Digital business remains a drag

View

Zee has reported a domestic ad revenue decline of 20% YoY, largely in line with industry estimates, despite a hefty ad revenue gain due to Zee Anmol moving towards FTA in June ’20. Ad growth challenges are expected to persist throughout H1FY22 due to lock-down in most states. However, the negative impact on ad revenue is estimated to be lower versus the first wave of COVID due to: 1) better contingency planning and preparedness in terms of live GEC shoots, which are largely ongoing, 2) ramp up in vaccinations, which may lead to lock-downs easing sooner than Wave I. We thereby expect a sharp recovery H2FY21 onwards, which will lead to a 20%YoY ad growth in FY22E over a low FY21 base (still down 5% versus FY20-pre-COVID levels). Subscription revenues are expected to remain muted, with uncertainty around NTO 2.0 implementation – This is an overhang which should cap margin improvement. lure EBITDA margin estimates are largely in line with management guidance after factoring in negative impact from increased content cost. On the digital business front, Zee5 is estimated to report huge gains in Q1FY22 on Radhe’s TVOD/OTT premiere. This is because subscriber addition has not shown enough strength to match up to hefty content costs paid for the film. Also, piracy has been an added drag on viewership. On a steady-state basis, excluding the impact of Radhe, Zee5 is still not promising enough to post better-than-industry average (video advertising) growth despite a low base versus other OTTs (Hoststar, YouTube etc.). Over dependence on telecom too limits strong growth prospects on the company’s SVOD revenue base for now. Despite all these concerns on the digital front, traditional business prospects remain strong with: 1) traction in regional genre and 2) best profitability versus peers.

Valuation

The stock is trading at an inexpensive 13.6x/12x basis FY22E/FY23E. We maintain Buy on Zee with a TP of lNR 300 based on 16x one-year forward P/E after factoring in Zee5 valuations (SOTP basis). We believe positive surprise on Zee5 revenue will act as a re-rating catalyst.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  ‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix

‘Cobra Kai Season 6 Part 3’ set for February 2025 release on Netflix  Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities

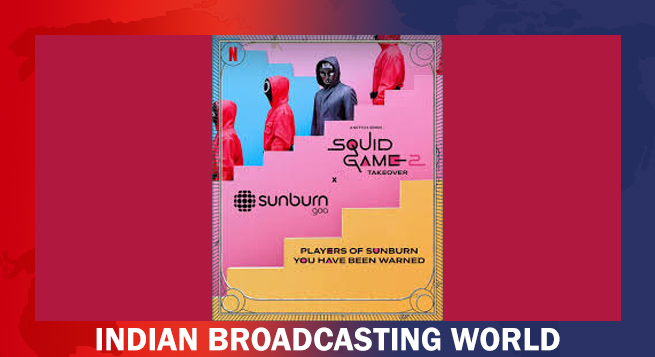

Radio City unveils ‘WOKA Santa’ to spread Christmas cheer across 10 cities  ‘Squid Game 2’ comes to Sunburn Goa 2024

‘Squid Game 2’ comes to Sunburn Goa 2024  Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29

Zee Telugu to premiere ‘Saripodhaa Sanivaaram’ on Dec 29  &pictures announces ‘Khichdi 2’ premieres December 29

&pictures announces ‘Khichdi 2’ premieres December 29