z . Growth concerns persist on subscription revenue growth too which is in line with our expectation due to 1) impact of shift towards digital that propels selective viewing within audience and 2) uncertainty over NTO 2.0. In terms of digital business, consumption and user growth metrics are compelling, however monetisation challenges persist as revenue growth is mere 23% YoY despite a low base vs peers in video advertising, at a time wherein video advertising spends in India are growing at almost 35-40%YoY. Profitability woes too persist on TV and digital due to higher content costs (sharper increase in content cost on digital due to a fragmented OTT space), which will further restrict earnings growth. Albeit above, we continue to believe that merger with Sony will be the key trigger for getting synergy benefits on the converging growth based TV business and digital OTT space, wherein a common go to market strategy can propel a better revenue growth performance in this fiercely competitive space as mentioned in our update dated 21st Dec,2021

Valuation – Maintain BUY with a TP of INR 450

Z is currently trading 15.5x basis FY24 earnings (core broadcasting business) estimates which remains inexpensive; however, re-rating on the same will only be basis 1) merger transition with Sony and 2) outcome of the digital strategy after both players go to market together. Maintain our BUY rating on the stock with a Mar’22 SOTP based TP of INR basis 450 (20x one year fwd PER for broadcasting and 6x EV/sales for OTT business)

Karan Taurani @ Elara Capital

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  Yearender 2024 most anticipated film sequels of 2025

Yearender 2024 most anticipated film sequels of 2025  Airtel faces outage, users across India report network disruptions

Airtel faces outage, users across India report network disruptions  Kartik Aaryan to star in ‘Tu Meri Main Tera, Main Tera Tu Meri’

Kartik Aaryan to star in ‘Tu Meri Main Tera, Main Tera Tu Meri’  ‘MasterChef India’ returns with a celebrity twist

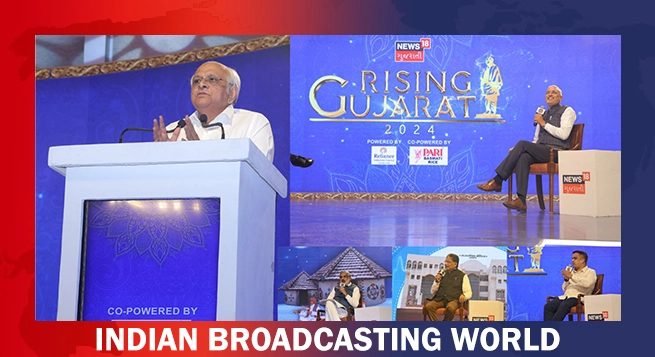

‘MasterChef India’ returns with a celebrity twist  News18 Gujarati hosts ‘Rising Gujarat’

News18 Gujarati hosts ‘Rising Gujarat’