The Zee Entertainment and Sony Pictures Network India proposed merger, where the latter would hold majority stake, has been creating headlines in the global media world and not just in India. So much so that an industry exec exulted this was right up there with the coming together of AT&T media biz and Discovery Inc.

Though there is still time before the merger gets all round clearance, including shareholders agreement and anti-trust body nod, the news itself has created ripples as it could create a behemoth that could be strong enough to give competition to global and domestic media companies.

As and when the merger finally happens (http://www.indianbroadcastingworld.com/zee-board-okays-merger-with-sony-punit-to-head-merged-entity/), it would be interesting to see how it pans out too as the merged entity would face headwinds of all types, including staff and personnel redundancy, and conflicting and competing services like streamers ZEE5 and SonyLIV.

Commenting on the announced merger, Karan Taurani of Elara Capital said prima facie it would have a positive impact for Zee.

“Less overlap, more synergies,” is how Taurani described the development, adding, “There is a big opportunity in terms of synergies as Sony is doing well in sports, mainstream GEC, whereas Zee has a strong recall on regional genre, which is less or absent for Sony. Both have a very strong movie catalogue, which can be used for OTT and TV offering

“Both companies can go to market together with their merged OTT offerings, which too are slightly different in content. Sony is more into sports and mainstream shows (‘Scam’), whereas Zee is into regional web series and, hence, the content strategy can augur well to create a platform, which have all offerings and may emerge (as) the second largest homegrown OTT (platform) after Disney+ in India.”

The combination of Zee and SPNI will create a combined content platform that can compete with domestic and global platforms and accelerate the region’s transition to digital, Ravi Ahuja, chairman of global television studios and Sony Pictures Entertainment corporate development, said in an internal memo, which was seen by Reuters.

A merger should improve management at Zee, said Hetal Dalal, chief operating officer at proxy advisory firm IiAS that had raised governance concerns. According to Reuters, Dalal said, however, that investors would need more details about the deal before their concerns are quelled.

Meanwhile, author, columnist and Business Standard Consulting Vanita Kohli-Khandekar in a LinkedIn post said: “The possible merger of Sony Pictures Entertainment and Zee Entertainment Enterprises Limited creates a broadcast entity with almost 30 percent share of TV viewing in India and Rs. 19,000 crore in topline. That pushed it firmly ahead of The Walt Disney Company’s Star TV Network. Watch out for more deals as others try to go over the Rs. 10,000 crore revenue mark.”

Yes, the economics of the companies being merged too is important.

According to Taurani, “As per our initial estimates, Sony is estimated to grow at a lower CAGR of 10 percent (F20-24) on PAT, which translates into INR 1,460 crore, whereas our estimate on Zee is INR 1676 crore for FY24 (CAGR of 20 percent). The combined entity could have a PAT of around INR 3,100 crore. We expect the PE multiples to be in the range of 16x-17x; execution on the digital business will drive further re-rating, however even on these valuations – there is a possibility of a 80-100 percent upside at least (market cap of INR 50,000cr).”

Pointing out that the consolidation is a big respite in itself as it will lead to both players capitalising on each other strengths and compete with the market leader, Disney, Taurani added: “With SPN having the controlling stake , the overhang on corporate governance will fade away and this will also enable multiple re-rating for the company. In terms of management, Punit has the best capabilities to run the broadcasting business.”

Another industry veteran and media entrepreneur Amit Dev, said, “The process of this Sony-Zee merger needs a few more big rounds of thoughts in their paths to get it fully completed. The details may be complicated, but as the intent is now, clearly it’s mandated to get the mutual benefit as desired by trade.”

The Indian media industry, which has been reeling under financial pressures owing to slowing economy and the pandemic, could heave a sigh of relief from such consolidations and mergers with some spread of positivity.

“This consolidation will create a positive impact for the broadcasting industry since it will help in boosting revenues of the existing players, which was (a) bit subdued on account of over-the-top (platforms),” Vivek Menon, co-founder of debt fund NV Capital, told Reuters dwelling on the Zee-Sony proposed merger.

As the Indian media industry looks at the outcome, it would be interesting to see how and where it finally settles.

Prime Video to limit in India number of TV sets having access per subscription

Prime Video to limit in India number of TV sets having access per subscription  Delhi HC orders meta to remove deepfake videos of Rajat Sharma

Delhi HC orders meta to remove deepfake videos of Rajat Sharma  Govt. blocked 18 OTT platforms for obscene content in 2024

Govt. blocked 18 OTT platforms for obscene content in 2024  Broadcasting industry resists inclusion under Telecom Act

Broadcasting industry resists inclusion under Telecom Act  DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO

DTH viewing going down & a hybrid ecosystem evolving: Dish TV CEO  Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player

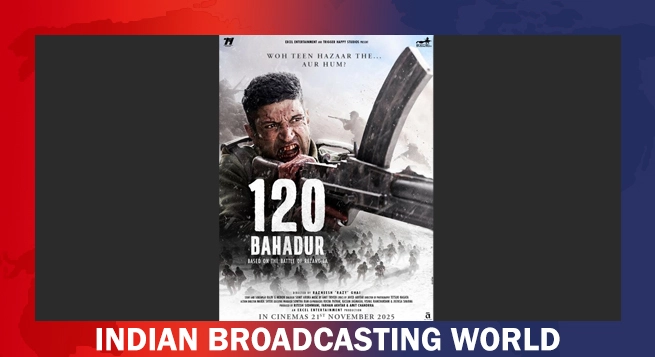

Abhishek Singh Rajput shines in ‘Swipe Crime’ on MX Player  Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025

Farhan Akhtar’s ‘120 Bahadur’ to hit theatres on November 21, 2025  COLORS announces 2025 lineup

COLORS announces 2025 lineup  Sony YAY! announces holiday wishes from Toon-Town this Christmas

Sony YAY! announces holiday wishes from Toon-Town this Christmas  8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025

8Bit Creatives partners with ESFI to elevate WAVES esports championship 2025