Zee Entertainment Enterprises’s board has approved a fundraise of up to Rs. 20 billion ($239.6 million), the Indian broadcaster said yesterday.

The company had two major deals — a $10 billion merger with Sony India and a $1.4 billion cricket broadcasting deal with Walt Disney — fail this year, and was forced to cut costs and reduce losses in its business to meet key profit targets.

Zee said it will use the funds to “enhance its strategic flexibility to pursue future growth opportunities in the evolving media landscape”, a Reuters report Bengaluru.

The company plans to raise the funds through equity shares or any other eligible securities, via a combination of private placements, qualified institutions placements, and preferential issues, it added.

Amid the fallout of the deals and legal battles, Zee also contends with new competition after Reliance and Disney’s merge their Indian media assets, creating an $8.5 billion behemoth.

Meanwhile, on the Zee decision yesterday, analyst Karan Taurani from Elara Securities said the fundraising could be through a preferential allotment to promoters or by raising money via QIP and either way this will “boost investor confidence”, which has been low since the merger with Sony was called off.

“The total fundraising amount is up to Rs. 20 billion, which is about 14 percent of the current market cap, though we don’t expect the entire amount to be raised. We expect that the cash infusion could lead to i) improved investor confidence and sentiment, and ii) business expansion and investments, given the increased competitive intensity in the sector following the RIL-Disney merger,” Taurani added.

TRAI revamps website to connect with wider audience

TRAI revamps website to connect with wider audience  Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Tata Play Binge brings Christmas movie lineup

Tata Play Binge brings Christmas movie lineup  ITG elevates Siddharth Zarabi to BT multiverse Editor

ITG elevates Siddharth Zarabi to BT multiverse Editor  Airtel leads subscriber growth with 1.93mn additions in October

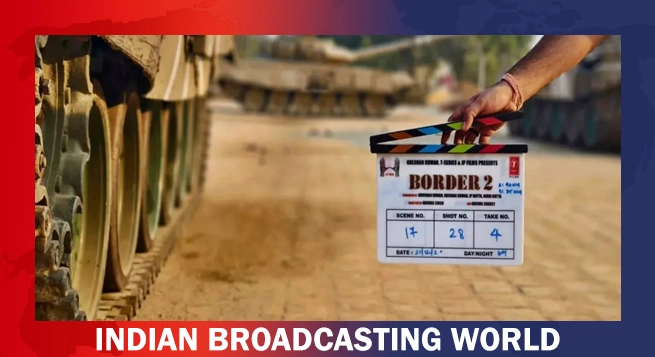

Airtel leads subscriber growth with 1.93mn additions in October  ‘Border 2’ begins filming

‘Border 2’ begins filming  Asianet announces festive programming for Christmas 2024

Asianet announces festive programming for Christmas 2024